Equity dilution occurs when a company issues additional shares, reducing the ownership percentage of existing shareholders. This process can impact your voting power and earnings per share, potentially affecting your investment value. Discover how equity dilution shapes investor stakes and what you need to know to protect your interests in the full article.

Table of Comparison

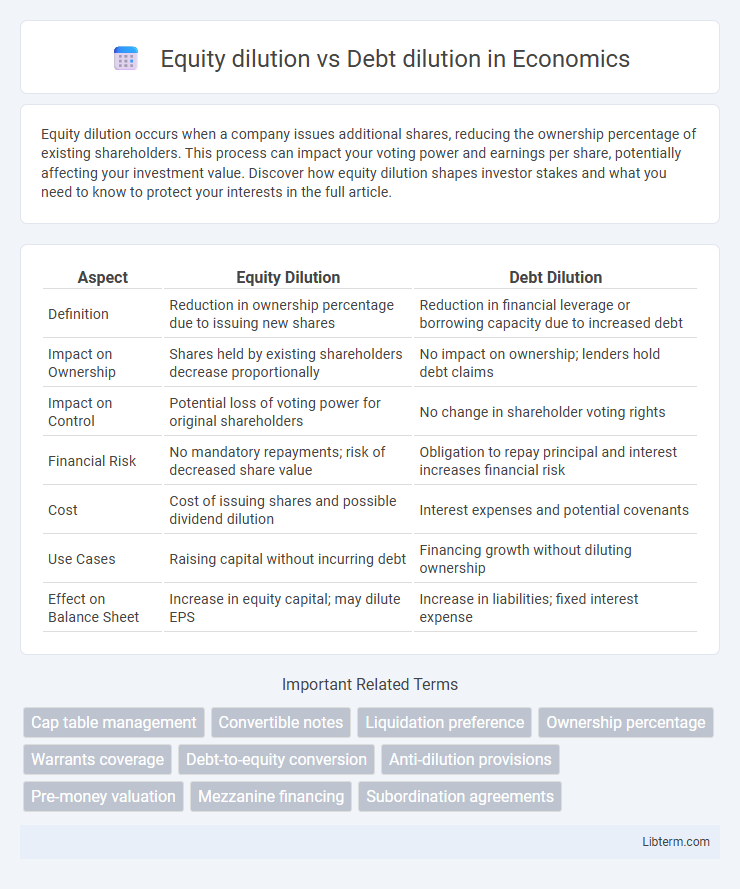

| Aspect | Equity Dilution | Debt Dilution |

|---|---|---|

| Definition | Reduction in ownership percentage due to issuing new shares | Reduction in financial leverage or borrowing capacity due to increased debt |

| Impact on Ownership | Shares held by existing shareholders decrease proportionally | No impact on ownership; lenders hold debt claims |

| Impact on Control | Potential loss of voting power for original shareholders | No change in shareholder voting rights |

| Financial Risk | No mandatory repayments; risk of decreased share value | Obligation to repay principal and interest increases financial risk |

| Cost | Cost of issuing shares and possible dividend dilution | Interest expenses and potential covenants |

| Use Cases | Raising capital without incurring debt | Financing growth without diluting ownership |

| Effect on Balance Sheet | Increase in equity capital; may dilute EPS | Increase in liabilities; fixed interest expense |

Introduction to Equity Dilution and Debt Dilution

Equity dilution occurs when a company issues additional shares, reducing existing shareholders' ownership percentage and voting power, often seen during fundraising or employee stock option exercises. Debt dilution involves the reduction in value or priority of existing debt instruments when new debt is issued under less favorable terms or converted into equity, impacting bondholders and creditors. Understanding equity and debt dilution is crucial for investors assessing changes in ownership structure and financial obligations affecting company control and credit risk.

