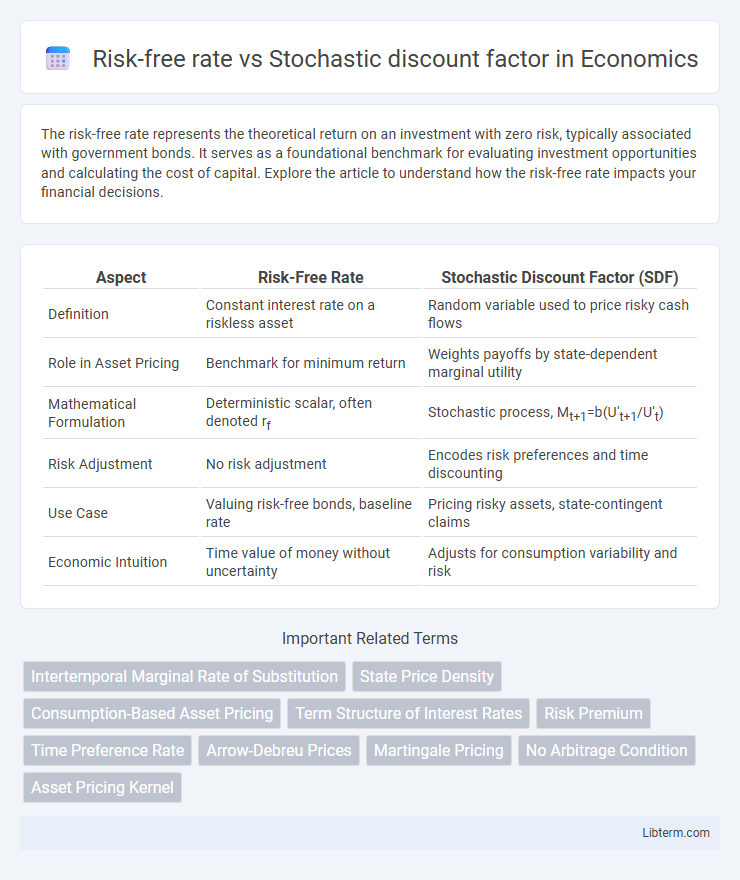

The risk-free rate represents the theoretical return on an investment with zero risk, typically associated with government bonds. It serves as a foundational benchmark for evaluating investment opportunities and calculating the cost of capital. Explore the article to understand how the risk-free rate impacts your financial decisions.

Table of Comparison

| Aspect | Risk-Free Rate | Stochastic Discount Factor (SDF) |

|---|---|---|

| Definition | Constant interest rate on a riskless asset | Random variable used to price risky cash flows |

| Role in Asset Pricing | Benchmark for minimum return | Weights payoffs by state-dependent marginal utility |

| Mathematical Formulation | Deterministic scalar, often denoted rf | Stochastic process, Mt+1=b(U't+1/U't) |

| Risk Adjustment | No risk adjustment | Encodes risk preferences and time discounting |

| Use Case | Valuing risk-free bonds, baseline rate | Pricing risky assets, state-contingent claims |

| Economic Intuition | Time value of money without uncertainty | Adjusts for consumption variability and risk |

Introduction to the Risk-Free Rate

The risk-free rate represents the theoretical return on an investment with zero risk, typically proxied by government Treasury bills or bonds. It serves as the foundational benchmark for pricing assets and discounting future cash flows in financial models. Unlike the stochastic discount factor, which adjusts for uncertainty and risk preferences dynamically, the risk-free rate assumes a constant, baseline compensation for time value of money.

Understanding the Stochastic Discount Factor (SDF)

The Stochastic Discount Factor (SDF) adjusts future payoffs by incorporating both time value and risk preferences, serving as a pivotal tool in asset pricing models. Unlike the risk-free rate, which assumes a guaranteed return, the SDF captures market uncertainties and investors' risk aversion through a random variable that discounts stochastic cash flows. This allows for more accurate valuation of risky assets by reflecting the covariance between payoffs and the SDF.

