The Mundell-Fleming model explains the relationship between exchange rates, interest rates, and output in an open economy under different exchange rate regimes. It highlights how fiscal and monetary policies impact national income and the balance of payments depending on whether the currency is fixed or floating. Discover how applying this model can improve your understanding of international economic policy by reading the full article.

Table of Comparison

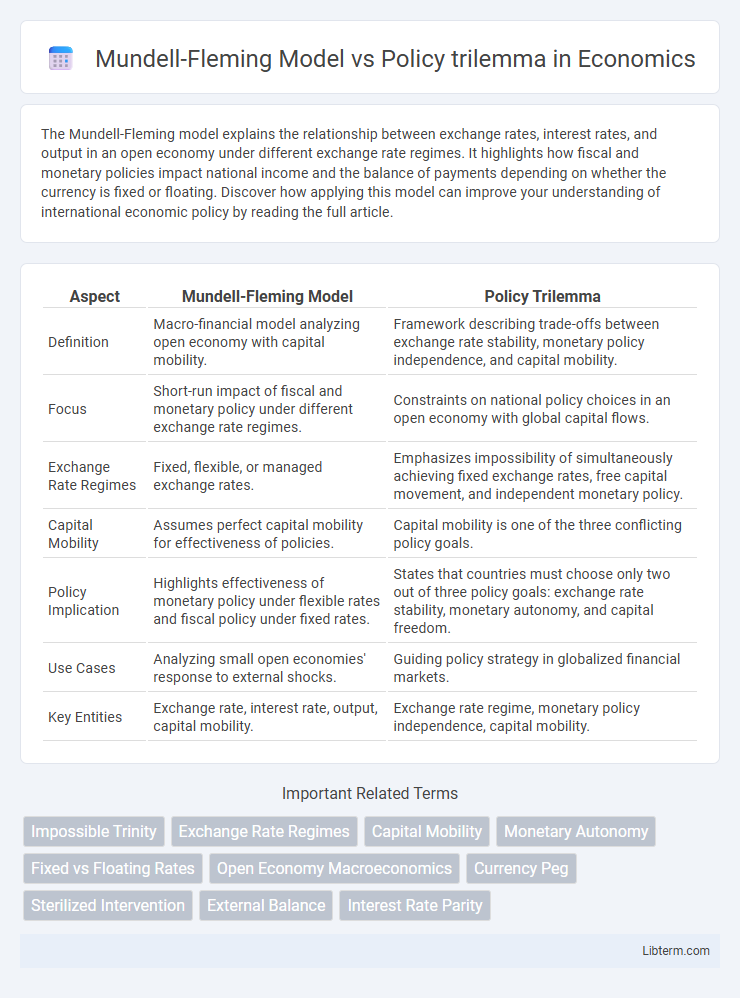

| Aspect | Mundell-Fleming Model | Policy Trilemma |

|---|---|---|

| Definition | Macro-financial model analyzing open economy with capital mobility. | Framework describing trade-offs between exchange rate stability, monetary policy independence, and capital mobility. |

| Focus | Short-run impact of fiscal and monetary policy under different exchange rate regimes. | Constraints on national policy choices in an open economy with global capital flows. |

| Exchange Rate Regimes | Fixed, flexible, or managed exchange rates. | Emphasizes impossibility of simultaneously achieving fixed exchange rates, free capital movement, and independent monetary policy. |

| Capital Mobility | Assumes perfect capital mobility for effectiveness of policies. | Capital mobility is one of the three conflicting policy goals. |

| Policy Implication | Highlights effectiveness of monetary policy under flexible rates and fiscal policy under fixed rates. | States that countries must choose only two out of three policy goals: exchange rate stability, monetary autonomy, and capital freedom. |

| Use Cases | Analyzing small open economies' response to external shocks. | Guiding policy strategy in globalized financial markets. |

| Key Entities | Exchange rate, interest rate, output, capital mobility. | Exchange rate regime, monetary policy independence, capital mobility. |

Introduction to the Mundell-Fleming Model

The Mundell-Fleming Model analyzes the interaction between exchange rates, interest rates, and output in an open economy under different exchange rate regimes. It extends the IS-LM framework by incorporating international capital mobility and distinguishes between fixed and flexible exchange rate systems. This model highlights the inherent trade-offs policymakers face, which directly relate to the Policy Trilemma of achieving monetary policy independence, exchange rate stability, and capital mobility simultaneously.

Understanding the Policy Trilemma (Impossible Trinity)

The Policy Trilemma, also known as the Impossible Trinity, states that a country cannot simultaneously maintain a fixed foreign exchange rate, free capital movement, and an independent monetary policy. The Mundell-Fleming Model highlights this trade-off by demonstrating how, under different exchange rate regimes, only two of these three objectives can be achieved effectively. Understanding the Policy Trilemma is crucial for policymakers to make informed decisions regarding exchange rate stability, capital mobility, and monetary sovereignty.