Defining Equity Dilution

Equity dilution occurs when a company issues additional shares, reducing existing shareholders' ownership percentage and stake in the company. This process impacts voting power and earnings per share, potentially lowering the value of existing shares. Unlike debt dilution, which affects a company's liabilities and interest obligations, equity dilution directly alters the equity structure and investor control.

Understanding Debt Dilution

Debt dilution occurs when a company issues additional debt instruments that convert into equity, increasing the total shares outstanding and reducing existing shareholders' ownership percentage. Unlike traditional equity dilution, debt dilution involves convertible bonds or debentures that dilute ownership only upon conversion, impacting control and future earnings per share. Understanding debt dilution is crucial for investors to assess risks related to potential equity issuance triggered by debt agreements.

Key Differences Between Equity and Debt Dilution

Equity dilution occurs when a company issues additional shares, reducing existing shareholders' ownership percentage, whereas debt dilution involves the reduction of debt's value or dominance, often through debt restructuring or conversion into equity. Equity dilution impacts voting power and earnings per share, while debt dilution affects creditors' claims and interest obligations. Key differences include the nature of stakeholder impact, where equity dilution affects shareholders' control, and debt dilution primarily influences creditor rights and financial leverage.

Causes and Triggers of Dilution Events

Equity dilution occurs when a company issues new shares, often triggered by raising capital through equity financing, stock-based compensation, or convertible securities conversion, reducing existing shareholders' ownership percentage. Debt dilution, on the other hand, happens when debt holders convert their bonds or loans into equity, typically triggered by financial distress, restructuring agreements, or negotiated conversion terms that convert debt into shares to improve the company's balance sheet. Both dilution types impact shareholder value but arise from different financial strategies and conditions.

Impact on Ownership Structure

Equity dilution reduces existing shareholders' ownership percentages by issuing new shares, potentially weakening control and voting power. Debt dilution involves increasing liabilities, which does not alter ownership percentages but can affect financial leverage and creditworthiness. Understanding these mechanisms is crucial for maintaining strategic control and capital structure balance in corporate finance.

Effects on Shareholder Value and Control

Equity dilution reduces existing shareholders' ownership percentage by increasing the total number of shares outstanding, which can decrease their voting power and earnings per share, potentially impacting shareholder value negatively. Debt dilution, often referring to the issuance of convertible bonds or debt instruments that can convert into equity, can indirectly dilute ownership but initially provides capital without immediate ownership loss, preserving control more effectively. The choice between equity and debt dilution affects shareholder value through changes in capital structure, risk profile, and control dynamics, with equity issuance potentially diluting control and earnings, while debt issuance increases financial leverage and obligations.

Risks and Advantages of Equity vs Debt Dilution

Equity dilution reduces ownership percentage and voting power, potentially lowering control but does not require repayment, making it less risky in cash flow terms. Debt dilution increases financial risk due to obligatory interest payments and principal repayment but preserves ownership and control. Choosing equity dilution mitigates default risk, while debt dilution leverages tax benefits and retains shareholder equity.

Real-World Examples: Equity and Debt Dilution in Action

Equity dilution occurs when a company issues additional shares, reducing existing shareholders' ownership percentage, as seen in Tesla's 2020 capital raising that expanded its share count by issuing new stock to fund expansion. Debt dilution involves issuing new debt that may reduce the value of existing debt or increase risk, exemplified by General Electric's debt restructuring in 2018, where new bonds issuance impacted existing bondholders. These real-world examples highlight how equity dilution affects shareholder control and value, while debt dilution influences creditor positions and company leverage.

Strategies to Mitigate Dilution Risks

To mitigate equity dilution risks, companies often implement share buyback programs and issue stock options selectively to retain control and maintain shareholder value. In managing debt dilution, firms focus on maintaining strong credit ratings and structuring convertible debt with protective covenants to prevent excessive dilution upon conversion. Strategic financial planning, including balancing debt-to-equity ratios and engaging in transparent investor communication, helps optimize capital structure and minimize dilution impacts.

Equity dilution Infographic

libterm.com

libterm.com