Fiscal stimulus boosts economic growth by increasing government spending or cutting taxes to encourage consumer demand and investment. This approach can help mitigate recession effects and reduce unemployment by injecting liquidity into the economy. Discover how fiscal stimulus can impact your financial future and the broader market in the rest of the article.

Table of Comparison

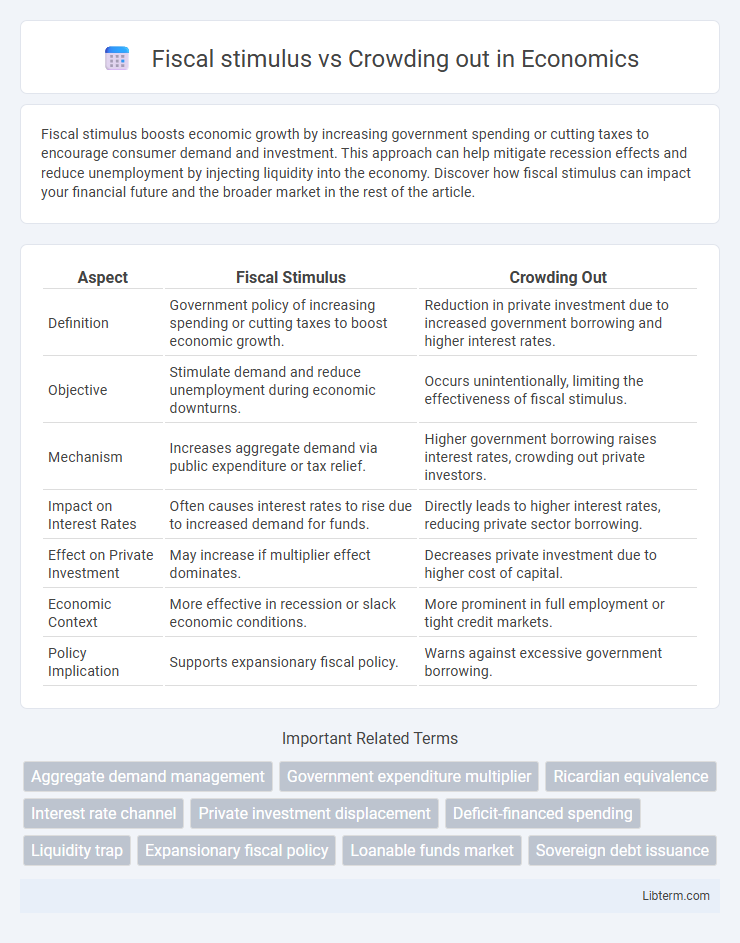

| Aspect | Fiscal Stimulus | Crowding Out |

|---|---|---|

| Definition | Government policy of increasing spending or cutting taxes to boost economic growth. | Reduction in private investment due to increased government borrowing and higher interest rates. |

| Objective | Stimulate demand and reduce unemployment during economic downturns. | Occurs unintentionally, limiting the effectiveness of fiscal stimulus. |

| Mechanism | Increases aggregate demand via public expenditure or tax relief. | Higher government borrowing raises interest rates, crowding out private investors. |

| Impact on Interest Rates | Often causes interest rates to rise due to increased demand for funds. | Directly leads to higher interest rates, reducing private sector borrowing. |

| Effect on Private Investment | May increase if multiplier effect dominates. | Decreases private investment due to higher cost of capital. |

| Economic Context | More effective in recession or slack economic conditions. | More prominent in full employment or tight credit markets. |

| Policy Implication | Supports expansionary fiscal policy. | Warns against excessive government borrowing. |

Introduction to Fiscal Stimulus and Crowding Out

Fiscal stimulus involves government spending increases or tax cuts aimed at boosting aggregate demand and economic growth during downturns. Crowding out occurs when rising government borrowing leads to higher interest rates, reducing private investment and offsetting stimulus effects. Understanding the interplay between fiscal stimulus and crowding out is essential for evaluating the effectiveness of fiscal policy.

