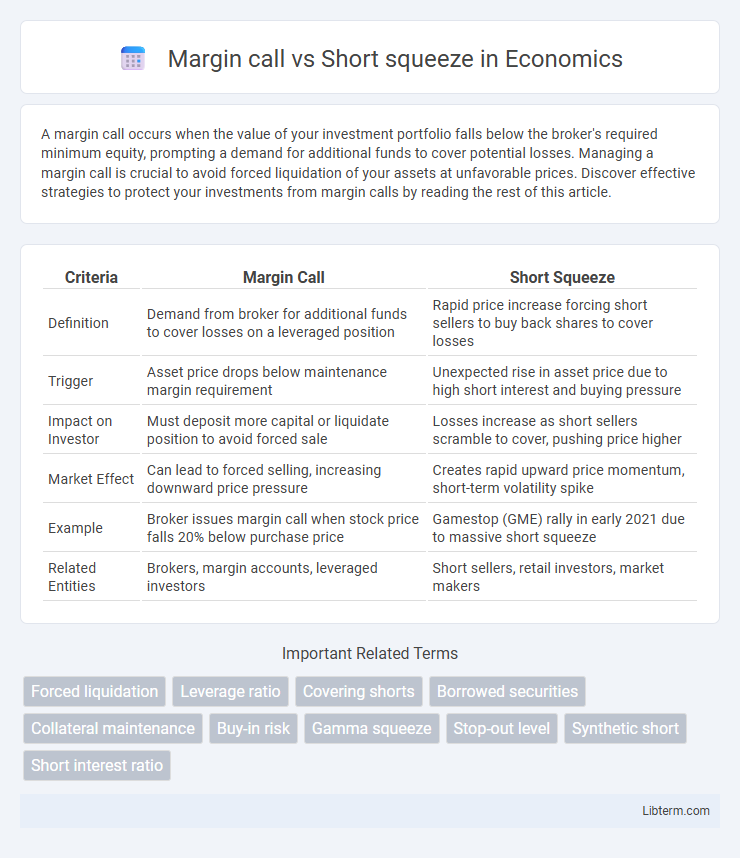

A margin call occurs when the value of your investment portfolio falls below the broker's required minimum equity, prompting a demand for additional funds to cover potential losses. Managing a margin call is crucial to avoid forced liquidation of your assets at unfavorable prices. Discover effective strategies to protect your investments from margin calls by reading the rest of this article.

Table of Comparison

| Criteria | Margin Call | Short Squeeze |

|---|---|---|

| Definition | Demand from broker for additional funds to cover losses on a leveraged position | Rapid price increase forcing short sellers to buy back shares to cover losses |

| Trigger | Asset price drops below maintenance margin requirement | Unexpected rise in asset price due to high short interest and buying pressure |

| Impact on Investor | Must deposit more capital or liquidate position to avoid forced sale | Losses increase as short sellers scramble to cover, pushing price higher |

| Market Effect | Can lead to forced selling, increasing downward price pressure | Creates rapid upward price momentum, short-term volatility spike |

| Example | Broker issues margin call when stock price falls 20% below purchase price | Gamestop (GME) rally in early 2021 due to massive short squeeze |

| Related Entities | Brokers, margin accounts, leveraged investors | Short sellers, retail investors, market makers |

Understanding Margin Calls: Definition and Mechanism

Margin calls occur when the value of a trader's margin account falls below the broker's required minimum, forcing the investor to deposit additional funds or sell assets to cover potential losses. This mechanism ensures that leveraged positions are adequately collateralized to mitigate the broker's risk exposure. Unlike a short squeeze, which is driven by rapid buying pressure on shorted stocks, margin calls are triggered by an account's decreased equity relative to the borrowed amount, imposing mandatory risk management protocols.

