Diminishing sensitivity refers to the decreasing responsiveness to changes in stimuli as their intensity increases, commonly observed in areas like perception, economics, and decision-making. This principle explains why your satisfaction or dissatisfaction from gains and losses becomes less pronounced the larger those gains or losses get. Explore the article to understand how diminishing sensitivity impacts your everyday choices and behaviors.

Table of Comparison

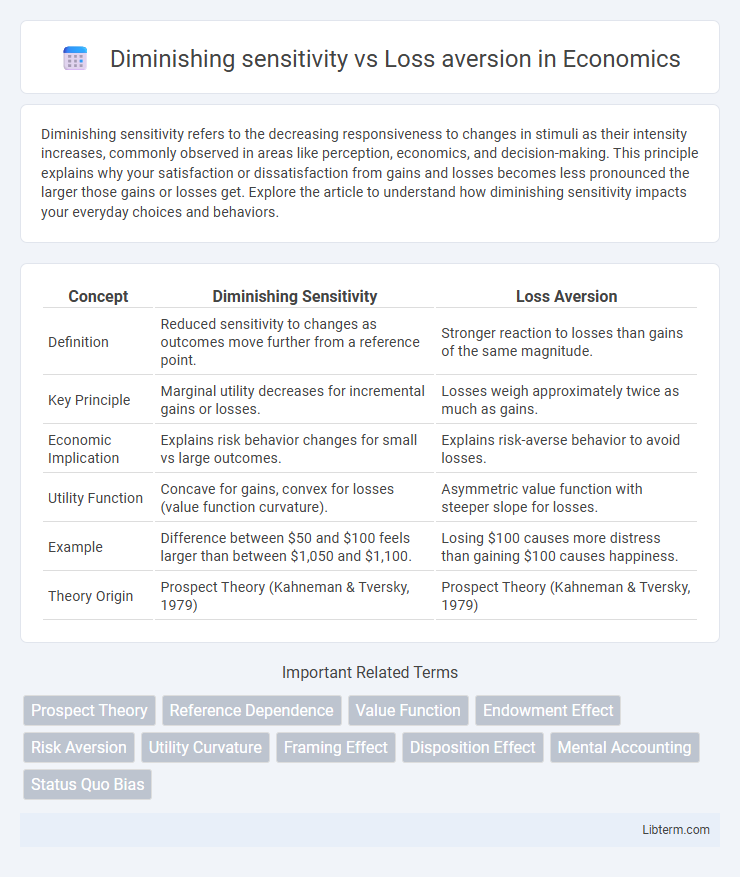

| Concept | Diminishing Sensitivity | Loss Aversion |

|---|---|---|

| Definition | Reduced sensitivity to changes as outcomes move further from a reference point. | Stronger reaction to losses than gains of the same magnitude. |

| Key Principle | Marginal utility decreases for incremental gains or losses. | Losses weigh approximately twice as much as gains. |

| Economic Implication | Explains risk behavior changes for small vs large outcomes. | Explains risk-averse behavior to avoid losses. |

| Utility Function | Concave for gains, convex for losses (value function curvature). | Asymmetric value function with steeper slope for losses. |

| Example | Difference between $50 and $100 feels larger than between $1,050 and $1,100. | Losing $100 causes more distress than gaining $100 causes happiness. |

| Theory Origin | Prospect Theory (Kahneman & Tversky, 1979) | Prospect Theory (Kahneman & Tversky, 1979) |

Understanding Diminishing Sensitivity and Loss Aversion

Diminishing sensitivity refers to the decreasing impact of changes in value as they move further from a reference point, meaning people perceive smaller differences in gains or losses as the amounts grow larger. Loss aversion describes the tendency for losses to have a stronger emotional impact than equivalent gains, often causing individuals to prefer avoiding losses rather than acquiring gains. Understanding diminishing sensitivity explains why incremental changes feel less significant over time, while loss aversion highlights the asymmetric evaluation of losses versus gains in decision-making.

Key Differences Between Diminishing Sensitivity and Loss Aversion

Diminishing sensitivity refers to the decreasing marginal impact of changes in wealth or outcomes as one moves further from a reference point, meaning the difference between $100 and $200 feels larger than between $1,100 and $1,200. Loss aversion describes the tendency for losses to have a stronger emotional impact than equivalent gains, typically making losses about twice as psychologically powerful as gains of the same size. The key difference lies in diminishing sensitivity focusing on how value perception changes with magnitude, while loss aversion emphasizes the asymmetric weighting of losses versus gains around the reference point.