Understanding Fiscal Stimulus: Purpose and Mechanisms

Fiscal stimulus involves increased government spending or tax cuts aimed at boosting economic activity during downturns by raising aggregate demand. Its primary mechanism includes direct government expenditure on infrastructure, social programs, or tax relief to enhance consumer and business spending power. This contrasts with crowding out, where higher government borrowing may lead to increased interest rates, potentially reducing private investment, but fiscal stimulus seeks to counteract economic slowdowns by injecting funds into the economy.

Defining the Crowding Out Effect in Economics

The crowding out effect in economics occurs when increased government spending leads to a reduction in private sector investment due to higher interest rates. Fiscal stimulus, aimed at boosting economic activity, can trigger this effect if government borrowing raises demand for loanable funds, driving up interest costs and discouraging businesses from investing. Understanding the balance between fiscal stimulus benefits and crowding out risks is critical for effective economic policy design.

Key Differences: Fiscal Stimulus vs Crowding Out

Fiscal stimulus involves increased government spending or tax cuts to boost aggregate demand and stimulate economic growth, directly impacting GDP and employment levels. Crowding out occurs when government borrowing raises interest rates, reducing private investment and potentially offsetting the stimulative effects of fiscal policy. The key difference lies in fiscal stimulus aiming to expand economic activity, while crowding out represents a limiting factor caused by government financing competing with the private sector.

Real-World Examples of Fiscal Stimulus

Fiscal stimulus, such as the U.S. American Recovery and Reinvestment Act of 2009, injected $831 billion into the economy to boost demand and reduce unemployment during the Great Recession. In contrast, crowding out occurs when government borrowing drives up interest rates, potentially limiting private investment, as seen in some high-debt countries where fiscal expansion led to tighter credit conditions. Real-world evidence suggests that effective fiscal stimulus in low-interest environments can spur growth without significant crowding out, particularly when targeted at infrastructure and social programs.

Evidence of Crowding Out in Economic History

Historical economic data reveal mixed evidence regarding fiscal stimulus and crowding out, with notable instances in the 1970s and 1980s where increased government spending raised interest rates, thereby reducing private investment. Empirical studies of advanced economies during large-scale fiscal expansions frequently document partial crowding out, especially in periods of full employment when government borrowing competes with private sector credit demand. However, in times of recession or liquidity traps, such as the 2008 financial crisis, crowding out effects tend to be minimal or absent, highlighting the importance of economic context in assessing fiscal policy outcomes.

Factors Influencing the Magnitude of Crowding Out

The magnitude of crowding out depends largely on interest rate sensitivity, the state of the economy, and monetary policy stance. High interest rate sensitivity in investment causes greater crowding out when fiscal stimulus increases government borrowing. In a recession with idle resources, crowding out is minimal, whereas during full employment, increased government spending can significantly displace private investment.

Fiscal Multiplier: Measuring the Impact of Stimulus

Fiscal stimulus effectiveness is often assessed through the fiscal multiplier, which measures the change in economic output resulting from government spending or tax cuts. A high fiscal multiplier indicates that stimulus significantly boosts GDP, while crowding out occurs when increased government borrowing raises interest rates, dampening private investment and reducing the multiplier effect. Empirical studies show fiscal multipliers tend to be larger during economic recessions when crowding out is minimal and monetary policy accommodates expansion.

Policy Considerations for Mitigating Crowding Out

Fiscal stimulus aims to boost economic activity by increasing government spending or cutting taxes, but it can lead to crowding out, where higher government borrowing drives up interest rates and reduces private investment. Policy considerations to mitigate crowding out include targeting fiscal stimulus during periods of economic slack, employing monetary policy coordination to keep interest rates low, and prioritizing spending on high-multiplier projects that enhance long-term productivity. Utilizing measures such as infrastructure investment and social programs can maximize economic output without significantly displacing private sector spending.

Conclusion: Balancing Stimulus and Economic Stability

Effective fiscal stimulus boosts economic growth by increasing aggregate demand, but excessive government spending risks crowding out private investment through higher interest rates. Policymakers must carefully calibrate stimulus measures to support recovery while maintaining fiscal discipline to avoid undermining long-term economic stability. Achieving this balance ensures sustained growth without triggering inflationary pressures or excessive public debt.

Fiscal stimulus Infographic

libterm.com

libterm.com