Market-clearing wage represents the pay rate at which the quantity of labor supplied equals the quantity demanded, eliminating any surplus or shortage in the labor market. This equilibrium wage ensures that businesses can hire the exact number of workers they need while employees find jobs matching their skill levels. Explore the rest of the article to understand how market-clearing wages impact your employment opportunities and overall economic stability.

Table of Comparison

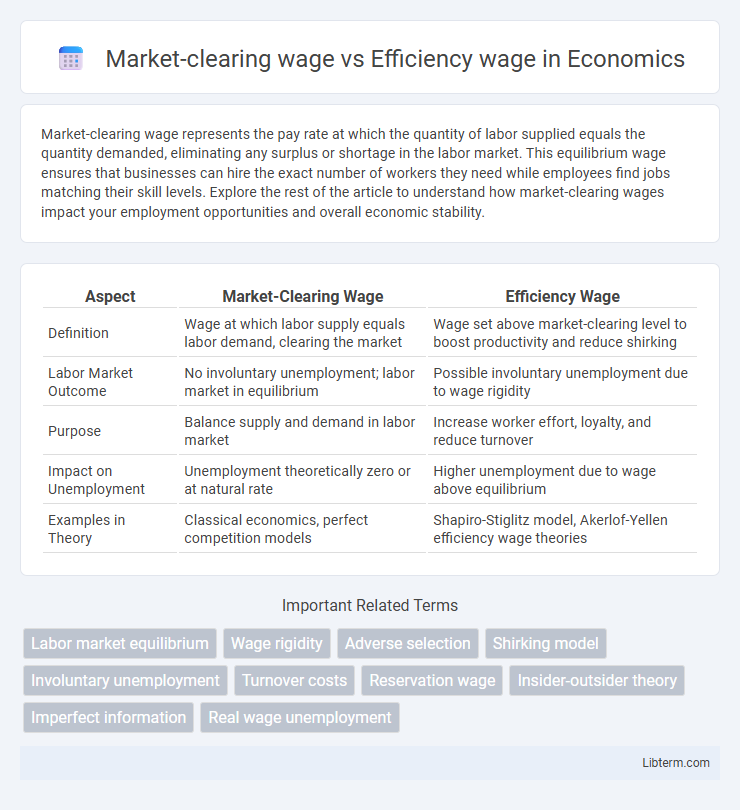

| Aspect | Market-Clearing Wage | Efficiency Wage |

|---|---|---|

| Definition | Wage at which labor supply equals labor demand, clearing the market | Wage set above market-clearing level to boost productivity and reduce shirking |

| Labor Market Outcome | No involuntary unemployment; labor market in equilibrium | Possible involuntary unemployment due to wage rigidity |

| Purpose | Balance supply and demand in labor market | Increase worker effort, loyalty, and reduce turnover |

| Impact on Unemployment | Unemployment theoretically zero or at natural rate | Higher unemployment due to wage above equilibrium |

| Examples in Theory | Classical economics, perfect competition models | Shapiro-Stiglitz model, Akerlof-Yellen efficiency wage theories |

Introduction to Market-Clearing Wage and Efficiency Wage

The market-clearing wage is the wage rate at which labor supply equals labor demand, ensuring no unemployment in a competitive labor market. Efficiency wage theory posits that employers pay above the market-clearing wage to increase worker productivity, reduce turnover, and discourage shirking. These contrasting wage concepts explain different labor market dynamics, with market-clearing wages emphasizing equilibrium and efficiency wages focusing on incentives and performance.

Defining Market-Clearing Wage

The market-clearing wage is the wage rate at which the quantity of labor supplied equals the quantity demanded, ensuring no unemployment in a perfectly competitive labor market. This wage allows for equilibrium where firms hire all workers willing to work at that wage and no excess labor supply exists. In contrast, the efficiency wage is set above the market-clearing level to boost worker productivity and reduce turnover, potentially causing involuntary unemployment.

