The multiplier effect describes how an initial increase in spending leads to a larger overall increase in national income, amplifying economic growth beyond the original expenditure. This phenomenon occurs because one person's spending becomes another person's income, stimulating further spending in a continuous cycle. Discover how understanding the multiplier effect can enhance your grasp of economic dynamics in the rest of this article.

Table of Comparison

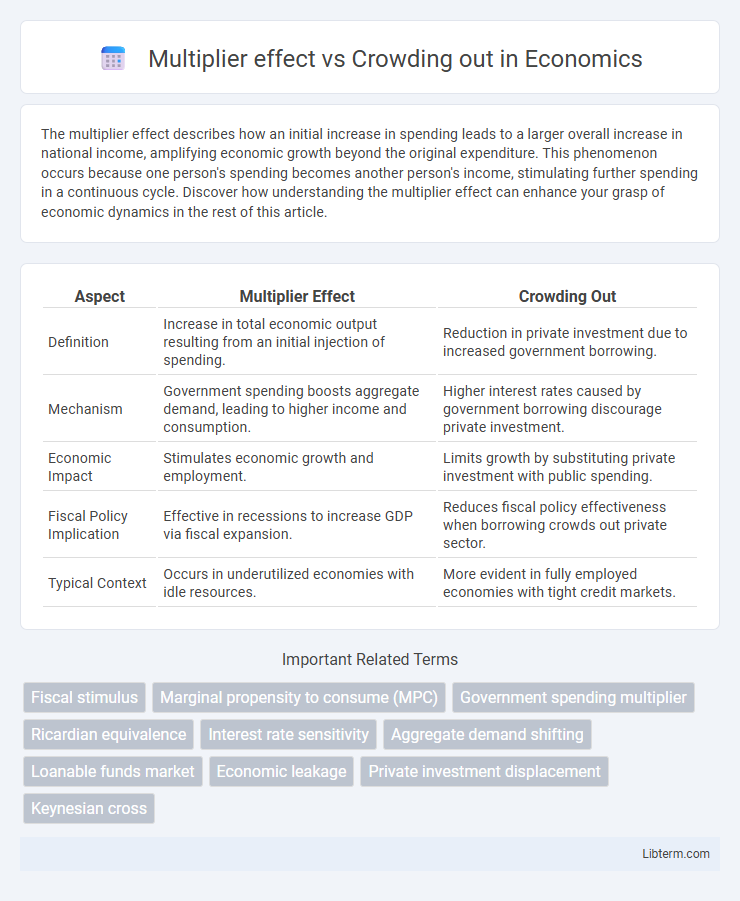

| Aspect | Multiplier Effect | Crowding Out |

|---|---|---|

| Definition | Increase in total economic output resulting from an initial injection of spending. | Reduction in private investment due to increased government borrowing. |

| Mechanism | Government spending boosts aggregate demand, leading to higher income and consumption. | Higher interest rates caused by government borrowing discourage private investment. |

| Economic Impact | Stimulates economic growth and employment. | Limits growth by substituting private investment with public spending. |

| Fiscal Policy Implication | Effective in recessions to increase GDP via fiscal expansion. | Reduces fiscal policy effectiveness when borrowing crowds out private sector. |

| Typical Context | Occurs in underutilized economies with idle resources. | More evident in fully employed economies with tight credit markets. |

Understanding the Multiplier Effect

The multiplier effect measures how initial government spending increases aggregate demand, leading to a larger overall economic output through successive rounds of consumption. This concept contrasts with crowding out, where increased public sector borrowing raises interest rates and reduces private investment, potentially neutralizing fiscal stimulus. Understanding the multiplier effect highlights the importance of fiscal policy in stimulating economic growth beyond the initial expenditure.

Mechanisms Behind the Multiplier Effect

The multiplier effect operates through increased consumer spending triggered by initial government expenditure, boosting aggregate demand and generating a chain reaction of income and production growth within the economy. This contrasts with crowding out, where higher government borrowing raises interest rates, thereby reducing private investment and mitigating the overall economic expansion. Understanding the multiplier involves analyzing how fiscal stimulus amplifies economic output via consumption and investment feedback loops.

Real-World Examples of the Multiplier Effect

The multiplier effect demonstrates how initial government spending in sectors like infrastructure can stimulate economic growth by increasing aggregate demand and generating additional income, as seen in the New Deal programs during the Great Depression. In contrast, crowding out occurs when increased public borrowing drives up interest rates, reducing private investment, evident during high US deficits in the 1980s that constrained private sector growth. Real-world examples of the multiplier effect include stimulus packages following the 2008 financial crisis, where direct fiscal interventions led to job creation and GDP growth beyond the initial expenditure.

Defining Crowding Out

Crowding out refers to the economic phenomenon where increased government spending leads to a reduction in private sector investment, often due to higher interest rates caused by government borrowing. This effect can diminish the intended stimulus of fiscal policy by limiting private capital availability and slowing economic growth. In contrast, the multiplier effect describes how initial government spending propagates through the economy, increasing overall demand and output beyond the original expenditure.

How Crowding Out Occurs

Crowding out occurs when increased government spending leads to higher interest rates, reducing private investment as borrowing becomes more expensive. This phenomenon often arises during full employment, where the government competes with the private sector for limited funds in financial markets. The resulting decline in private sector spending can offset the initial stimulus, diminishing the overall multiplier effect of fiscal policy.

Fiscal Policy: Multiplier vs Crowding Out

Fiscal policy's multiplier effect amplifies government spending by increasing aggregate demand, leading to higher income and consumption levels throughout the economy. Crowding out occurs when increased government borrowing raises interest rates, which reduces private investment spending and offsets some of the initial fiscal stimulus. The balance between these phenomena determines the net impact of fiscal policy on economic growth and overall output.

Factors Influencing the Magnitude of Each Effect

The magnitude of the multiplier effect depends on the marginal propensity to consume, openness of the economy, and the level of spare capacity, which determine how initial spending translates into increased aggregate demand. Crowding out intensity is influenced by interest rate sensitivity of investment, fiscal deficit size, and monetary policy stance, affecting how government borrowing may displace private investment. Both effects are moderated by economic conditions such as inflation expectations and the responsiveness of capital markets, shaping overall fiscal impact on economic growth.

Empirical Evidence: Multiplier vs Crowding Out

Empirical evidence shows that fiscal multipliers vary significantly depending on economic conditions, often exceeding one during recessions and being near zero or negative in times of full employment, indicating limited crowding out. Studies using cross-country data and natural experiments reveal that government spending can boost output without fully displacing private investment when interest rates are low or monetary policy is accommodative. Conversely, in economies operating near capacity, increased public spending often crowds out private sector activity, validating the crowding out hypothesis.

Policy Implications and Economic Growth

The multiplier effect boosts economic growth by amplifying government spending through increased aggregate demand and consumption, leading to higher output and employment levels. Crowding out occurs when excessive government borrowing raises interest rates, reducing private investment and potentially dampening growth prospects. Policymakers must balance stimulus measures to maximize multiplier benefits while minimizing crowding out risks for sustainable economic expansion.

Striking a Balance: Lessons for Policymakers

Striking a balance between the multiplier effect and crowding out is crucial for effective fiscal policy. Policymakers must carefully design government spending to stimulate aggregate demand without triggering excessive interest rate increases that displace private investment. Understanding the nuances of fiscal multipliers and the sensitivity of capital markets enables more efficient resource allocation and sustainable economic growth.

Multiplier effect Infographic

libterm.com

libterm.com