What is a Short Squeeze? Key Concepts Explained

A short squeeze occurs when a heavily shorted stock's price rises rapidly, forcing short sellers to buy shares to cover their positions, which further drives up the price. This phenomenon intensifies price volatility as the demand from short sellers creates a feedback loop, leading to sharp upward price movements. Key concepts include high short interest ratio, low float, and sudden positive news or market momentum triggering the squeeze.

Margin Call vs Short Squeeze: Core Differences

Margin calls occur when an investor's borrowed funds fall below the required maintenance margin, forcing them to either deposit more capital or liquidate holdings to cover losses. Short squeezes happen when a heavily shorted stock's price rises rapidly, compelling shorts to buy shares to cover positions, which further drives the price up. The core difference lies in margin calls being broker-enforced risk management events, while short squeezes are market-driven phenomena triggered by buying pressure on short sellers.

How Margin Calls Occur in Trading

Margin calls occur when the value of an investor's margin account falls below the broker's required maintenance margin, triggering a demand to deposit additional funds or liquidate positions. This situation arises due to adverse price movements in leveraged securities, reducing the investor's equity and increasing the broker's risk exposure. Margin calls can force traders to sell assets quickly, potentially amplifying market volatility and leading to scenarios like short squeezes when many traders rush to cover positions simultaneously.

Causes and Triggers of a Short Squeeze

A short squeeze occurs when heavily shorted stocks experience a rapid price increase, forcing short sellers to buy shares to cover their positions, which further drives up the price. The primary causes and triggers include a sudden positive news announcement, strong earnings reports, or influential market sentiment shifts that create buying pressure. In contrast, a margin call arises from a decline in the value of securities held on margin, requiring investors to deposit additional funds or liquidate positions to meet margin requirements, not necessarily triggering a price surge like a short squeeze.

The Role of Leverage in Margin Calls and Short Squeezes

Leverage magnifies gains and losses, intensifying the risk of margin calls when asset prices decline and investors must quickly provide additional capital to maintain their positions. In short squeezes, high leverage on short positions forces traders to buy back shares at escalating prices to cover losses, accelerating the upward price momentum. The interplay of leverage in both scenarios can trigger rapid market movements, highlighting the systemic risk posed by excessive borrowing.

Risk Management Strategies for Traders

Margin calls force traders to add funds or close positions when account equity falls below maintenance margin, emphasizing the importance of monitoring leverage and maintaining sufficient collateral. Short squeezes occur when rapid price increases compel short sellers to cover positions, often causing sharp volatility and exacerbating losses, highlighting the need for stop-loss orders and diversified portfolios. Effective risk management combines position sizing, real-time monitoring, and hedging techniques to mitigate potential impacts from margin calls and short squeezes.

Real-World Examples: Margin Calls and Short Squeezes in Action

The GameStop (GME) saga in early 2021 exemplified a dramatic short squeeze triggered by retail investors driving up the stock price, forcing short sellers into margin calls to cover their positions. Tesla (TSLA) has frequently experienced margin calls during volatile trading periods, highlighting the risks of leveraged short positions in high-profile stocks. These events showcase how margin calls can escalate a short squeeze, leading to rapid price surges and significant market disruptions.

Impact on Market Volatility and Investor Behavior

Margin calls trigger rapid liquidation of leveraged positions, intensifying market volatility as forced selling amplifies price swings. Short squeezes provoke sharp price spikes, forcing short sellers to cover at escalating costs, which exacerbates volatility and fuels speculative trading behavior. Both mechanisms significantly influence investor psychology, driving panic selling during margin calls and aggressive buying during short squeezes.

Preventing Losses: Tips to Avoid Margin Calls and Survive Short Squeezes

To prevent losses from margin calls, maintain a conservative leverage ratio and regularly monitor your account's equity to ensure it stays above the required maintenance margin. Diversify holdings and implement stop-loss orders to limit downside risk in volatile markets, mitigating the severity of short squeezes triggered by rapid price spikes. Staying informed about market sentiment and short interest data helps traders anticipate potential squeezes and adjust positions proactively.

Margin call Infographic

libterm.com

libterm.com