Understanding Efficiency Wage Theory

Efficiency wage theory posits that employers pay wages above the market-clearing level to increase worker productivity, reduce turnover, and discourage shirking, thereby improving overall firm efficiency. Unlike the market-clearing wage that balances labor supply and demand, efficiency wages create a labor market equilibrium with involuntary unemployment to sustain higher worker effort. Empirical studies demonstrate that firms adopting efficiency wages experience enhanced employee morale and lower monitoring costs, validating the theory's role in explaining persistent wage rigidities.

Key Differences Between Market-Clearing and Efficiency Wages

Market-clearing wages represent the equilibrium wage where labor supply equals labor demand, ensuring no excess unemployment in the market. Efficiency wages are set above the market-clearing level to increase worker productivity, reduce turnover, and discourage shirking, often causing involuntary unemployment. The key difference lies in the purpose: market-clearing wages balance supply and demand, while efficiency wages prioritize firm-level benefits at the cost of potential labor market inefficiencies.

Factors Influencing Market-Clearing Wages

Market-clearing wages are primarily influenced by labor supply and demand dynamics, productivity levels, and prevailing economic conditions which balance the number of job seekers with available positions. Factors like worker skill levels, geographical labor market conditions, and employer competition drive these wages toward equilibrium, ensuring no excess unemployment. In contrast, efficiency wages exceed market-clearing levels to boost worker productivity, reduce turnover, and discourage shirking, often leading to wage rigidity despite labor market imbalances.

Determinants of Efficiency Wages

Efficiency wages are influenced by factors such as worker productivity, turnover costs, and the need to reduce shirking or enhance morale. Firms pay above the market-clearing wage to incentivize higher effort, decrease monitoring expenses, and attract skilled labor. This wage-setting strategy contrasts with the market-clearing wage that balances labor supply and demand without accounting for efficiency-related incentives.

Impacts on Employment and Unemployment

Market-clearing wage theory asserts that wages adjust to balance labor supply and demand, leading to full employment without involuntary unemployment, whereas efficiency wage theory suggests employers pay above-market wages to boost worker productivity, which can create unemployment by reducing labor demand. Under market-clearing wages, employment levels stabilize naturally as wages fluctuate, while efficiency wages may cause layoffs or deter hiring due to higher labor costs despite increased efficiency. The divergence in wage-setting mechanisms between these models directly impacts unemployment rates, with efficiency wages often explaining persistent unemployment in real-world labor markets.

Productivity and Worker Motivation

Market-clearing wages balance labor supply and demand, ensuring full employment but may lead to minimal worker motivation and average productivity levels since wages reflect market conditions rather than performance incentives. Efficiency wages, set above the market-clearing level, boost worker motivation by increasing job satisfaction and reducing turnover, resulting in higher productivity and enhanced effort. This wage strategy leverages intrinsic and extrinsic motivation factors to promote greater output and organizational efficiency.

Real-World Examples and Case Studies

Market-clearing wages adjust to balance labor supply and demand, as seen in competitive labor markets like retail and hospitality sectors where wages fluctuate with unemployment rates and skill availability. Efficiency wage theory, demonstrated by companies such as Costco and Toyota, involves paying above-market wages to boost worker productivity, reduce turnover, and improve morale, leading to enhanced firm performance and lower recruitment costs. Case studies from the technology industry reveal firms like Google implementing efficiency wages to attract top talent, contrasting with fast-food chains relying on market-clearing wages to maintain flexible labor costs.

Policy Implications and Future Trends

Market-clearing wage theory suggests wages adjust to equilibrate labor supply and demand, promoting competitive labor markets and minimizing unemployment, guiding policymakers toward deregulation and flexible wage-setting practices. In contrast, efficiency wage theory posits that higher wages can boost productivity and reduce turnover, encouraging policies that support wage floors and worker incentives to enhance firm performance. Future trends indicate increased integration of behavioral economics in wage-setting, with technology-driven labor market data enabling more dynamic and evidence-based wage policies.

Market-clearing wage Infographic

libterm.com

libterm.com