A thin market is characterized by low trading volume and limited liquidity, making it difficult to buy or sell assets without causing significant price fluctuations. This market condition often leads to higher volatility and wider bid-ask spreads, increasing the risk for investors. Discover how understanding thin markets can help you navigate potential challenges and optimize your trading strategies throughout the rest of the article.

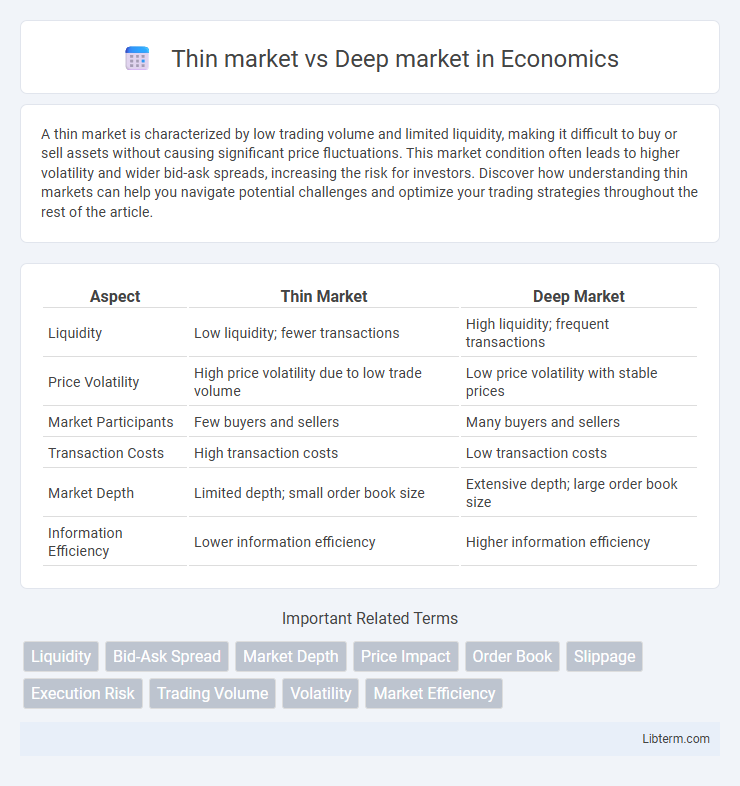

Table of Comparison

| Aspect | Thin Market | Deep Market |

|---|---|---|

| Liquidity | Low liquidity; fewer transactions | High liquidity; frequent transactions |

| Price Volatility | High price volatility due to low trade volume | Low price volatility with stable prices |

| Market Participants | Few buyers and sellers | Many buyers and sellers |

| Transaction Costs | High transaction costs | Low transaction costs |

| Market Depth | Limited depth; small order book size | Extensive depth; large order book size |

| Information Efficiency | Lower information efficiency | Higher information efficiency |

Understanding Thin and Deep Markets

Thin markets characteristically feature low trading volumes and limited liquidity, causing higher volatility and wider bid-ask spreads, which can challenge price discovery and increase transaction costs. Deep markets boast high trading volumes and abundant liquidity, facilitating efficient price discovery, tighter spreads, and smoother execution of large orders without significant price impact. Understanding the dynamics between thin and deep markets is crucial for investors and traders aiming to optimize trade strategies and manage risks effectively.

Key Characteristics of Thin Markets

Thin markets are characterized by low trading volumes and limited liquidity, resulting in wider bid-ask spreads and higher price volatility. Transactions in thin markets often involve fewer participants, making it difficult to execute large orders without significantly impacting prices. These markets typically exhibit slower price discovery and increased susceptibility to manipulation or sudden price swings.

Main Features of Deep Markets

Deep markets exhibit high liquidity, characterized by a large volume of buy and sell orders that allow transactions to occur quickly without significant price changes. They feature tight bid-ask spreads, reflecting efficient pricing and lower transaction costs for investors. High market depth reduces volatility and enables large trades to be executed with minimal market impact, differentiating them from thin markets.

Liquidity Differences: Thin vs Deep

Thin markets exhibit low liquidity characterized by fewer buyers and sellers, resulting in wider bid-ask spreads and higher price volatility. Deep markets have high liquidity with numerous participants and substantial trading volumes, enabling narrow spreads and more stable prices. The liquidity disparity impacts market efficiency, transaction costs, and the ability to execute large orders quickly without significant price changes.

Price Volatility Comparison

Thin markets exhibit higher price volatility due to low liquidity and fewer participants, causing larger price swings from relatively small trades. In contrast, deep markets feature abundant liquidity and numerous buyers and sellers, which stabilizes prices by absorbing large orders with minimal impact. Consequently, price volatility in deep markets remains comparatively low, fostering more predictable price movements.

Trading Volume Implications

Thin markets exhibit low trading volume, leading to wider bid-ask spreads and increased price volatility, which complicates order execution and heightens transaction costs. Deep markets, characterized by high trading volume, provide enhanced liquidity, narrower spreads, and greater price stability, enabling efficient trade execution with minimal market impact. Traders in thin markets face challenges such as slippage and delayed fills, while those in deep markets benefit from robust market depth that supports larger transactions without significant price disruption.

Impact on Bid-Ask Spreads

Thin markets exhibit wider bid-ask spreads due to lower liquidity and fewer participants, increasing transaction costs and market volatility. Deep markets benefit from tighter bid-ask spreads as a result of high trading volume and competition among market makers, enhancing price stability and execution efficiency. The difference in spread size directly influences investor costs and market depth, impacting overall market efficiency.

Market Participants and Their Roles

Thin markets have limited market participants, often resulting in lower liquidity and higher volatility as buyers and sellers struggle to find counterparties. Deep markets feature numerous participants, including individual investors, institutional traders, and market makers, providing high liquidity and smoother price discovery. Market makers in deep markets play a crucial role by continuously offering buy and sell quotes, reducing spreads and enhancing transaction efficiency.

Risks Associated with Thin Markets

Thin markets exhibit low trading volumes and limited liquidity, leading to higher price volatility and increased bid-ask spreads. These conditions heighten the risk of price manipulation and slippage, making it difficult for investors to execute large orders without significantly impacting market prices. The lack of depth in thin markets also results in reduced transparency and inconsistent price discovery, which can amplify market inefficiencies and investor uncertainty.

Advantages of Deep Markets

Deep markets offer enhanced liquidity, enabling smoother transactions with minimal price volatility and tighter bid-ask spreads. Investors benefit from greater market efficiency and reduced execution risk due to the high volume of participants and diverse order flow. These characteristics foster improved price discovery and increased confidence for both buyers and sellers in executing large trades.

Thin market Infographic

libterm.com

libterm.com