Quantitative easing is a monetary policy tool used by central banks to stimulate the economy by increasing the money supply through large-scale asset purchases. This approach lowers interest rates, encourages lending, and boosts investment and consumption. Discover how quantitative easing impacts your financial landscape and the broader economy in the rest of this article.

Table of Comparison

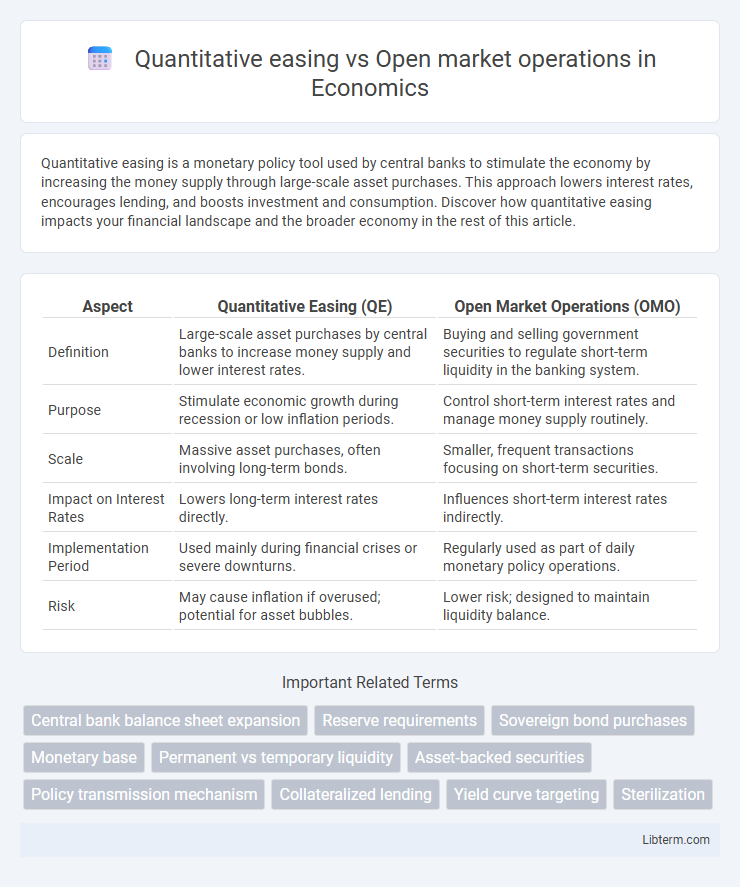

| Aspect | Quantitative Easing (QE) | Open Market Operations (OMO) |

|---|---|---|

| Definition | Large-scale asset purchases by central banks to increase money supply and lower interest rates. | Buying and selling government securities to regulate short-term liquidity in the banking system. |

| Purpose | Stimulate economic growth during recession or low inflation periods. | Control short-term interest rates and manage money supply routinely. |

| Scale | Massive asset purchases, often involving long-term bonds. | Smaller, frequent transactions focusing on short-term securities. |

| Impact on Interest Rates | Lowers long-term interest rates directly. | Influences short-term interest rates indirectly. |

| Implementation Period | Used mainly during financial crises or severe downturns. | Regularly used as part of daily monetary policy operations. |

| Risk | May cause inflation if overused; potential for asset bubbles. | Lower risk; designed to maintain liquidity balance. |

Introduction to Quantitative Easing and Open Market Operations

Quantitative easing (QE) involves central banks purchasing long-term securities to inject liquidity directly into the economy, aiming to lower interest rates and stimulate borrowing and investment during economic downturns. Open market operations (OMOs) refer to the routine buying and selling of short-term government securities by central banks to regulate money supply and control short-term interest rates. Both QE and OMOs are vital monetary policy tools, with QE primarily deployed in extraordinary economic conditions while OMOs maintain everyday liquidity and financial stability.

Defining Quantitative Easing (QE)

Quantitative easing (QE) is a monetary policy tool used by central banks to stimulate the economy by purchasing long-term securities, such as government bonds, to increase money supply and lower interest rates. Unlike open market operations (OMO) that typically involve short-term government securities to manage liquidity, QE targets longer-term assets to encourage lending and investment when conventional policy tools are insufficient. This expansion of the central bank's balance sheet aims to boost economic activity during periods of low growth and deflationary pressure.

