National saving represents the total amount of income that a country sets aside from consumption to invest in future growth. It includes both private savings from households and businesses as well as public savings from government budgets. Explore the rest of the article to understand how national saving impacts your economy and financial stability.

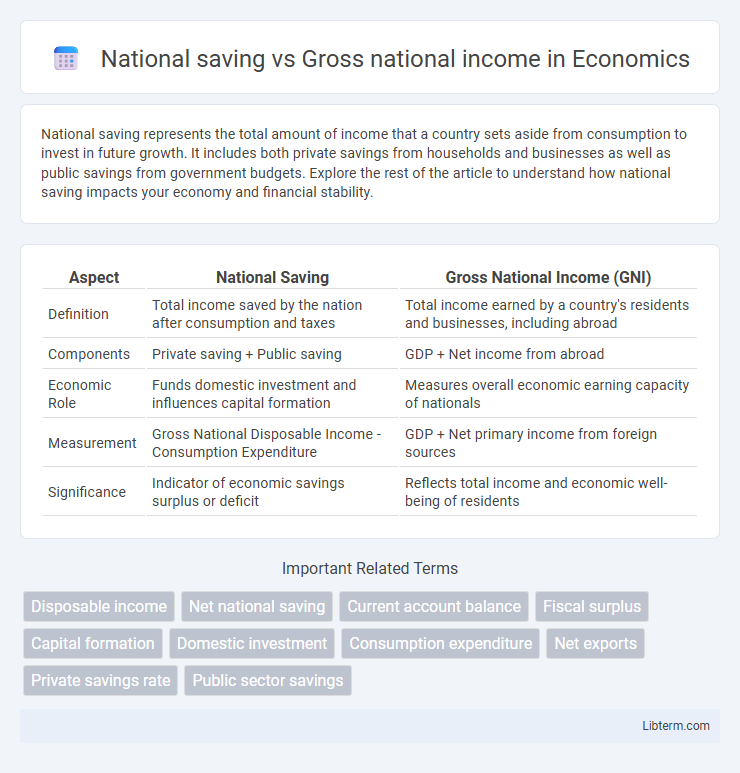

Table of Comparison

| Aspect | National Saving | Gross National Income (GNI) |

|---|---|---|

| Definition | Total income saved by the nation after consumption and taxes | Total income earned by a country's residents and businesses, including abroad |

| Components | Private saving + Public saving | GDP + Net income from abroad |

| Economic Role | Funds domestic investment and influences capital formation | Measures overall economic earning capacity of nationals |

| Measurement | Gross National Disposable Income - Consumption Expenditure | GDP + Net primary income from foreign sources |

| Significance | Indicator of economic savings surplus or deficit | Reflects total income and economic well-being of residents |

Definition of National Saving

National saving refers to the total amount of income in an economy that is not consumed by households or the government, representing the sum of private and public savings. It plays a crucial role in financing investment and supporting sustainable economic growth within a country. Unlike Gross National Income (GNI), which measures the total income earned by a nation's residents including net income from abroad, national saving specifically captures the portion of income reserved for future use rather than current expenditure.

Understanding Gross National Income

Gross National Income (GNI) measures the total income earned by a country's residents and businesses, including income from abroad, reflecting economic strength beyond domestic production alone. National saving represents the portion of GNI that is not consumed, indicating the funds available for investment within the economy. Understanding GNI provides insight into a nation's overall economic performance and the potential for capital accumulation through national saving.

Components of National Saving

National saving comprises the sum of private saving and public saving, reflecting the total amount of income not consumed by households and government. Private saving is derived from household income minus consumption expenditure, while public saving is the difference between government revenue and government spending. Gross National Income (GNI) includes the total income earned by a nation's residents from domestic and foreign sources but does not directly measure the allocation between consumption and saving within the economy.

Measuring Gross National Income

Gross National Income (GNI) measures the total economic output of a country, including the value of all finished goods and services produced within a nation's borders plus net income earned from abroad, reflecting the overall economic strength. National saving, on the other hand, represents the portion of GNI that is not consumed and is set aside for investment or future use, serving as a key indicator of a country's investment potential and financial stability. Accurate measurement of GNI involves compiling data on domestic production, income earned by residents from foreign investments, and subtracting income earned by foreigners within the country to provide a comprehensive view of national income flows.

Relationship Between National Saving and GNI

National saving represents the portion of Gross National Income (GNI) that is not consumed and is available for investment or debt repayment. The relationship between national saving and GNI is direct, as higher GNI typically allows for increased saving capacity within a country. This saving influences economic growth by providing funds for capital formation, which in turn can enhance future GNI.

Economic Significance of National Saving

National saving, comprising both private and public savings, is crucial for funding domestic investment and ensuring sustainable economic growth without relying heavily on foreign capital. Gross National Income (GNI) measures total income earned by a nation's residents and businesses, reflecting overall economic performance but not directly indicating the capacity for investment. The economic significance of national saving lies in its role in capital formation, enhancing productive capacity, and stabilizing the economy by providing resources for infrastructural development and innovation.

The Impact of GNI on Economic Growth

Gross National Income (GNI) directly influences economic growth by reflecting the total domestic and foreign income earned by a country, which determines the available financial resources for investment and consumption. A higher GNI increases national saving capacity, providing more capital for infrastructure development, business expansion, and technological innovation that drive economic growth. Economic policies that enhance GNI, such as improving productivity and fostering international trade, contribute significantly to sustained economic development and improved living standards.

Factors Influencing National Saving Rates

National saving rates are influenced by factors such as income levels, interest rates, government fiscal policies, and demographic trends, which shape the capacity and willingness of individuals and institutions to save from Gross National Income (GNI). Higher GNI typically provides a larger base for saving, but variations in consumption patterns, social safety nets, and economic stability significantly affect national saving behavior. Understanding these dynamics is crucial for analyzing how effectively a country converts its income into savings that fuel investment and economic growth.

Trends in National Saving and GNI

National saving, representing the portion of Gross National Income (GNI) not consumed, typically reflects economic health and investment capacity trends. Recent data indicates a fluctuating pattern in national saving rates influenced by changes in GNI due to economic growth, fiscal policies, and external shocks. Analyzing these trends reveals that increases in GNI often correlate with rising national savings, enhancing capital accumulation and long-term economic stability.

Policy Implications for Improving National Saving and GNI

National saving, representing the portion of Gross National Income (GNI) not consumed, critically influences a nation's investment capacity and economic growth potential. Policies aimed at improving national saving often focus on tax incentives for savings, pension reforms, and enhancing financial literacy to boost household and corporate saving rates, thereby increasing available funds for investment. Strengthening GNI requires policies that promote productivity, foreign direct investment, and sustainable resource management to enhance overall income generation and national wealth.

National saving Infographic

libterm.com

libterm.com