Core Assumptions of the Mundell-Fleming Model

The Mundell-Fleming Model assumes a small open economy with perfect capital mobility and fixed world interest rates, emphasizing short-run macroeconomic equilibrium under different exchange rate regimes. It presumes prices are sticky, allowing output and exchange rates to adjust to shocks, while ignoring long-term capital accumulation and supply-side factors. The model contrasts with the Policy Trilemma by focusing on the feasibility of simultaneously achieving fixed exchange rates, monetary policy independence, and capital mobility, highlighting trade-offs imposed by its core assumptions.

Key Components of the Policy Trilemma

The Policy Trilemma, also known as the impossible trinity, highlights the key components of exchange rate stability, monetary policy independence, and capital mobility, where a country can only achieve two of these three at the same time. The Mundell-Fleming Model analyzes the effectiveness of fiscal and monetary policies within an open economy under different exchange rate regimes, implicitly reflecting the constraints posed by the trilemma. Understanding these components is crucial for policymakers aiming to balance international capital flows, currency stability, and domestic economic objectives.

Exchange Rate Regimes and Capital Mobility

The Mundell-Fleming Model highlights the trade-offs between exchange rate regimes and capital mobility, demonstrating that a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. This forms the basis of the Policy Trilemma, which asserts that only two of these three objectives can be achieved at the same time. Countries adopting a floating exchange rate enjoy monetary policy autonomy with open capital markets, whereas those with fixed rates must restrict capital flows or relinquish monetary independence.

Monetary Policy Independence in Both Frameworks

The Mundell-Fleming model highlights the trade-off between monetary policy independence and exchange rate stability under different capital mobility conditions, showing that fixed exchange rates limit a country's autonomy in setting interest rates. The policy trilemma, or impossible trinity, asserts that a nation cannot simultaneously maintain monetary policy independence, fixed exchange rates, and free capital movement, mandating a choice among these objectives. In both frameworks, monetary policy independence is constrained by the degree of capital mobility and exchange rate regime, emphasizing the practical limitations central banks face in controlling domestic monetary conditions.

Real-World Applications and Case Studies

The Mundell-Fleming Model provides a framework for understanding the effectiveness of monetary and fiscal policy under different exchange rate regimes and capital mobility conditions, as evidenced by the contrasting policy responses of countries like the US during the 2008 financial crisis and China's managed exchange rate system. The Policy Trilemma highlights the trade-offs countries face between exchange rate stability, monetary policy independence, and capital mobility, a dilemma clearly illustrated by the European Monetary Union's challenges and emerging markets like Argentina, which have struggled to maintain all three simultaneously. Real-world applications demonstrate that nations often prioritize two of the three trilemma vertices, shaping their macroeconomic strategies and influencing international economic stability.

Limitations and Criticisms of Each Approach

The Mundell-Fleming Model assumes perfect capital mobility and fixed or flexible exchange rates, oversimplifying real-world complexities such as capital controls and market imperfections, which limits its applicability in diverse economic contexts. The Policy Trilemma highlights the impossible trinity of maintaining fixed exchange rates, monetary policy independence, and capital mobility simultaneously, but it often neglects practical nuances like varying degrees of capital controls and the role of financial innovation. Both frameworks face criticism for their static assumptions, lack of consideration for global financial integration dynamics, and inability to fully capture the effects of unconventional monetary policies.

Policy Implications for Open Economies

The Mundell-Fleming model illustrates the trade-offs between monetary policy effectiveness and exchange rate regimes in open economies, indicating that under fixed exchange rates, monetary policy loses autonomy, while flexible rates restore it at the cost of exchange rate volatility. The Policy Trilemma, or Impossible Trinity, posits that an open economy cannot simultaneously maintain a fixed exchange rate, free capital movement, and independent monetary policy, requiring policymakers to prioritize two of these three objectives. These frameworks guide governments in choosing exchange rate regimes and capital control measures, directly influencing inflation targeting, interest rate adjustments, and financial market stability in globalized markets.

Conclusion: Integrating Insights from Both Models

The Mundell-Fleming model highlights the trade-offs between exchange rate stability, monetary policy autonomy, and capital mobility under different exchange rate regimes, providing a foundational understanding of open-economy macroeconomics. The Policy Trilemma further refines this by asserting that countries can only simultaneously achieve two of the three goals: fixed exchange rates, free capital movement, and independent monetary policy. Integrating insights from both models emphasizes the necessity for policymakers to strategically balance these objectives, recognizing that pursuing all three goals concurrently is infeasible in a globalized financial system.

Mundell-Fleming Model Infographic

libterm.com

libterm.com