Understanding Open Market Operations (OMO)

Open Market Operations (OMO) are central bank activities involving the buying and selling of government securities to regulate the money supply and influence short-term interest rates. Unlike quantitative easing, which involves large-scale asset purchases to inject liquidity during economic downturns, OMOs are more routine and targeted interventions aimed at maintaining desired market conditions. Effective OMO implementation supports monetary policy goals by managing liquidity, stabilizing inflation, and fostering economic growth.

Key Differences Between QE and OMO

Quantitative easing (QE) involves large-scale asset purchases aimed at injecting liquidity to stimulate the economy during periods of low interest rates and economic stagnation, whereas open market operations (OMO) are routine transactions conducted by central banks to manage short-term interest rates and control money supply. QE typically purchases longer-term securities like government bonds or mortgage-backed securities, targeting long-term interest rates, while OMO usually involves short-term government securities to influence short-term interest rates. The scale, purpose, and impact duration distinguish QE's expansive monetary stimulus from OMO's regular market liquidity management.

Objectives of QE vs OMO

Quantitative easing (QE) primarily aims to stimulate economic growth by increasing the money supply and lowering long-term interest rates through large-scale asset purchases, typically during periods of low inflation and sluggish economic activity. Open market operations (OMO) focus on regulating short-term interest rates and controlling liquidity in the banking system to maintain price stability and support overall monetary policy goals. QE targets broader financial conditions by directly influencing asset prices, while OMO operates mainly as a tool for fine-tuning monetary policy on a day-to-day basis.

Mechanisms of QE and OMO

Quantitative easing (QE) involves central banks purchasing longer-term securities such as government bonds and mortgage-backed securities to inject liquidity directly into the economy, aiming to lower long-term interest rates and stimulate investment. Open market operations (OMO) typically consist of buying or selling short-term government securities to regulate the money supply and control short-term interest rates, directly influencing liquidity in the banking system. QE expands the central bank's balance sheet significantly, targeting structural issues in credit markets, while OMO maintains daily liquidity levels and usually operates within pre-set policy rate frameworks.

Economic Impacts of QE and OMO

Quantitative easing (QE) significantly boosts economic growth by injecting large-scale liquidity into the financial system, lowering long-term interest rates, and encouraging increased lending and investment, which stimulates aggregate demand. Open market operations (OMO), involving the short-term buying or selling of government securities, primarily influence short-term interest rates and liquidity, maintaining price stability and controlling inflation. While QE aggressively targets economic expansion during recessions, OMO functions as a regular monetary policy tool for fine-tuning economic conditions and managing inflationary pressures.

Advantages and Disadvantages of Each Strategy

Quantitative easing (QE) increases money supply by purchasing long-term securities, which can stimulate economic growth but risks inflation and asset bubbles. Open market operations (OMO) involve buying or selling short-term government securities to control liquidity with quicker implementation and finer control but limited impact during liquidity traps. QE supports large-scale economic recovery, while OMO excels in routine monetary policy adjustments, each with inherent trade-offs between scope and control.

Historical Examples and Case Studies

The Federal Reserve's quantitative easing (QE) during the 2008 financial crisis involved large-scale asset purchases to inject liquidity, contrasting with its traditional open market operations (OMO) used for short-term interest rate targeting. Japan's prolonged QE from the 1990s highlights a central bank's response to deflationary pressures by buying government bonds and other securities, a strategy differing from OMOs which primarily stabilize daily money market rates. The European Central Bank's 2015 QE program demonstrated expansive asset buying to combat low inflation and stimulate growth, while its OMOs continued managing liquidity on a routine basis.

Conclusion: Choosing the Right Monetary Policy Tool

Quantitative easing and open market operations serve distinct roles in monetary policy, with QE aimed at large-scale asset purchases during economic downturns and OMO targeting short-term liquidity adjustments. The choice between these tools depends on economic conditions, policy goals, and the central bank's mandate to influence interest rates and stimulate growth. Effective monetary policy relies on selecting the appropriate mechanism to balance liquidity, control inflation, and support financial stability.

Quantitative easing Infographic

libterm.com

libterm.com