The Role of the Risk-Free Rate in Finance

The risk-free rate serves as the foundational benchmark for discounting future cash flows, reflecting the time value of money without any uncertainty. In contrast, the stochastic discount factor incorporates risk by adjusting for varying states of the world, capturing the market's pricing of risk beyond the risk-free baseline. The risk-free rate's role in finance is pivotal for asset valuation, portfolio optimization, and derivative pricing, providing a consistent, default rate against which risky assets are measured.

Stochastic Discount Factor: Definition and Significance

The Stochastic Discount Factor (SDF) is a fundamental concept in financial economics used to price uncertain future payoffs by adjusting for risk and time preferences. It represents a random variable that, when multiplied by future payoffs, yields their present value under the real-world probability measure. Unlike the risk-free rate, which assumes certainty and serves as a baseline for discounting, the SDF captures the variability in returns and incorporates investors' attitudes toward risk, making it essential for asset pricing and risk management.

Mathematical Formulation: Risk-Free Rate vs SDF

The risk-free rate is mathematically expressed as the return on a zero-coupon bond maturing in one period, often denoted by \( R_f = \frac{1}{E[M]} \), where \( M \) is the stochastic discount factor (SDF). The stochastic discount factor itself is a random variable representing state-price densities, linking current and future payoffs via \( P_t = E_t[M_{t+1} X_{t+1}] \), where \( X_{t+1} \) is a future payoff. While the risk-free rate is the reciprocal of the expected SDF, the SDF encapsulates risk adjustments across all possible states, reflecting the full pricing kernel in asset valuation models.

Key Differences Between Risk-Free Rate and SDF

The risk-free rate represents the guaranteed return on an investment with no default risk, typically used as a benchmark in finance, while the Stochastic Discount Factor (SDF) adjusts future cash flows for both time value and uncertainty by reflecting state-dependent pricing kernels. Key differences include that the risk-free rate is a deterministic, constant metric used to discount riskless cash flows, whereas the SDF incorporates randomness and captures the marginal rate of substitution between current and future consumption across different states of the world. The SDF's flexibility allows it to price assets with varying risk profiles, contrasting with the risk-free rate's limited application to riskless securities.

Applications in Asset Pricing and Valuation

The risk-free rate serves as a benchmark for discounting future cash flows in traditional asset pricing models, reflecting the time value of money without uncertainty. The stochastic discount factor (SDF) incorporates risk preferences and economic states, allowing for more accurate pricing of risky assets by adjusting cash flows for varying risk exposures. Asset valuation models using the SDF can capture market-wide risk factors, improving pricing efficiency and better explaining observed asset returns compared to models relying solely on the risk-free rate.

Implications for Investment Decision-Making

The risk-free rate represents the baseline return for guaranteed investments, while the stochastic discount factor (SDF) incorporates uncertainty and varying risk preferences in valuing future cash flows. Investors using the risk-free rate may underestimate the cost of capital or misprice risky assets, leading to suboptimal portfolio allocation. Applying the stochastic discount factor allows for more precise asset valuation, enhancing decision-making under uncertainty by reflecting true risk-adjusted returns.

Challenges in Estimating SDF and Risk-Free Rate

Estimating the risk-free rate involves challenges such as identifying truly default-free assets and accounting for liquidity premiums that can bias observed yields. The stochastic discount factor (SDF) estimation requires modeling the joint dynamics of consumption, asset returns, and preferences, which introduces complexity due to model misspecification and data limitations. Both risk-free rate and SDF estimations face difficulties in capturing time-varying risk premia and market frictions, impacting asset pricing models' accuracy.

Conclusion: Integrating Risk-Free Rate and SDF in Financial Models

Integrating the risk-free rate with the stochastic discount factor (SDF) enhances the accuracy of asset pricing by capturing both time value and uncertainty in cash flows. This combination allows for a more robust representation of discounting future payoffs, reflecting risk preferences and market conditions simultaneously. Employing both elements in financial models optimizes portfolio evaluation and risk management by aligning theoretical valuations with empirical observations.

Risk-free rate Infographic

libterm.com

libterm.com