Tax arbitrage involves exploiting differences in tax rates or regulations between jurisdictions to minimize tax liabilities and maximize after-tax returns. This strategy can be employed by individuals or corporations to legally reduce their tax burden by shifting income, deductions, or investments across borders. Explore the detailed mechanisms and risks of tax arbitrage to understand how you can optimize your tax planning effectively.

Table of Comparison

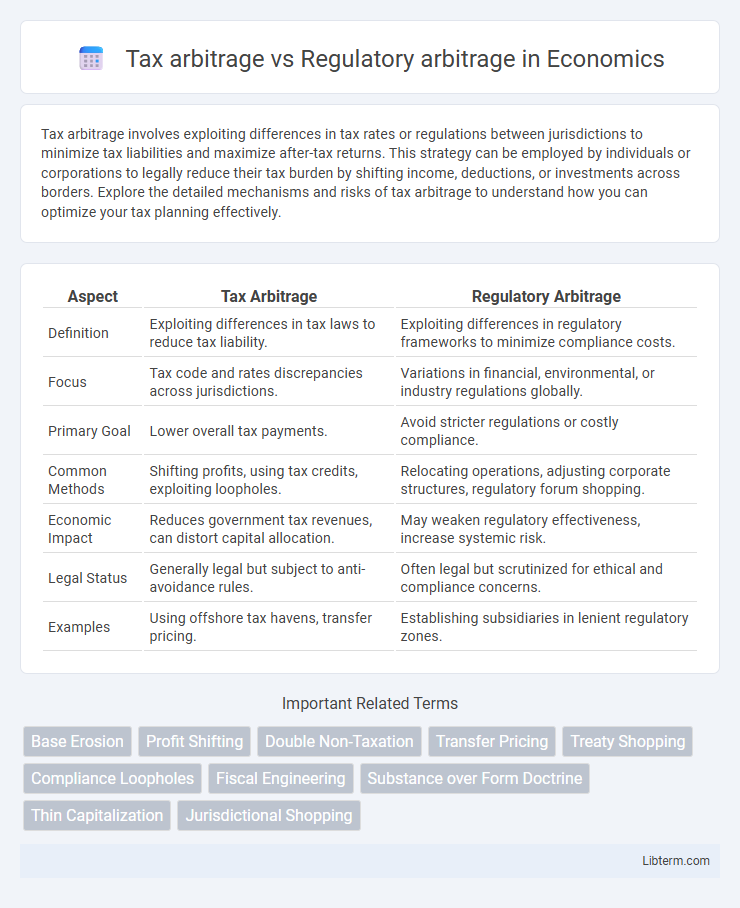

| Aspect | Tax Arbitrage | Regulatory Arbitrage |

|---|---|---|

| Definition | Exploiting differences in tax laws to reduce tax liability. | Exploiting differences in regulatory frameworks to minimize compliance costs. |

| Focus | Tax code and rates discrepancies across jurisdictions. | Variations in financial, environmental, or industry regulations globally. |

| Primary Goal | Lower overall tax payments. | Avoid stricter regulations or costly compliance. |

| Common Methods | Shifting profits, using tax credits, exploiting loopholes. | Relocating operations, adjusting corporate structures, regulatory forum shopping. |

| Economic Impact | Reduces government tax revenues, can distort capital allocation. | May weaken regulatory effectiveness, increase systemic risk. |

| Legal Status | Generally legal but subject to anti-avoidance rules. | Often legal but scrutinized for ethical and compliance concerns. |

| Examples | Using offshore tax havens, transfer pricing. | Establishing subsidiaries in lenient regulatory zones. |

Introduction to Arbitrage in Finance

Arbitrage in finance involves exploiting price differences of the same asset across different markets to generate risk-free profits. Tax arbitrage focuses on capitalizing on disparities in tax regulations between jurisdictions to reduce tax obligations and increase returns. Regulatory arbitrage seeks to benefit from varying regulatory frameworks by shifting activities to environments with more favorable rules, optimizing compliance costs and operational flexibility.

