Revenue deficit occurs when a government's revenue expenditure exceeds its revenue receipts, indicating that current incomes are insufficient to cover ongoing expenses. This shortfall impacts economic stability and can lead to increased borrowing or reduced public investment. Explore the rest of the article to understand how revenue deficit affects your nation's financial health and possible solutions.

Table of Comparison

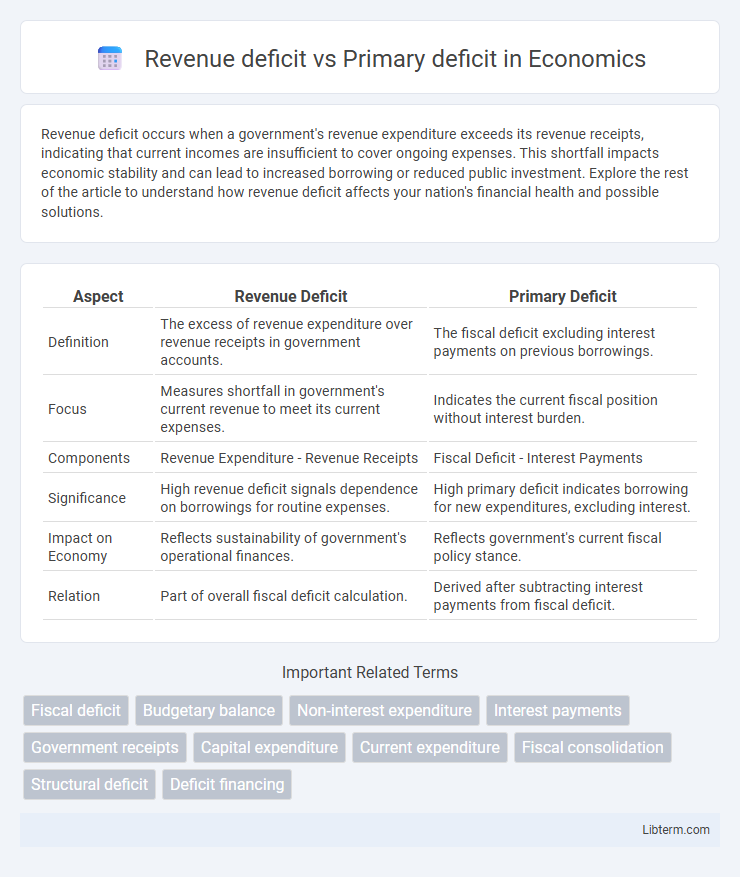

| Aspect | Revenue Deficit | Primary Deficit |

|---|---|---|

| Definition | The excess of revenue expenditure over revenue receipts in government accounts. | The fiscal deficit excluding interest payments on previous borrowings. |

| Focus | Measures shortfall in government's current revenue to meet its current expenses. | Indicates the current fiscal position without interest burden. |

| Components | Revenue Expenditure - Revenue Receipts | Fiscal Deficit - Interest Payments |

| Significance | High revenue deficit signals dependence on borrowings for routine expenses. | High primary deficit indicates borrowing for new expenditures, excluding interest. |

| Impact on Economy | Reflects sustainability of government's operational finances. | Reflects government's current fiscal policy stance. |

| Relation | Part of overall fiscal deficit calculation. | Derived after subtracting interest payments from fiscal deficit. |

Introduction to Fiscal Deficits

Revenue deficit refers to the shortfall when the government's revenue expenditure exceeds its revenue receipts, indicating that current income is insufficient to cover ongoing expenses. Primary deficit measures the fiscal deficit excluding interest payments on previous borrowings, reflecting the current borrowing requirement for non-interest spending. Understanding these distinctions is crucial for analyzing fiscal health and sustainability in public finance management.

Defining Revenue Deficit

Revenue deficit occurs when a government's revenue expenditure exceeds its revenue receipts, signaling a shortfall in funds available for day-to-day operations without borrowing. Primary deficit measures the fiscal gap after excluding interest payments on outstanding debt, reflecting the current fiscal balance. Understanding revenue deficit is crucial for assessing fiscal health, as it highlights the inability to cover routine expenses from regular income sources.

