Dollarization occurs when a country adopts the US dollar alongside or instead of its national currency to stabilize the economy and reduce inflation risks. This process can attract foreign investment and facilitate international trade while potentially limiting monetary policy control. Explore the rest of the article to understand the implications of dollarization for your financial landscape.

Table of Comparison

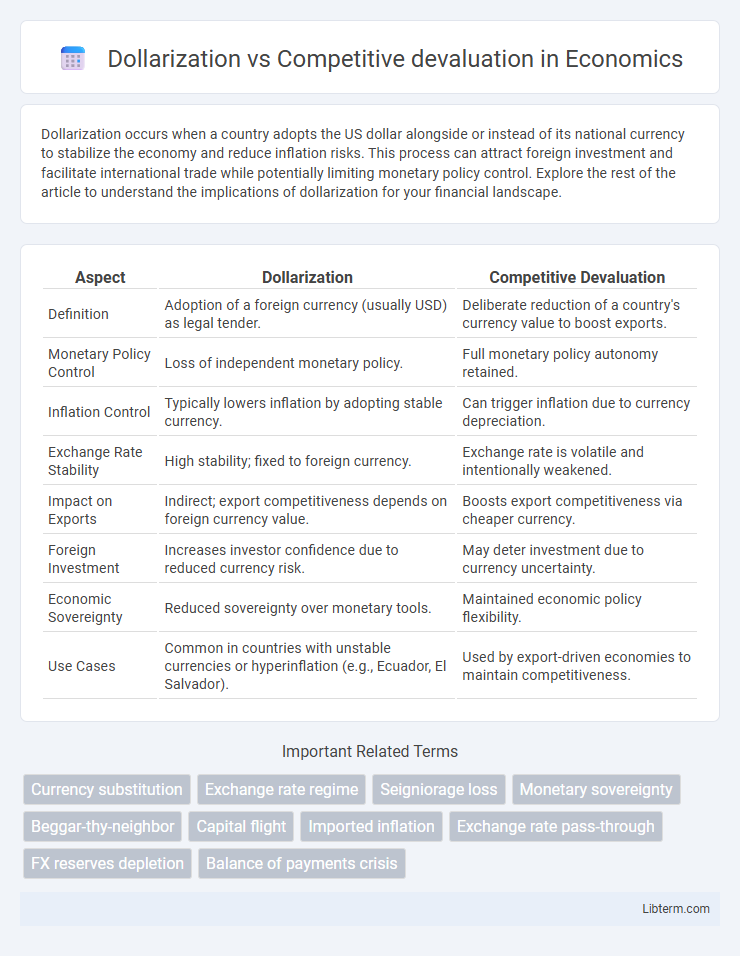

| Aspect | Dollarization | Competitive Devaluation |

|---|---|---|

| Definition | Adoption of a foreign currency (usually USD) as legal tender. | Deliberate reduction of a country's currency value to boost exports. |

| Monetary Policy Control | Loss of independent monetary policy. | Full monetary policy autonomy retained. |

| Inflation Control | Typically lowers inflation by adopting stable currency. | Can trigger inflation due to currency depreciation. |

| Exchange Rate Stability | High stability; fixed to foreign currency. | Exchange rate is volatile and intentionally weakened. |

| Impact on Exports | Indirect; export competitiveness depends on foreign currency value. | Boosts export competitiveness via cheaper currency. |

| Foreign Investment | Increases investor confidence due to reduced currency risk. | May deter investment due to currency uncertainty. |

| Economic Sovereignty | Reduced sovereignty over monetary tools. | Maintained economic policy flexibility. |

| Use Cases | Common in countries with unstable currencies or hyperinflation (e.g., Ecuador, El Salvador). | Used by export-driven economies to maintain competitiveness. |

Introduction to Dollarization and Competitive Devaluation

Dollarization occurs when a country adopts a foreign currency, typically the US dollar, as its official currency to stabilize its economy and curb hyperinflation. Competitive devaluation involves a country deliberately lowering its currency value to gain export advantages by making goods cheaper on the international market. Both strategies aim to address economic instability but differ fundamentally in currency control and policy implications.