The Psychological Foundations of Loss Aversion

Loss aversion is rooted in the psychological principle that individuals experience the pain of losses more intensely than the pleasure of equivalent gains, a concept central to prospect theory. Diminishing sensitivity explains how the subjective difference in value decreases as outcomes move further from a reference point, causing people to be more sensitive to changes near that reference point. This interplay creates a cognitive bias where losses loom larger than gains, driving risk-averse behavior in decision-making processes.

How Diminishing Sensitivity Influences Decision-Making

Diminishing sensitivity influences decision-making by causing individuals to perceive changes in value less intensely as they move further from a reference point, which shapes risk assessment and preference patterns. This concept explains why people react strongly to initial gains or losses but gradually become less sensitive to subsequent changes, affecting economic and behavioral choices. In contrast to loss aversion, diminishing sensitivity highlights the nonlinear perception of value rather than the asymmetry between losses and gains.

Real-World Examples of Loss Aversion

Loss aversion is a behavioral economics principle demonstrating that people experience the pain of losses more intensely than the pleasure of equivalent gains, influencing decisions in financial markets, such as investors holding losing stocks longer to avoid realizing losses. Retailers exploit loss aversion through limited-time offers and money-back guarantees, triggering customers' fear of missing out or incurring a loss, thereby boosting sales. In insurance, individuals often overpay for coverage to prevent potential losses, reflecting the disproportionate weight of losses over gains in risk assessment.

The Role of Prospect Theory in Explaining Both Concepts

Prospect Theory explains diminishing sensitivity as the decreasing impact of incremental changes in gains or losses on an individual's value perception, highlighting how people perceive outcomes relative to a reference point. Loss aversion, a core component of Prospect Theory, describes the tendency to weigh losses more heavily than equivalent gains, emphasizing the asymmetry in individuals' utility functions. Together, these concepts illustrate how human decision-making deviates from expected utility theory by accounting for psychological biases in evaluating risk and reward.

Diminishing Sensitivity in Financial Choices

Diminishing sensitivity in financial choices refers to the reduced impact of incremental gains or losses as their magnitude increases, influencing decision-making by making small changes more psychologically significant than larger ones. This concept explains why investors may react strongly to initial portfolio gains or losses but become less responsive as amounts grow, leading to risk-averse behavior in gains and risk-seeking behavior in losses. Unlike loss aversion, which emphasizes the asymmetry in reactions to gains versus losses, diminishing sensitivity highlights the nonlinear perception of value changes, crucial for understanding behaviors in investment, spending, and saving decisions.

Loss Aversion and Behavioral Economics

Loss aversion, a core concept in behavioral economics, describes individuals' tendency to prefer avoiding losses over acquiring equivalent gains, often leading to risk-averse behavior and suboptimal decision-making. This phenomenon contrasts with diminishing sensitivity, which explains how the subjective value of gains or losses decreases as their magnitude increases, but loss aversion specifically highlights the asymmetry in emotional impact between equivalent gains and losses. Understanding loss aversion is crucial for designing effective economic policies, marketing strategies, and financial models that account for real-world consumer behaviors and decision-making biases.

Practical Implications for Marketers and Businesses

Understanding diminishing sensitivity helps marketers design pricing strategies by emphasizing smaller incremental gains or losses to influence consumer perception, while loss aversion highlights consumers' stronger reactions to potential losses rather than equivalent gains. Businesses can leverage loss aversion by framing offers and discounts to minimize perceived losses, such as money-back guarantees or highlighting what customers avoid losing by not purchasing. Combining both concepts enhances promotional messaging, optimizing consumer engagement and increasing conversion rates through tailored value propositions.

Strategies to Counteract Loss Aversion and Diminishing Sensitivity

Strategies to counteract loss aversion include reframing choices to highlight potential gains, employing pre-commitment devices to reduce impulsive decisions, and using gradual exposure to losses to desensitize negative emotional responses. Addressing diminishing sensitivity involves breaking large decisions into smaller increments to maintain consistent motivation and leveraging frequent feedback to sustain perceived value. Combining behavioral nudges with cognitive restructuring techniques effectively mitigates biases arising from both loss aversion and diminishing sensitivity.

Diminishing sensitivity Infographic

libterm.com

libterm.com