Symmetric risk refers to situations where potential gains and losses are evenly balanced, creating equal probabilities for positive or negative outcomes. This concept is crucial in investment strategies and risk management as it helps in understanding the trade-offs involved. Explore the rest of the article to learn how symmetric risk impacts your financial decisions.

Table of Comparison

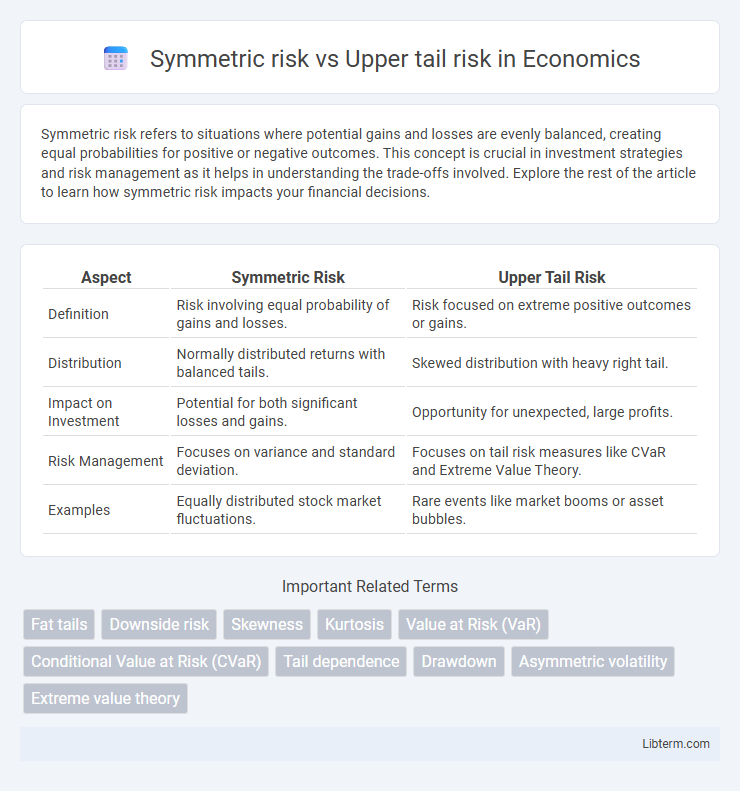

| Aspect | Symmetric Risk | Upper Tail Risk |

|---|---|---|

| Definition | Risk involving equal probability of gains and losses. | Risk focused on extreme positive outcomes or gains. |

| Distribution | Normally distributed returns with balanced tails. | Skewed distribution with heavy right tail. |

| Impact on Investment | Potential for both significant losses and gains. | Opportunity for unexpected, large profits. |

| Risk Management | Focuses on variance and standard deviation. | Focuses on tail risk measures like CVaR and Extreme Value Theory. |

| Examples | Equally distributed stock market fluctuations. | Rare events like market booms or asset bubbles. |

Introduction to Symmetric Risk and Upper Tail Risk

Symmetric risk refers to the potential for equal magnitude of losses and gains, where outcomes distribute evenly around a central value such as the mean or median. Upper tail risk, a form of asymmetric risk, specifically highlights the possibility and impact of extreme positive outcomes that lie in the upper tail of a probability distribution. Understanding these risk types is crucial for portfolio management and financial modeling, as symmetric risk assumes balanced variability while upper tail risk focuses on rare but significant upward deviations.

Defining Symmetric Risk: Concepts and Examples

Symmetric risk refers to scenarios where potential losses and gains are equally probable and balanced around a central point, often modeled by normal distribution in finance. Examples include investment portfolios with balanced positions in options or assets exhibiting volatility equally distributed on both sides of the mean return. Understanding symmetric risk is crucial for risk management strategies relying on variance or standard deviation as measures of uncertainty.

