A perfect competitor operates in a market characterized by a large number of buyers and sellers, homogeneous products, and free entry and exit. This ensures that no individual firm can influence the market price, leading to optimal resource allocation and efficient production. Discover how understanding perfect competition can help you navigate market dynamics effectively by reading the rest of the article.

Table of Comparison

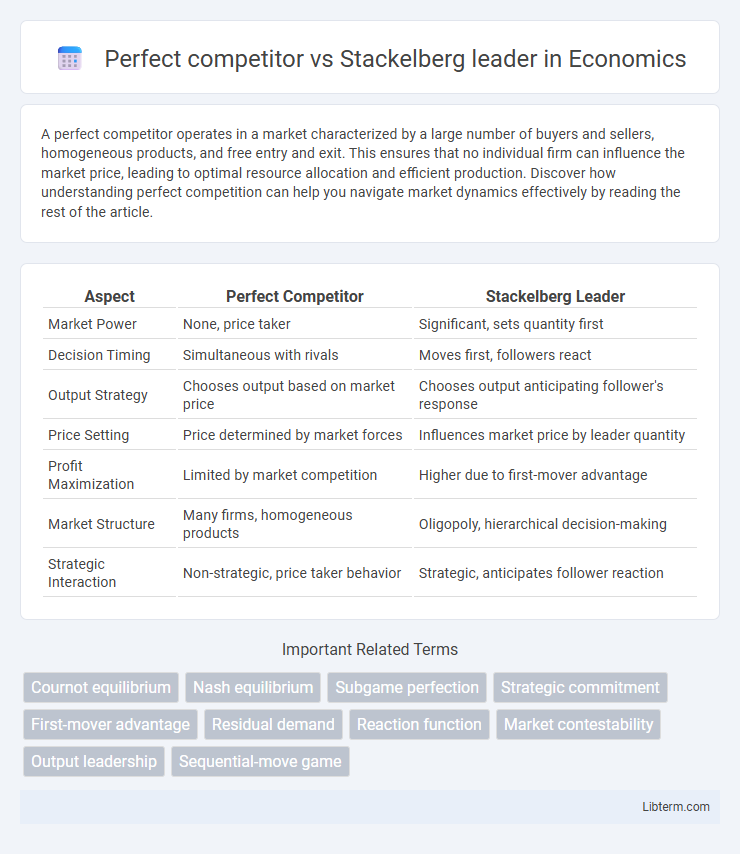

| Aspect | Perfect Competitor | Stackelberg Leader |

|---|---|---|

| Market Power | None, price taker | Significant, sets quantity first |

| Decision Timing | Simultaneous with rivals | Moves first, followers react |

| Output Strategy | Chooses output based on market price | Chooses output anticipating follower's response |

| Price Setting | Price determined by market forces | Influences market price by leader quantity |

| Profit Maximization | Limited by market competition | Higher due to first-mover advantage |

| Market Structure | Many firms, homogeneous products | Oligopoly, hierarchical decision-making |

| Strategic Interaction | Non-strategic, price taker behavior | Strategic, anticipates follower reaction |

Introduction to Market Structures

In a perfectly competitive market, numerous small firms operate as price takers, ensuring no single entity can influence market prices, leading to allocative and productive efficiency. In contrast, a Stackelberg leader operates within an oligopolistic market structure, where the leader firm moves first, strategically setting output to influence followers and maximize market advantage. The comparison highlights differences in market power, strategic behavior, and equilibrium outcomes in these fundamental economic models.

Defining the Perfect Competitor

A perfect competitor operates in a market with many firms offering homogeneous products, ensuring no single firm can influence prices, thus they accept the market price as given. In contrast, a Stackelberg leader strategically sets output levels anticipating the follower's response to maximize its own profit. The perfect competitor's defining characteristic lies in price-taking behavior driven by perfect information and free market entry.

Understanding the Stackelberg Leader

The Stackelberg leader distinguishes itself by strategically choosing its output first, anticipating the followers' reactions, unlike perfect competitors who act simultaneously without market influence. By committing to a production quantity, the Stackelberg leader can effectively influence market prices and maximize profits, exploiting its first-mover advantage. This strategic commitment contrasts with perfect competition's price-taking behavior, highlighting the leader's role in shaping market equilibrium and follower responses.

Key Assumptions in Perfect Competition

Perfect competition assumes a large number of small firms with no individual market power, homogeneous products, and free entry and exit, ensuring price-taking behavior. In contrast, a Stackelberg leader assumes a firm with strategic market power that moves first, influencing followers' output decisions in a sequential game. The key assumption in perfect competition is that no single firm can affect market price, resulting in equilibrium where firms produce at the minimum average cost and earn zero economic profits.

Stackelberg Leadership Model Explained

The Stackelberg leadership model describes a strategic game in oligopoly markets where the leader firm moves first and sets its output, influencing the follower firms' decisions. Unlike perfect competition, where firms are price takers with no market power, the Stackelberg leader exploits first-mover advantage to maximize profit by anticipating follower reactions. This model highlights the impact of sequential decision-making and market power on output, pricing, and competitive dynamics.

Strategic Decision-Making: Comparison

Perfect competitors base strategic decisions on price-taking behavior, accepting market prices without influence, resulting in no incentive to act strategically. Stackelberg leaders anticipate followers' reactions and set quantities strategically to maximize their own profit, exploiting first-mover advantage. This strategic foresight enables Stackelberg leaders to influence market outcomes, while perfect competitors operate under assumptions of price and output homogeneity.

Output and Pricing Strategies

In a perfect competition market, firms are price takers producing output where marginal cost equals market price, resulting in optimal allocative efficiency and no individual influence on the market price. The Stackelberg leader strategically sets output first, anticipating followers' responses, allowing it to influence the market price to maximize its own profit by producing a higher quantity than competitors. While perfect competitors accept prices determined by aggregate supply and demand, the Stackelberg leader leverages output decisions as a tool for price leadership and market power.

Profit Outcomes: Perfect Competitor vs Stackelberg Leader

In a perfect competition market, firms are price takers, resulting in zero economic profit in the long run due to free entry and exit. The Stackelberg leader, by committing to an output level first, strategically influences the follower's production, thereby securing higher profits compared to firms in perfect competition. This first-mover advantage allows the Stackelberg leader to capture a larger market share and generate greater economic profits by optimizing output and pricing decisions under imperfect competition.

Real-World Examples and Applications

In perfect competition, firms are price takers like local farmers markets where numerous sellers offer identical products, leading to minimal control over market prices. The Stackelberg leader model is evident in industries such as the automotive sector, where a dominant firm like Toyota sets production levels first, influencing competitors' output decisions. Real-world applications of these models highlight how market structure impacts pricing, output strategies, and competitive dynamics in various economic environments.

Conclusion: Strategic Implications for Businesses

Perfect competitors operate in markets with numerous small firms, each unable to influence prices, leading to zero economic profit in the long run, whereas Stackelberg leaders strategically set output first, gaining a competitive advantage by influencing follower firms' decisions. Businesses adopting a Stackelberg leadership position can secure higher profits through proactive quantity commitments and market influence, while firms in perfect competition must rely on efficiency and cost leadership to survive. Emphasizing strategic positioning and market power exploitation is crucial for firms aiming to transition from perfect competition dynamics to Stackelberg leadership benefits.

Perfect competitor Infographic

libterm.com

libterm.com