Noise Trader Theory explains how irrational investors, driven by random or irrelevant information, can impact financial markets and cause price fluctuations unrelated to fundamentals. These traders create market inefficiencies by making unpredictable trades based on sentiment or misinformation rather than objective analysis. Explore the full article to understand how noise traders influence market dynamics and what this means for Your investment strategy.

Table of Comparison

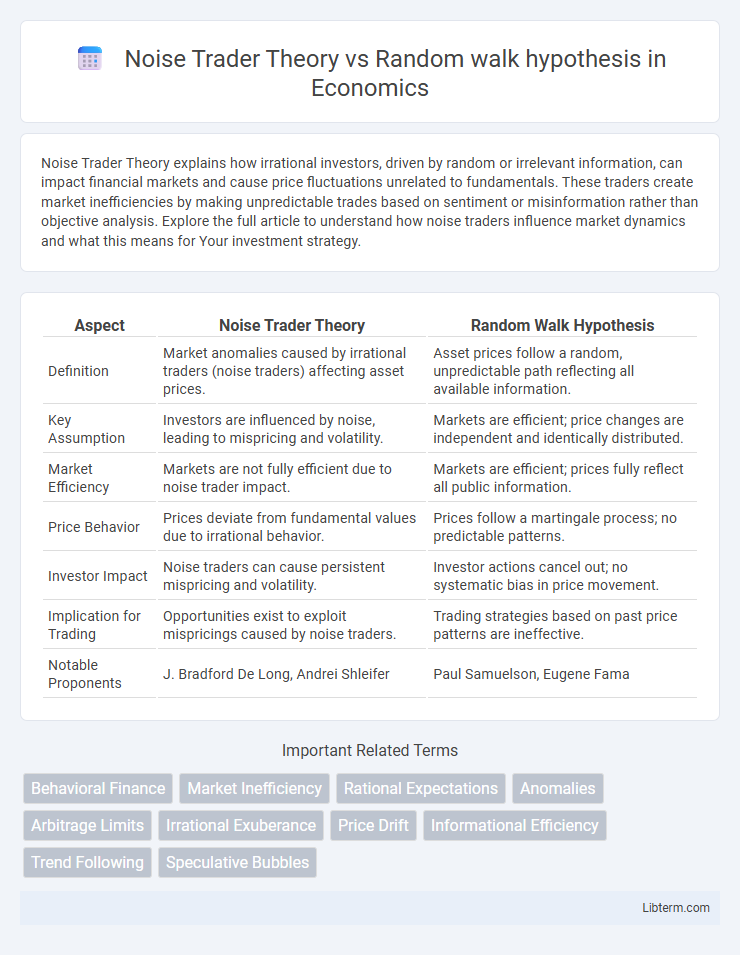

| Aspect | Noise Trader Theory | Random Walk Hypothesis |

|---|---|---|

| Definition | Market anomalies caused by irrational traders (noise traders) affecting asset prices. | Asset prices follow a random, unpredictable path reflecting all available information. |

| Key Assumption | Investors are influenced by noise, leading to mispricing and volatility. | Markets are efficient; price changes are independent and identically distributed. |

| Market Efficiency | Markets are not fully efficient due to noise trader impact. | Markets are efficient; prices fully reflect all public information. |

| Price Behavior | Prices deviate from fundamental values due to irrational behavior. | Prices follow a martingale process; no predictable patterns. |

| Investor Impact | Noise traders can cause persistent mispricing and volatility. | Investor actions cancel out; no systematic bias in price movement. |

| Implication for Trading | Opportunities exist to exploit mispricings caused by noise traders. | Trading strategies based on past price patterns are ineffective. |

| Notable Proponents | J. Bradford De Long, Andrei Shleifer | Paul Samuelson, Eugene Fama |

Introduction to Noise Trader Theory

Noise Trader Theory describes how investors making decisions based on erroneous or irrelevant information can influence market prices, causing deviations from fundamental values. Unlike the Random Walk Hypothesis, which suggests stock prices follow an unpredictable path due to rational expectations and information, Noise Trader Theory emphasizes the impact of irrational behavior and sentiment-driven trading. This theory highlights the potential for noise traders to create market inefficiencies and excess volatility, challenging the notion of perfectly efficient markets.

