Replacement value measures the cost to replace an asset with a new one of similar kind and quality, reflecting current market prices and conditions. This valuation method is crucial for insurance coverage, financial reporting, and asset management to ensure adequate protection against loss. Explore the full article to understand how to accurately determine your replacement value and its implications.

Table of Comparison

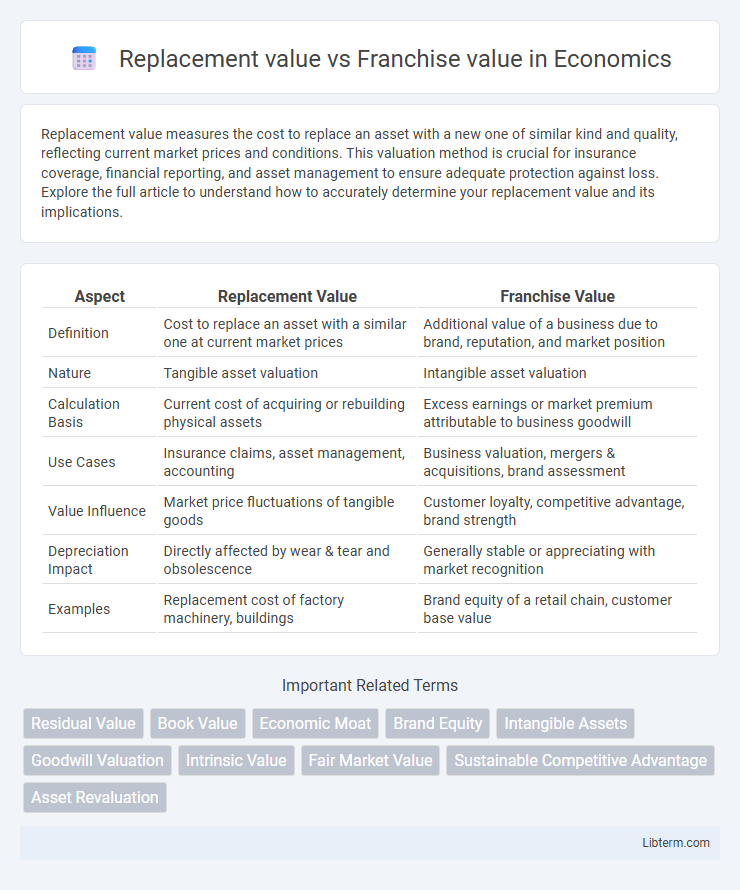

| Aspect | Replacement Value | Franchise Value |

|---|---|---|

| Definition | Cost to replace an asset with a similar one at current market prices | Additional value of a business due to brand, reputation, and market position |

| Nature | Tangible asset valuation | Intangible asset valuation |

| Calculation Basis | Current cost of acquiring or rebuilding physical assets | Excess earnings or market premium attributable to business goodwill |

| Use Cases | Insurance claims, asset management, accounting | Business valuation, mergers & acquisitions, brand assessment |

| Value Influence | Market price fluctuations of tangible goods | Customer loyalty, competitive advantage, brand strength |

| Depreciation Impact | Directly affected by wear & tear and obsolescence | Generally stable or appreciating with market recognition |

| Examples | Replacement cost of factory machinery, buildings | Brand equity of a retail chain, customer base value |

Understanding Replacement Value and Franchise Value

Replacement value represents the cost required to replace an asset or property with a similar one at current market prices, excluding depreciation. Franchise value measures the intangible value of a business over its net asset value, reflecting brand strength, customer loyalty, and market position. Understanding these concepts helps businesses assess asset worth for insurance purposes and evaluate the true market value beyond physical assets.

Key Differences Between Replacement Value and Franchise Value

Replacement value represents the cost to replace an asset or property with a similar one at current market prices, essential for insurance and asset management purposes. Franchise value refers to the present value of expected future profits generated by a company's established brand, customer loyalty, and competitive advantages, critical in business valuation. Key differences include replacement value's focus on tangible asset costs, while franchise value emphasizes intangible business earnings potential and market positioning.

Importance of Replacement Value in Business Valuation

Replacement value represents the cost to replace an asset with a similar one at current market prices, making it critical in business valuation for accurately assessing the investment required to maintain operational capacity. Franchise value captures the intangible benefits of brand reputation, customer loyalty, and market positioning, but does not reflect direct asset costs. Emphasizing replacement value ensures businesses understand the real economic costs of asset replenishment, aiding in precise financial planning and risk assessment.

The Role of Franchise Value in Long-Term Success

Franchise value represents the long-term competitive advantage and customer loyalty that a business builds, significantly impacting its sustainable profitability and market positioning. Unlike replacement value, which measures the cost to replicate physical assets, franchise value encapsulates intangible elements such as brand reputation, customer relationships, and operational efficiencies that drive enduring success. Firms with high franchise value often achieve superior returns on investment and resilience against market fluctuations, highlighting its critical role in long-term strategic planning.

Factors Influencing Replacement Value

Replacement value depends heavily on factors such as current material costs, labor rates, and technological advancements in construction or manufacturing. Geographic location and local market conditions also significantly impact the replacement cost by affecting resource availability and transportation expenses. Insurance policies and depreciation rates further influence the accurate calculation of replacement value compared to franchise value.

Critical Drivers of Franchise Value

Critical drivers of franchise value include brand strength, customer loyalty, and market positioning, which collectively enhance long-term revenue potential beyond the asset's replacement cost. Unlike replacement value, which focuses on the cost to reproduce or replace physical assets, franchise value captures intangible benefits such as goodwill, competitive advantage, and consistent cash flow generation. These elements are essential for understanding a franchise's premium valuation in strategic acquisitions and financial analysis.

Replacement Value vs Franchise Value: Which Matters More?

Replacement value represents the actual cost to replace an asset with a new one of similar kind and quality, reflecting current market prices and material costs. Franchise value captures the intangible benefits of a business, including brand reputation, customer loyalty, and ongoing revenue streams beyond physical assets. In valuation and investment decisions, replacement value matters more for asset-heavy industries, while franchise value holds greater significance for businesses reliant on brand strength and market position.

Impact on Investment Decisions

Replacement value represents the cost to replace an asset with a similar one at current market prices, directly influencing investment decisions by providing a benchmark for asset valuation and risk assessment. Franchise value reflects the intangible worth of a company's brand, customer loyalty, and operational efficiency, affecting investment choices through long-term profitability and competitive advantage. Investors weigh replacement value for tangible asset appraisal while considering franchise value for growth potential and sustainable returns.

Real-World Examples: Replacement vs Franchise Value

Replacement value in real estate refers to the cost to rebuild a property with similar materials and quality at current market prices, often used in insurance claims to ensure full restoration without depreciation. Franchise value represents the additional worth derived from brand recognition, business reputation, and customer loyalty beyond the tangible asset value, typically seen in commercial properties like fast-food chains or hotels. For example, a McDonald's restaurant's replacement value covers the physical building and equipment, while its franchise value includes the established brand presence, franchise rights, and ongoing customer base, which can significantly exceed just the rebuilding cost.

Best Practices for Maximizing Both Values

Optimizing replacement value involves comprehensive asset assessments and investing in high-quality materials to reduce future costs while maintaining asset integrity. Maximizing franchise value requires strengthening brand reputation through exceptional customer service, consistent quality, and strategic marketing to enhance long-term profitability. Integrating data analytics to monitor market trends and customer preferences ensures balanced growth and sustainable value in both replacement and franchise aspects.

Replacement value Infographic

libterm.com

libterm.com