Defining Tax Arbitrage

Tax arbitrage involves exploiting differences in tax rates or regulations between jurisdictions to reduce overall tax liability, often by shifting profits or expenses strategically. Regulatory arbitrage, in contrast, focuses on bypassing or minimizing compliance costs by selecting regulatory environments with more favorable rules or enforcement levels. Understanding tax arbitrage requires analyzing international tax laws, transfer pricing, and corporate structures designed to optimize tax outcomes without violating legal frameworks.

Understanding Regulatory Arbitrage

Regulatory arbitrage involves exploiting differences in regulatory rules and frameworks between jurisdictions to minimize compliance costs or gain competitive advantages. Companies strategically structure operations, transactions, or financial activities to benefit from less stringent regulations, often in areas like banking, environmental policy, or labor laws. Understanding regulatory arbitrage requires analyzing legal loopholes, enforcement discrepancies, and regulatory gaps that firms leverage to optimize efficiency and profitability while navigating complex global compliance landscapes.

Key Differences: Tax vs. Regulatory Arbitrage

Tax arbitrage involves exploiting differences in tax rates or tax regulations across jurisdictions to reduce overall tax liabilities, such as shifting profits to low-tax countries. Regulatory arbitrage focuses on capitalizing on discrepancies in regulatory frameworks between regions, enabling firms to bypass stricter rules or lower compliance costs by operating in less regulated environments. While tax arbitrage centers on minimizing tax burdens, regulatory arbitrage aims at optimizing operational or financial advantages through regulatory loopholes.

Common Strategies in Tax Arbitrage

Common strategies in tax arbitrage include exploiting differences in tax rates between jurisdictions by shifting profits through transfer pricing, utilizing tax treaties to minimize withholding taxes, and structuring transactions to take advantage of tax deferrals or exemptions. Companies often use hybrid instruments or entities to classify income differently across countries, thereby reducing their overall tax liabilities. These strategies contrast with regulatory arbitrage, which focuses on exploiting differences in regulatory frameworks rather than tax rules.

Popular Regulatory Arbitrage Tactics

Popular regulatory arbitrage tactics include exploiting differences in regulatory requirements across jurisdictions, such as varying capital adequacy rules or reporting standards. Firms often establish operations in regions with less stringent oversight to reduce compliance costs and increase operational flexibility. This practice enables companies to optimize regulatory burdens while maintaining core business activities in more heavily regulated markets.

Risks and Challenges in Arbitrage Practices

Tax arbitrage involves exploiting differences in tax laws across jurisdictions to minimize tax liabilities, while regulatory arbitrage focuses on navigating varying regulatory frameworks to gain competitive advantages. Both practices carry substantial risks including legal penalties, reputational damage, and escalating compliance costs as regulations tighten globally. The inherent uncertainty in regulatory environments and tax policies increases the complexity of managing arbitrage strategies, demanding constant vigilance and adaptive risk management.

Legal and Ethical Implications

Tax arbitrage involves exploiting differences in tax laws between jurisdictions to minimize tax liabilities, which is legal but often scrutinized for ethical concerns related to fairness and social responsibility. Regulatory arbitrage refers to the practice of navigating between different regulatory frameworks to gain a competitive advantage, which may comply with legal standards but can raise ethical questions about circumventing intended protections and transparency. Both strategies carry risks of reputational damage and potential legal challenges if authorities view them as abusive or undermining regulatory intent.

Impact on Markets and Governments

Tax arbitrage enables companies to exploit differences in tax rates between jurisdictions, often resulting in reduced government tax revenues and creating competitive distortions in international markets. Regulatory arbitrage involves firms shifting activities to evade stricter regulations, potentially undermining regulatory effectiveness and causing uneven market conditions. Both practices challenge governments' ability to enforce fiscal and regulatory policies, influencing market stability and public resource allocation.

Future Trends in Arbitrage Regulation

Future trends in arbitrage regulation emphasize enhanced transparency and stricter compliance frameworks targeting tax arbitrage and regulatory arbitrage practices. Increasing collaboration among global regulatory bodies and the adoption of advanced technologies such as AI-driven monitoring tools aim to detect and prevent cross-jurisdictional exploitation. Continuous updates in international tax laws and financial regulations reflect efforts to close loopholes, ensuring fair market competition and reducing risks associated with arbitrage strategies.

Tax arbitrage Infographic

libterm.com

libterm.com