Defining Dollarization: Key Features and Motivations

Dollarization occurs when a country adopts a foreign currency, typically the US dollar, as its legal tender to stabilize the economy, improve investor confidence, and curb hyperinflation. Key features of dollarization include loss of independent monetary policy, elimination of exchange rate risk, and increased transparency in financial transactions. Motivations for dollarization often stem from chronic inflation, economic instability, and the desire to align with a strong, stable currency to attract foreign investment and lower interest rates.

Understanding Competitive Devaluation in Global Economics

Competitive devaluation occurs when countries intentionally lower their currency value to boost export competitiveness by making goods cheaper on the international market. This strategy often triggers retaliatory devaluations, leading to currency wars that can destabilize global trade and economic growth. Understanding competitive devaluation involves analyzing its impact on exchange rates, trade balances, inflation, and international monetary policy coordination.

Historical Context and Case Studies

Dollarization, the adoption of the U.S. dollar as a country's official currency, often emerges from severe economic crises to restore stability, as witnessed in Ecuador following its 1999-2000 banking collapse. Competitive devaluation, the strategic lowering of a nation's currency value to boost exports, was notably employed by countries during the Great Depression and more recently by China to address trade imbalances. Historical case studies highlight Ecuador's dollarization stabilizing inflation and attracting foreign investment, while Argentina's repeated competitive devaluations in the early 2000s temporarily improved export competitiveness but also led to inflationary pressures and loss of investor confidence.

Economic Impacts: Growth, Stability, and Investment

Dollarization enhances economic stability by reducing inflation and currency risk, which encourages foreign investment and promotes steady growth. Competitive devaluation can temporarily boost exports and economic activity but often leads to inflationary pressures and reduced investor confidence, undermining long-term stability. Countries adopting dollarization tend to experience lower interest rates and increased capital inflows, while those relying on devaluation face exchange rate volatility that can hinder sustained investment and economic expansion.

Currency Sovereignty vs. External Anchoring

Dollarization involves adopting a foreign currency, typically the US dollar, which sacrifices currency sovereignty for external anchoring, stabilizing inflation and interest rates by linking the economy to a stable currency regime. Competitive devaluation preserves currency sovereignty by allowing a country to adjust its exchange rate independently, aiming to boost exports and correct trade imbalances but often leading to inflationary pressures and reduced investor confidence. The choice between dollarization and competitive devaluation reflects a trade-off between maintaining monetary policy autonomy and achieving macroeconomic stability through external anchors.

Policy Tools and Constraints Under Each Approach

Dollarization eliminates exchange rate policy as a tool, fixing the currency to the US dollar, which restricts monetary policy independence but stabilizes inflation and anchors expectations. Competitive devaluation relies on adjusting the national currency's value to improve export competitiveness, requiring flexible exchange rate regimes and active central bank intervention, but risks triggering inflation and retaliatory devaluations. Policymakers face constraints in dollarization due to loss of seigniorage and inability to respond to local shocks, while competitive devaluation demands careful balance to avoid currency wars and macroeconomic instability.

Social and Political Implications

Dollarization stabilizes economies by reducing inflation and fostering investor confidence, but it often limits a nation's monetary policy flexibility, potentially sparking social unrest due to perceived loss of economic sovereignty. Competitive devaluation can temporarily boost exports and employment but risks triggering retaliatory actions, inflationary pressures, and widening social inequality. Politically, dollarization may enhance international credibility but reduce government control, while competitive devaluation can provoke nationalist sentiment and instability through exchange rate volatility.

Comparative Analysis: Risks and Benefits

Dollarization offers currency stability and reduced inflation risk by adopting a foreign currency like the US dollar, but it limits monetary policy flexibility and seigniorage revenue. Competitive devaluation can boost export competitiveness and correct trade imbalances but risks triggering inflation, capital flight, and retaliatory currency devaluations from trade partners. The choice depends on a country's economic structure and policy priorities, weighing the long-term credibility of dollarization against the short-term trade advantages of devaluation.

Choosing the Right Strategy: Factors for Policymakers

Policymakers must assess economic stability, inflation rates, and foreign exchange reserves when choosing between dollarization and competitive devaluation. Dollarization provides currency stability and reduces exchange rate risk but limits monetary policy control, while competitive devaluation can boost export competitiveness but risks imported inflation and financial volatility. Factors such as the structure of the economy, trade dependencies, and political commitment to fiscal discipline are critical in determining the optimal exchange rate strategy.

Dollarization Infographic

libterm.com

libterm.com