Understanding Primary Deficit

Primary deficit represents the fiscal deficit excluding interest payments on previous borrowings, highlighting the current government's borrowing needs to fund its expenditures beyond revenues. Revenue deficit occurs when government's revenue receipts are insufficient to cover its revenue expenditures, indicating the gap in covering day-to-day expenses. Understanding primary deficit is crucial as it reflects the true fiscal health by showing whether current fiscal policies are sustainable without considering past debt obligations.

Key Components of Revenue Deficit

Revenue deficit primarily indicates that the government's revenue expenditure exceeds its revenue receipts, reflecting a shortfall in meeting routine operational expenses. Key components of revenue deficit include subsidies, interest payments, salaries, and pensions, all representing non-developmental expenditures financed by borrowed funds. In contrast, primary deficit measures the gap between fiscal deficit and interest payments, highlighting current fiscal imbalances excluding debt servicing costs.

Key Components of Primary Deficit

Primary deficit is the fiscal deficit excluding interest payments on previous borrowings, focusing on the government's current fiscal health. Key components of the primary deficit include total government expenditure minus interest payments and total revenue receipts, emphasizing the gap in non-interest fiscal operations. Revenue deficit, by contrast, arises when the government's revenue expenditure exceeds its revenue receipts, reflecting a shortfall in covering operational expenses without borrowing.

Revenue Deficit vs Primary Deficit: Core Differences

Revenue deficit indicates the gap between the government's revenue expenditure and revenue receipts, highlighting insufficient income to cover operational costs. In contrast, primary deficit measures the fiscal imbalance excluding interest payments on previous debts, reflecting the current year's borrowing requirement for non-interest expenditures. Understanding these distinctions clarifies the government's fiscal health and aids in assessing sustainability and debt management strategies.

Causes of High Revenue and Primary Deficits

High revenue deficits often result from a persistent mismatch between government revenue and revenue expenditure, primarily caused by inefficient tax collection, expanding subsidies, and rising operational costs of public services. Primary deficits arise when non-interest expenditures exceed total non-interest revenues, typically driven by increased government spending on welfare schemes, infrastructure, and administrative expenses without corresponding revenue growth. Both deficits are exacerbated by economic slowdowns, structural fiscal imbalances, and insufficient reforms in public financial management and tax policy.

Economic Implications of Revenue Deficit

Revenue deficit indicates that the government's revenue expenditure exceeds its revenue receipts, affecting its ability to fund routine operations without borrowing. This shortfall leads to increased fiscal stress, undermining economic stability and reducing the scope for developmental spending. In contrast, primary deficit reflects the difference between fiscal deficit and interest payments, highlighting the government's borrowing needs excluding past debt servicing.

Economic Impacts of Primary Deficit

Primary deficit, defined as the fiscal deficit excluding interest payments on past debt, directly influences a country's borrowing needs and fiscal sustainability, impacting long-term economic growth. A high primary deficit signals that current expenditures exceed revenues excluding interest, potentially leading to increased debt accumulation and higher future interest obligations. Managing the primary deficit is crucial for maintaining investor confidence, controlling inflation, and ensuring stable economic development by preventing fiscal imbalances.

Steps to Manage and Reduce Fiscal Deficits

To manage and reduce fiscal deficits, it is essential to distinguish between revenue deficit and primary deficit, as the former indicates the shortfall in current income against current expenditure, while the latter excludes interest payments on debt, highlighting the government's fiscal discipline. Effective steps include enhancing tax revenues through broadening the tax base and improving compliance, rationalizing subsidies, and controlling non-essential expenditure to reduce the revenue deficit. For the primary deficit, strategies focus on controlling interest expenses by restructuring debt and promoting fiscal consolidation policies that emphasize sustainable borrowing and efficient public spending.

Revenue deficit Infographic

libterm.com

libterm.com