An incomplete market occurs when not all risks can be fully traded or hedged due to a lack of financial instruments or participants. This limitation can lead to inefficiencies and challenges in pricing assets or managing risk effectively. Explore the rest of this article to understand how incomplete markets impact your investment decisions and financial strategies.

Table of Comparison

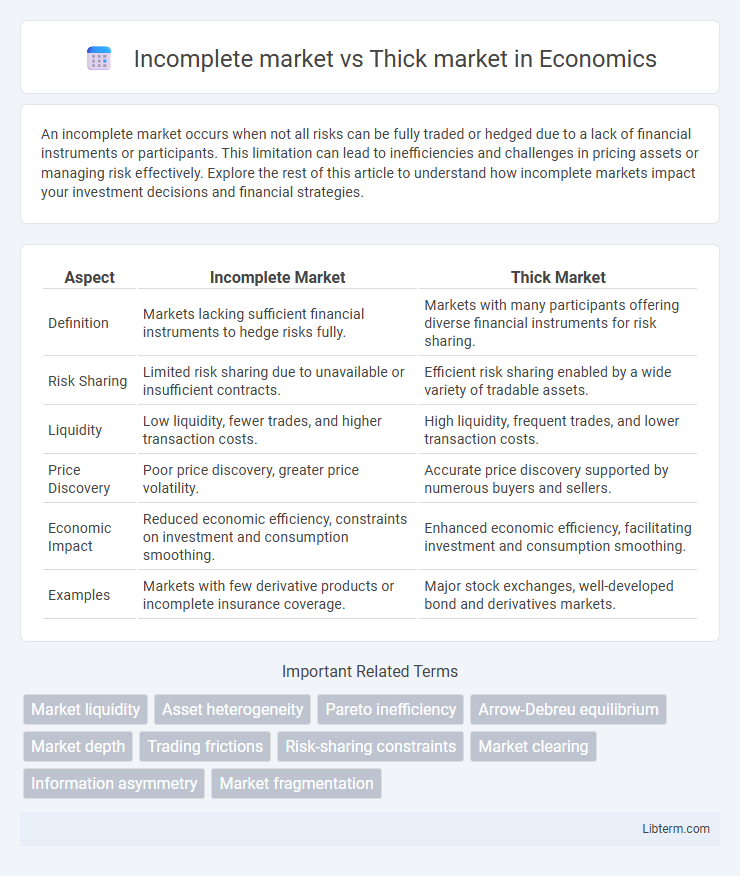

| Aspect | Incomplete Market | Thick Market |

|---|---|---|

| Definition | Markets lacking sufficient financial instruments to hedge risks fully. | Markets with many participants offering diverse financial instruments for risk sharing. |

| Risk Sharing | Limited risk sharing due to unavailable or insufficient contracts. | Efficient risk sharing enabled by a wide variety of tradable assets. |

| Liquidity | Low liquidity, fewer trades, and higher transaction costs. | High liquidity, frequent trades, and lower transaction costs. |

| Price Discovery | Poor price discovery, greater price volatility. | Accurate price discovery supported by numerous buyers and sellers. |

| Economic Impact | Reduced economic efficiency, constraints on investment and consumption smoothing. | Enhanced economic efficiency, facilitating investment and consumption smoothing. |

| Examples | Markets with few derivative products or incomplete insurance coverage. | Major stock exchanges, well-developed bond and derivatives markets. |

Understanding Incomplete Markets

Incomplete markets lack a full range of financial instruments to hedge against all risks, limiting individuals' ability to insure against uncertainties and optimize consumption over time. Understanding incomplete markets involves recognizing how missing assets create gaps in risk-sharing and affect pricing and allocation efficiency. This contrasts with thick markets, where abundant participants and diverse instruments enable more efficient risk distribution and market liquidity.

Defining Thick Markets

Thick markets are characterized by a high volume of buyers and sellers, facilitating efficient trade and price discovery in financial and commodity exchanges. Unlike incomplete markets, where information asymmetry and limited participants restrict liquidity and risk-sharing, thick markets offer greater transparency and reduced transaction costs. This density of participants enables better matching of supply and demand, supporting more stable and accurate pricing mechanisms.

Key Differences Between Incomplete and Thick Markets

Incomplete markets lack sufficient assets or instruments for individuals to fully hedge risks, resulting in limited trading opportunities and reduced liquidity. Thick markets feature a high volume of transactions, numerous buyers and sellers, and abundant assets that facilitate efficient risk-sharing and price discovery. The key differences revolve around asset availability, market participation density, and the ability to achieve optimal risk allocation.

Causes of Market Incompleteness

Market incompleteness arises from factors such as information asymmetry, transaction costs, and regulatory constraints that prevent the creation of all possible contingent claims. Incomplete markets lack sufficient diversity of financial instruments, limiting risk-sharing and hedging opportunities for investors. These structural limitations hinder market thickness, reducing liquidity and the ability to efficiently allocate resources.

Characteristics of Thick Markets

Thick markets are characterized by a high volume of buyers and sellers, leading to greater liquidity and more efficient price discovery. These markets feature dense trading activity, narrow bid-ask spreads, and reduced transaction costs, which facilitate smoother exchange of assets or goods. Unlike incomplete markets, thick markets provide diverse opportunities for risk-sharing and improved matching between supply and demand.

Implications for Buyers and Sellers

Incomplete markets limit buyers' and sellers' options due to fewer available assets or trading opportunities, increasing risk and reducing liquidity. Thick markets provide numerous participants and assets, enhancing price discovery, reducing transaction costs, and improving market efficiency. Buyers benefit from competitive pricing and greater choice, while sellers enjoy faster asset liquidation and better price realization in thick markets.

Effects on Asset Pricing and Liquidity

Incomplete markets limit investors' ability to fully hedge risks, leading to higher asset price volatility and risk premiums, which decreases overall market liquidity. Thick markets, characterized by numerous active participants and high trading volume, enhance price discovery and reduce bid-ask spreads, thereby improving asset pricing efficiency and increasing liquidity. The degree of market completeness directly impacts the availability of assets for risk sharing, influencing both asset prices and the ease with which investors can transact.

Risk Sharing in Incomplete vs Thick Markets

Risk sharing in incomplete markets is limited due to the absence of a full range of financial instruments, resulting in higher exposure to idiosyncratic risks. In thick markets, diverse and abundant trading opportunities enable more efficient risk diversification and pooling among participants. Consequently, thick markets facilitate optimal risk sharing by allowing agents to better hedge against uncertainties through extensive asset availability.

Real-World Examples and Case Studies

Incomplete markets, characterized by missing financial instruments or limited trading opportunities, often hinder risk-sharing and efficient pricing in sectors like insurance or emerging economies. Examples include microinsurance markets in developing countries where coverage options are scarce, leading to suboptimal protection for individuals. Thick markets, as seen in major stock exchanges like NYSE or NASDAQ, feature ample buyers and sellers, facilitating liquidity, price discovery, and efficient allocation of resources through extensive real-time trading and diverse asset offerings.

Policy Implications and Market Design Strategies

Incomplete markets, characterized by missing financial instruments or limited participation, challenge policymakers to enhance risk-sharing and liquidity by introducing regulatory reforms that encourage innovation and lower entry barriers. Thick markets, defined by abundant trading volume and diverse participants, require market design strategies that promote transparency, reduce transaction costs, and prevent market manipulation to maintain efficiency. Effective policy interventions in both market types aim to improve allocative efficiency and financial stability through tailored measures such as expanding contract variety or reinforcing market infrastructure.

Incomplete market Infographic

libterm.com

libterm.com