Monopoly is a classic board game that challenges players to dominate the real estate market by buying, trading, and developing properties. Mastering its strategies can help you maximize wealth and bankrupt opponents through savvy decision-making and risk management. Discover expert tips and tactics in the rest of this article to improve your gameplay and increase your chances of winning.

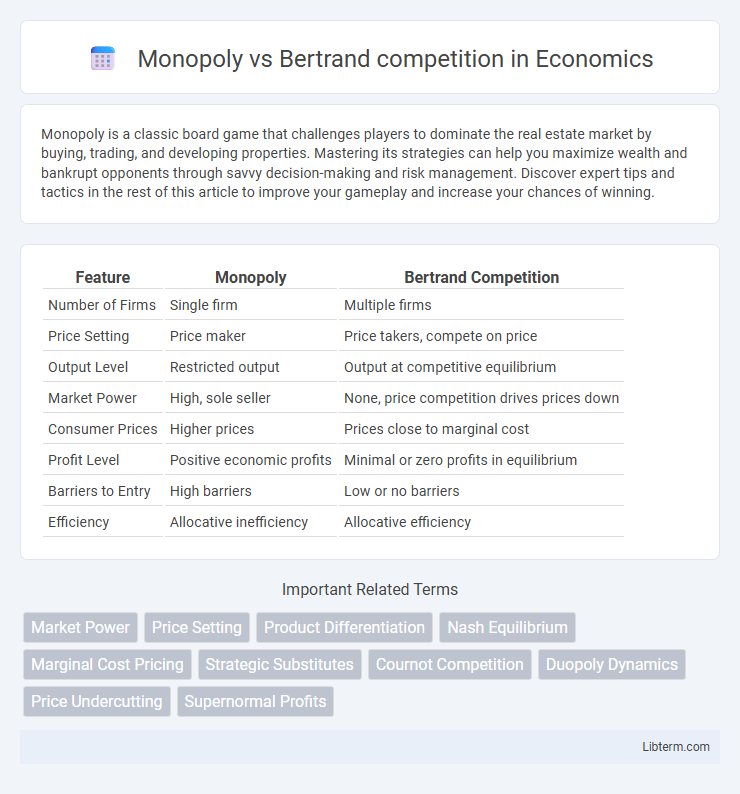

Table of Comparison

| Feature | Monopoly | Bertrand Competition |

|---|---|---|

| Number of Firms | Single firm | Multiple firms |

| Price Setting | Price maker | Price takers, compete on price |

| Output Level | Restricted output | Output at competitive equilibrium |

| Market Power | High, sole seller | None, price competition drives prices down |

| Consumer Prices | Higher prices | Prices close to marginal cost |

| Profit Level | Positive economic profits | Minimal or zero profits in equilibrium |

| Barriers to Entry | High barriers | Low or no barriers |

| Efficiency | Allocative inefficiency | Allocative efficiency |

Introduction to Monopoly and Bertrand Competition

Monopoly is a market structure characterized by a single firm that dominates the entire industry, setting prices without competition due to high barriers to entry. Bertrand competition involves multiple firms competing by setting prices simultaneously, leading to price reductions that can drive profits to zero in markets with identical products. The fundamental difference lies in monopoly's price-making power versus Bertrand's price-setting rivalry, which significantly impacts market efficiency and consumer welfare.

Defining Key Characteristics of Monopoly

A monopoly is characterized by a single seller dominating the entire market with no close substitutes, resulting in high market power and price-setting ability. The absence of competition allows the monopolist to control supply and set prices above marginal cost, leading to potential allocative inefficiency. Barriers to entry, such as high startup costs or exclusive control over resources, prevent other firms from entering the market.

Understanding Bertrand Competition: Basics and Assumptions

Bertrand competition models market scenarios where firms compete by setting prices rather than quantities, assuming homogeneous products and rational consumers who buy from the lowest-priced seller. Firms simultaneously choose prices, leading to an equilibrium where prices equal marginal cost, eliminating economic profits under perfect competition assumptions. This contrasts with monopoly markets, where a single firm controls pricing and output, maximizing profits without competitive pressure.

Market Structure: Monopoly vs Bertrand Competition

Monopoly market structure features a single firm dominating market supply, allowing price-setting power without direct competition. In contrast, Bertrand competition involves multiple firms simultaneously setting prices for homogeneous products, leading to prices driven down to marginal cost. This distinction sharply impacts market dynamics, with monopoly enabling higher prices and restricted output, whereas Bertrand competition fosters price competition and consumer benefits.

Pricing Strategies in Monopoly and Bertrand Competition

Monopoly pricing strategies involve setting a single profit-maximizing price above marginal cost, exploiting the firm's market power to restrict output and increase prices, resulting in consumer surplus loss. In contrast, Bertrand competition drives firms to price at or near marginal cost, as multiple competitors continuously undercut each other's prices, leading to minimal or zero economic profit. The stark difference arises because monopolists face no immediate pricing pressure, while Bertrand competitors operate in a market with perfect substitutes and intense price rivalry.

Consumer Welfare and Market Outcomes

Monopoly markets typically result in higher prices and reduced output compared to Bertrand competition, leading to lower consumer welfare due to diminished choice and higher consumer surplus loss. Bertrand competition drives prices down to marginal cost levels, maximizing consumer welfare through increased product availability and lower prices. The efficient market outcomes under Bertrand competition encourage innovation and allocation efficiency, contrasting with monopolistic inefficiencies that create deadweight loss.

Barriers to Entry in Both Market Models

Monopoly markets exhibit high barriers to entry due to factors such as exclusive access to essential resources, economies of scale, and government regulations or patents, which prevent new competitors from entering. In Bertrand competition, barriers to entry are typically lower because multiple firms can enter as long as they can match or undercut existing prices, fostering intense price competition. However, substantial initial capital or network effects may still create moderate barriers in Bertrand markets, influencing firm behavior and market dynamics.

Real-World Examples: Monopoly vs Bertrand Competition

In real-world markets, monopolies like utility companies exemplify single-firm dominance with significant price-setting power due to high entry barriers and unique resource control. Bertrand competition is evident in industries such as airlines and telecommunications, where firms continuously undercut each other's prices to attract cost-sensitive consumers in highly competitive settings. These models showcase contrasting market dynamics: monopolies prioritize maximizing profits under limited competition, whereas Bertrand firms engage in aggressive pricing strategies to capture market share.

Policy Implications and Regulatory Considerations

Monopoly markets typically require stringent regulatory oversight to prevent price-setting abuses and encourage innovation, whereas Bertrand competition, characterized by firms competing on price, often leads to outcomes closer to perfect competition, reducing the need for direct price controls. Policy implications for monopolies include antitrust enforcement and price regulation to protect consumer welfare, while in Bertrand competition scenarios, regulators focus on maintaining transparency and preventing collusion. Effective regulatory frameworks must balance promoting competition with preventing market failures, tailoring interventions to the specific market structure and firm behavior.

Summary: Key Differences and Economic Impacts

Monopoly markets feature a single firm controlling prices and output, leading to higher prices and reduced consumer surplus, while Bertrand competition involves multiple firms setting prices simultaneously, driving prices down to marginal cost and maximizing consumer welfare. In monopolies, economic inefficiency arises from output restriction and deadweight loss, whereas Bertrand competition enhances allocative efficiency and promotes innovation through price competition. These differences significantly impact market outcomes, affecting consumer choice, product availability, and overall economic welfare.

Monopoly Infographic

libterm.com

libterm.com