Moral hazard occurs when one party takes on excessive risks because they do not bear the full consequences of their actions, often seen in insurance, finance, and employment contexts. This behavior can lead to inefficiencies and financial losses, making it crucial for institutions to implement monitoring and incentive mechanisms. Discover more about how moral hazard impacts decision-making and what measures can mitigate its effects in the full article.

Table of Comparison

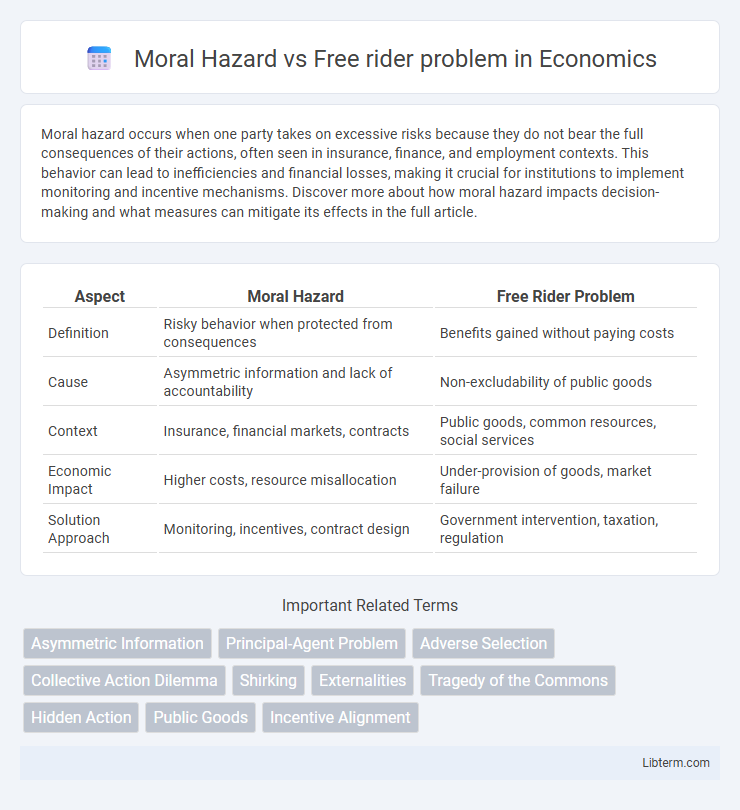

| Aspect | Moral Hazard | Free Rider Problem |

|---|---|---|

| Definition | Risky behavior when protected from consequences | Benefits gained without paying costs |

| Cause | Asymmetric information and lack of accountability | Non-excludability of public goods |

| Context | Insurance, financial markets, contracts | Public goods, common resources, social services |

| Economic Impact | Higher costs, resource misallocation | Under-provision of goods, market failure |

| Solution Approach | Monitoring, incentives, contract design | Government intervention, taxation, regulation |

Understanding Moral Hazard: A Brief Overview

Moral hazard arises when individuals or entities take on excessive risks because they do not bear the full consequences of their actions, often seen in insurance and financial markets. It contrasts with the free rider problem, where individuals benefit from resources or services without paying for them, leading to under-provision of public goods. Understanding moral hazard involves recognizing how asymmetric information and misaligned incentives drive risky behaviors that can jeopardize economic stability and organizational efficiency.

Defining the Free Rider Problem

The Free Rider Problem occurs when individuals consume a shared resource or benefit from a service without contributing to its cost, leading to under-provision or depletion of that resource. It is common in public goods, where non-excludability allows people to benefit regardless of payment, causing inefficiency and potential market failure. Unlike Moral Hazard, which involves risk-taking behavior after a contract is made, the Free Rider Problem centers on reluctance to contribute upfront to collective goods.

Key Differences Between Moral Hazard and Free Rider Problem

Moral hazard occurs when one party takes greater risks because they do not bear the full consequences, often seen in insurance or financial markets, while the free rider problem arises when individuals consume a resource without paying for it, leading to under-provision of public goods. Key differences include moral hazard involving asymmetric information and risk-shifting behavior after a contract is in place, whereas the free rider problem involves individuals benefiting from resources or services without contributing to their cost, causing collective action challenges. Both issues result in market inefficiencies but stem from distinct economic incentives and informational gaps.

Causes and Conditions: What Leads to Each Problem?

Moral hazard arises when individuals or entities lack incentives to act responsibly because they do not bear the full consequences of their actions, often occurring in insurance markets or financial sectors where risk is partially transferred. The free rider problem emerges when individuals benefit from resources or services without contributing to their provision, typically in public goods contexts where exclusion is challenging. Both issues are fueled by asymmetric information and the difficulty of enforcing contribution or accountability in shared-risk or shared-benefit environments.

Real-World Examples of Moral Hazard

Moral hazard occurs when individuals or institutions take excessive risks because they do not bear the full consequences of their actions, exemplified by insurance companies witnessing higher claims from policyholders who act less cautiously after obtaining coverage. Another real-world example includes financial institutions engaging in risky lending practices, knowing governments may bail them out to prevent systemic collapse, as seen during the 2008 financial crisis. This contrasts with the free rider problem, where individuals benefit from resources or services without contributing to their provision, reducing overall public goods availability.

Notable Cases Illustrating the Free Rider Problem

The Free Rider Problem is exemplified by notable cases such as public broadcasting services, where individuals consume content without contributing funding, undermining resource sustainability. Environmental protection efforts also reveal this issue, as some countries or entities benefit from global clean air initiatives without actively participating or investing. These cases highlight challenges in collective action, requiring policy interventions to ensure fair contribution and prevent exploitation of shared resources.

Economic and Social Impacts of Moral Hazard

Moral hazard leads to inefficient economic outcomes by encouraging riskier behavior when individuals or firms do not bear the full consequences of their actions, often increasing costs in sectors like insurance and finance. Socially, moral hazard strains public resources, as governments or institutions may need to intervene with bailouts or subsidies, reducing trust in market fairness. This phenomenon contrasts with the free rider problem, which primarily involves under-provision of public goods due to individuals benefiting without contributing.

Consequences of the Free Rider Problem on Public Goods

The free rider problem leads to significant under-provision of public goods, as individuals benefit without contributing to their cost, reducing overall funding and sustainability. This behavior results in inefficient allocation of resources and potential market failure, where essential services like clean air, public parks, and national defense remain underfunded or deteriorate. The lack of incentive for voluntary contribution necessitates government intervention or alternative mechanisms to ensure adequate provision and maintenance of public goods.

Strategies to Mitigate Moral Hazard and Free Rider Issues

Implementing monitoring mechanisms and performance-based incentives can effectively reduce moral hazard by aligning individual actions with organizational goals. To combat free rider problems, strategies such as fostering group accountability and employing exclusionary tactics like membership fees encourage active participation and equitable contribution. Combining transparent communication and tailored contract designs further enhances mitigation efforts for both moral hazard and free rider challenges in economic and organizational contexts.

Policy Implications: Addressing Both Problems in Practice

Policy measures targeting moral hazard often involve increasing transparency and accountability through monitoring mechanisms, while addressing the free rider problem requires incentivizing contribution via selective benefits or exclusion penalties. Combining these approaches, governments and organizations implement tailored contracts and enforcement strategies to balance risk-sharing and collective action incentives. Effective policy designs integrate behavioral insights and economic incentives to mitigate opportunistic behaviors in public goods provision and insurance markets.

Moral Hazard Infographic

libterm.com

libterm.com