Value-added tax (VAT) is a consumption tax imposed on the value added to goods and services at each stage of production or distribution. It impacts pricing, business operations, and compliance requirements, making it essential for businesses to understand its application. Explore the rest of the article to learn how VAT affects your transactions and strategies for managing it effectively.

Table of Comparison

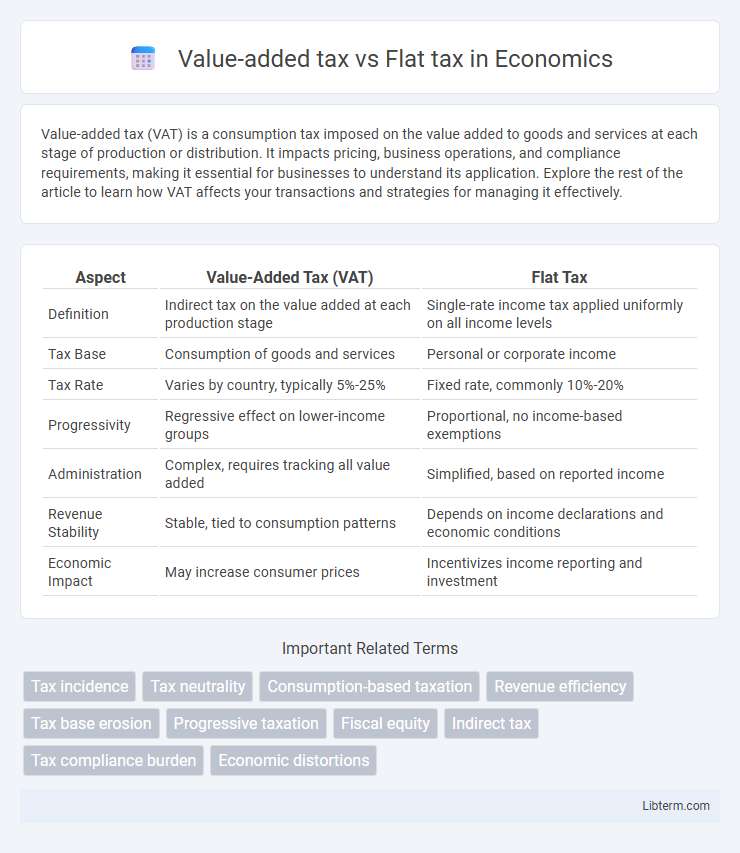

| Aspect | Value-Added Tax (VAT) | Flat Tax |

|---|---|---|

| Definition | Indirect tax on the value added at each production stage | Single-rate income tax applied uniformly on all income levels |

| Tax Base | Consumption of goods and services | Personal or corporate income |

| Tax Rate | Varies by country, typically 5%-25% | Fixed rate, commonly 10%-20% |

| Progressivity | Regressive effect on lower-income groups | Proportional, no income-based exemptions |

| Administration | Complex, requires tracking all value added | Simplified, based on reported income |

| Revenue Stability | Stable, tied to consumption patterns | Depends on income declarations and economic conditions |

| Economic Impact | May increase consumer prices | Incentivizes income reporting and investment |

Introduction to Value-Added Tax (VAT) and Flat Tax

Value-Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution, commonly used in over 160 countries worldwide. Flat tax, by contrast, is a fixed-rate income tax system where all taxpayers pay the same percentage regardless of income level, aiming for simplicity and efficiency. Understanding the fundamental differences in structure and application between VAT and flat tax is essential for evaluating their impact on economic growth and tax equity.

How Value-Added Tax Works

Value-Added Tax (VAT) is a consumption tax levied on the value added at each stage of production or distribution, collected incrementally by businesses but ultimately borne by the final consumer. Unlike a flat tax applied uniformly to income or sales, VAT is calculated as a percentage of the difference between a business's sales and its purchases. This system ensures tax is paid on the net value added, reducing tax evasion and improving revenue collection efficiency compared to flat tax regimes.

Understanding the Flat Tax System

The flat tax system applies a single constant tax rate to all taxpayers regardless of income level, simplifying tax calculations and compliance. Unlike value-added tax (VAT), which is a consumption tax levied at each stage of production and distribution, the flat tax aims to promote fairness by taxing income uniformly. Proponents argue that the flat tax enhances economic efficiency and transparency by reducing administrative costs and minimizing loopholes.

Key Differences Between VAT and Flat Tax

Value-added tax (VAT) is a consumption tax levied incrementally at each stage of production or distribution based on the value added, whereas a flat tax is a single-rate income tax applied uniformly to individual or corporate earnings regardless of income level. VAT collects revenue throughout the supply chain, ensuring tax is paid on the final consumption value, while a flat tax simplifies tax administration by applying one constant rate to all taxable income without deductions or exemptions. The key differences lie in their application: VAT targets consumption with multi-stage collection, promoting tax neutrality, whereas flat tax targets income with a single-stage collection aiming for simplicity and efficiency.

Advantages of Value-Added Tax

Value-Added Tax (VAT) offers advantages such as reducing tax evasion through its multi-stage collection system, which ensures transparency and accountability at each production and distribution level. VAT broadens the tax base by applying uniformly to goods and services, promoting fairness and efficiency in revenue generation. This indirect tax structure stimulates compliance and provides steady government revenue without directly burdening income earners.

Benefits of Flat Tax

Flat tax offers simplicity by applying a single tax rate to all income levels, reducing administrative costs and minimizing loopholes compared to Value-added tax (VAT). It encourages economic growth by providing clear incentives for investment and work, avoiding the cascading effect seen in VAT systems. The predictability and transparency of flat tax systems improve compliance and make tax planning easier for individuals and businesses.

Challenges and Criticisms of VAT

Value-added tax (VAT) faces significant challenges such as its regressive impact, disproportionately affecting lower-income individuals by increasing the cost of essential goods and services. Administrative complexities and high compliance costs burden small businesses, leading to inefficiencies and potential tax evasion. Critics also argue that VAT lacks transparency, making it difficult for consumers to understand the actual tax paid, whereas flat tax systems are often praised for simplicity but criticized for potentially increasing income inequality.

Drawbacks of Flat Tax Systems

Flat tax systems often face criticism for their regressive impact, disproportionately burdening low-income earners by applying a uniform tax rate regardless of ability to pay. They can reduce government revenue needed for social programs, limiting resources for education, healthcare, and infrastructure development. Lack of progressive scaling in flat taxes may exacerbate income inequality and reduce overall economic fairness compared to value-added tax (VAT) systems that adjust with consumption levels.

Global Adoption: VAT vs Flat Tax

Value-added tax (VAT) enjoys widespread global adoption, implemented by over 160 countries as a consumption tax levied on goods and services at each production stage, making it a significant revenue source for governments. Flat tax systems, characterized by a single unified rate on income, are less globally prevalent but have been adopted by some Eastern European and post-Soviet states like Estonia and Russia, aiming for simplicity and economic growth stimulation. While VAT's broad international usage reflects its efficiency in taxing consumption, flat tax adoption remains limited and context-specific, focusing primarily on income taxation reform.

Choosing the Best Tax System for Economic Growth

Value-added tax (VAT) promotes economic growth by taxing consumption at each production stage, enhancing revenue stability and reducing tax evasion. Flat tax simplifies tax compliance through a uniform rate on income, encouraging investment and labor participation due to its predictability and transparency. Evaluating economic growth effects involves analyzing factors like revenue efficiency, administrative costs, and incentives for productivity inherent in both VAT and flat tax systems.

Value-added tax Infographic

libterm.com

libterm.com