Understanding Upper Tail Risk: An Overview

Upper tail risk refers to the potential for extreme positive outcomes in a distribution, highlighting the possibility of significant gains beyond average expectations. Unlike symmetric risk, which assumes equal likelihood of losses and gains, upper tail risk emphasizes the skewed nature of returns where extreme positive events can disproportionately impact portfolio performance. Understanding upper tail risk is crucial for investors seeking to capture outsized returns while managing traditional measures of volatility and downside risk.

Key Differences Between Symmetric and Upper Tail Risk

Symmetric risk involves equal probability and magnitude of losses and gains on both sides of a distribution, reflecting balanced volatility around the mean, whereas upper tail risk specifically refers to the potential for extreme positive outcomes in the distribution's upper tail. Key differences include that symmetric risk assesses overall variability, while upper tail risk highlights rare, high-impact positive deviations often associated with opportunity rather than loss. Quantitative measures like variance and standard deviation capture symmetric risk, whereas metrics such as Conditional Value at Risk (CVaR) focused on upper quantiles are used to evaluate upper tail risk.

Practical Applications in Portfolio Management

Symmetric risk considers equal likelihood of gains and losses, making it suitable for portfolio strategies emphasizing balanced volatility control and mean-variance optimization. Upper tail risk focuses on extreme positive outcomes, guiding investors toward strategies that capitalize on rare, significant market upswings, crucial in hedge fund overlays and options trading. Understanding these risk types helps portfolio managers tailor asset allocations and risk mitigation techniques to match investment goals and market conditions effectively.

Measuring Symmetric vs Upper Tail Risk: Tools and Methods

Measuring symmetric risk often involves standard deviation and variance as key tools reflecting overall volatility in asset returns, capturing fluctuations on both sides of the mean. Upper tail risk assessment focuses on extreme positive outcomes, typically using metrics such as Conditional Value at Risk (CVaR) and higher moments like skewness to quantify the probability and impact of unusually large positive returns. Tools like stress testing and scenario analysis further enhance understanding by simulating market conditions that emphasize upper tail events, providing a comprehensive view of potential upside risks beyond symmetric measures.

Impact on Asset Allocation and Investment Decisions

Symmetric risk measures overall volatility by considering equal deviations on both sides of the mean, influencing asset allocation toward balanced diversification to manage general market fluctuations. Upper tail risk targets extreme positive outcomes, potentially leading to overweighting high-reward assets in investment decisions that prioritize upside potential. Understanding the interplay between symmetric risk and upper tail risk guides portfolio managers in optimizing risk-return profiles by blending volatility control with opportunities for significant gains.

Real-World Case Studies: Symmetric vs Upper Tail Events

Symmetric risk involves equal probability of upside and downside returns, as seen in balanced portfolio strategies during stable market conditions. Upper tail risk focuses on extreme, rare positive outcomes, illustrated by tech stocks experiencing sudden volatility spikes in 2020. Case studies from the 2008 financial crisis demonstrate that ignoring upper tail risks in credit markets led to catastrophic losses, whereas symmetric risk models underestimated the impact of both gains and losses.

Managing and Mitigating Both Risk Types

Managing symmetric risk involves balancing potential losses and gains by diversifying portfolios and applying volatility-based hedging strategies. Mitigating upper tail risk requires stress testing for extreme market events, utilizing options like deep out-of-the-money puts, and implementing scenario analysis to protect against rare but severe losses. Effective risk management combines quantitative models identifying symmetric risk exposures with tail risk hedging to enhance overall financial resilience.

Conclusion: Choosing the Right Risk Framework

Selecting the appropriate risk framework requires understanding that symmetric risk measures treat upside and downside volatility equally, suitable for general market fluctuations. Upper tail risk focuses specifically on extreme positive deviations, critical for strategies sensitive to rare, high-impact events like large gains or losses. Investors targeting balanced portfolios benefit from symmetric risk models, while those managing asymmetric payoff structures or seeking to hedge against extreme events should prioritize upper tail risk assessments.

Symmetric risk Infographic

libterm.com

libterm.com