Overview of Random Walk Hypothesis

The Random Walk Hypothesis asserts that stock prices follow an unpredictable path due to the immediate incorporation of all available information into market prices, making future price movements independent of past trends. This theory implies market efficiency, where price changes are random and cannot be consistently exploited for excess returns. Unlike the Noise Trader Theory, which highlights the impact of irrational traders and market noise on price fluctuations, the Random Walk Hypothesis emphasizes the dominance of rational, information-driven market behavior.

Key Assumptions of Noise Trader Theory

Noise Trader Theory assumes that some investors make decisions based on erroneous or incomplete information, driving prices away from fundamental values and causing market inefficiencies. These noise traders create excess volatility and mispricings, contrasting with the Random Walk Hypothesis, which posits that price movements are unpredictable and reflect all available information, implying market efficiency. The theory highlights the impact of irrational behavior, overconfidence, and herd mentality on asset price dynamics.

Fundamental Principles of Random Walk Hypothesis

The Random Walk Hypothesis asserts that stock prices evolve according to a random, unpredictable path, reflecting all available information and making future price movements inherently uncertain. This theory is grounded in the efficient market hypothesis, which posits that markets fully incorporate information instantly, rendering technical analysis ineffective. In contrast, Noise Trader Theory acknowledges the impact of irrational traders whose decisions are influenced by emotions and misinformation, causing price deviations from fundamental values.

Behavioral Aspects in Noise Trading

Noise Trader Theory emphasizes the impact of irrational and sentiment-driven investors whose trading decisions deviate from fundamental values, leading to market inefficiencies and price volatility. Unlike the Random Walk Hypothesis, which assumes price changes are independent and unpredictable, Noise Trading captures psychological biases, such as overconfidence and herd behavior, influencing market dynamics. Behavioral aspects of noise trading highlight how emotions and cognitive errors create systematic mispricings, challenging the notion of fully efficient markets.

Market Efficiency and Random Walks

Noise Trader Theory challenges Market Efficiency by emphasizing how irrational traders' actions can cause persistent mispricing and deviations from fundamental values, leading to price trends that contradict the Random Walk hypothesis. The Random Walk hypothesis asserts that stock prices follow an unpredictable path driven solely by new information, reflecting fully efficient markets with no exploitable patterns. Empirical evidence shows that markets exhibit both efficiency and anomalies, suggesting that noise traders contribute to temporary inefficiencies, while long-term price movements often resemble a random walk.

Comparing Market Impacts: Noise Traders vs Random Walk

Noise Trader Theory suggests that irrational investors who trade based on misinformation or sentiment can cause market prices to deviate significantly from fundamental values, leading to increased volatility and periodic mispricings. In contrast, the Random Walk Hypothesis argues that stock price movements are unpredictable and follow a path dictated solely by new, random information, implying markets are efficient and free of exploitable patterns. Therefore, while Noise Trader Theory highlights the impact of behavioral biases creating market inefficiencies, the Random Walk Hypothesis emphasizes inherent market randomness with prices reflecting all available information.

Empirical Evidence: Noise Trader Theory

Empirical evidence supporting Noise Trader Theory highlights the significant impact of irrational traders on asset price volatility and market anomalies, challenging the efficient market hypothesis. Studies reveal that noise traders' collective behavior can generate price trends and bubbles, deviating prices from fundamental values for extended periods. Experimental and market data indicate that noise traders' biases contribute to excess volatility and profitability opportunities for rational arbitrageurs, confirming the theory's validity in explaining real-world financial market dynamics.

Empirical Support for Random Walk Hypothesis

Empirical support for the Random Walk Hypothesis is evidenced by numerous studies showing stock prices exhibit unpredictable, independent, and identically distributed price changes consistent with a random walk model. Research on market efficiency often highlights weak-form efficiency, where past price data fails to predict future prices, reinforcing the hypothesis. However, the presence of anomalies and behavioral biases challenges pure randomness but does not fully invalidate the empirical foundation of the random walk in financial markets.

Implications for Investors and Market Predictions

Noise Trader Theory implies that investor sentiment and irrational behaviors can cause significant and persistent market deviations from fundamental values, leading to increased volatility and unpredictable price movements. Random Walk Hypothesis posits that stock prices evolve randomly, making it impossible to consistently predict market trends or outperform the market through technical analysis. Investors relying on Noise Trader Theory may seek opportunities in market inefficiencies, while those adhering to Random Walk Hypothesis emphasize diversification and passive investment strategies to manage unpredictability.

Noise Trader Theory Infographic

libterm.com

libterm.com