Oligopoly is a market structure characterized by a few large firms dominating the industry, resulting in limited competition and potential collusion. These firms often engage in strategic decision-making, where the actions of one directly influence the others, impacting prices and output levels. Explore the rest of the article to understand how oligopolistic markets shape your choices as a consumer and influence economic dynamics.

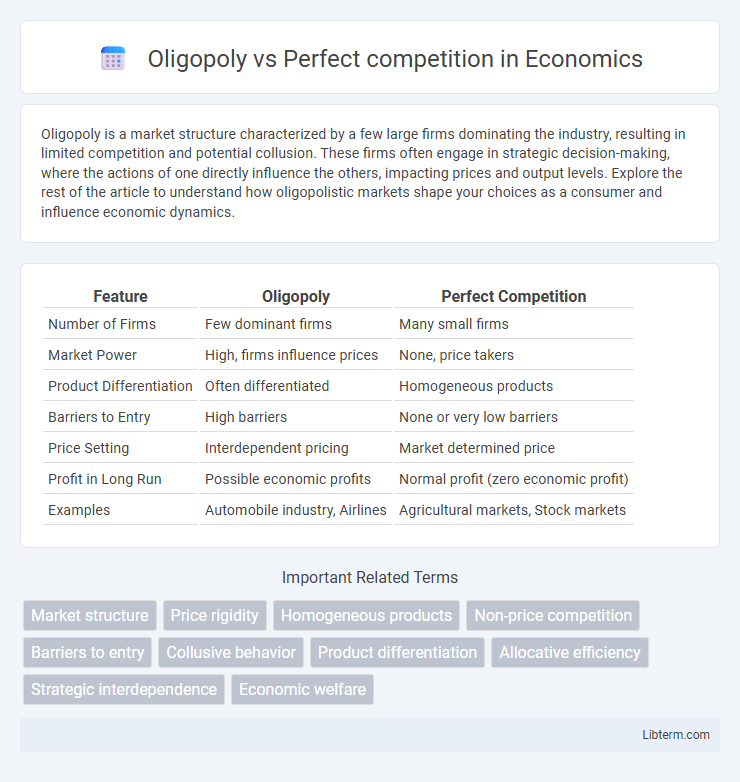

Table of Comparison

| Feature | Oligopoly | Perfect Competition |

|---|---|---|

| Number of Firms | Few dominant firms | Many small firms |

| Market Power | High, firms influence prices | None, price takers |

| Product Differentiation | Often differentiated | Homogeneous products |

| Barriers to Entry | High barriers | None or very low barriers |

| Price Setting | Interdependent pricing | Market determined price |

| Profit in Long Run | Possible economic profits | Normal profit (zero economic profit) |

| Examples | Automobile industry, Airlines | Agricultural markets, Stock markets |

Understanding Oligopoly and Perfect Competition

Oligopoly markets are characterized by a few dominant firms that hold significant market power, resulting in limited competition and potential collusion, while perfect competition features numerous small firms with no individual market influence, leading to price-taking behavior. In an oligopoly, barriers to entry are high, and strategic interactions among firms influence pricing and output decisions, whereas perfect competition assumes free entry and exit with homogeneous products. Understanding these market structures is crucial for analyzing firm behavior, market efficiency, and consumer welfare in different economic environments.

Key Characteristics of Oligopoly

Oligopoly is characterized by a market dominated by a few large firms, each holding significant market power that influences prices and output. Barriers to entry are high, preventing new competitors from easily entering the market, while products can be either homogeneous or differentiated. Firms in an oligopoly often engage in strategic behavior, such as collusion or price leadership, to maximize joint profits and maintain market stability.

Defining Features of Perfect Competition

Perfect competition is defined by a large number of small firms producing homogenous products, ensuring no single firm can influence market prices. Firms are price takers with free entry and exit from the market, resulting in perfect information and zero economic profits in the long run. This contrasts with oligopoly, where few firms dominate with significant market power and product differentiation.

Market Structure Comparison: Oligopoly vs Perfect Competition

Oligopoly market structure is characterized by a few dominant firms with significant market power, leading to limited competition and potential for collusion, whereas perfect competition consists of many small firms with no single entity able to influence market prices. In oligopoly, product differentiation and high barriers to entry restrict new competitors, while perfect competition features homogeneous products and free market entry and exit. Price-setting in oligopoly is strategic and interdependent among firms, contrasting with perfect competition's price-taking behavior driven by supply and demand forces.

Pricing Strategies in Oligopoly and Perfect Competition

In an oligopoly, firms employ strategic pricing methods such as price leadership, collusion, or kinked demand pricing to maintain market stability and maximize profits due to the interdependence of competitors. In contrast, perfect competition features price takers where individual firms must accept the market price determined by overall supply and demand, leading to prices equating marginal cost. The pricing power in oligopolies contrasts sharply with the perfectly elastic demand curve faced by firms in perfect competition.

Barriers to Entry: Oligopoly vs Perfect Competition

Barriers to entry in an oligopoly are significantly high due to factors like economies of scale, substantial capital requirements, and strong brand loyalty, which deter new competitors from entering the market. In contrast, perfect competition features virtually no barriers to entry, allowing new firms to freely enter or exit the market based on supply and demand conditions. These contrasting entry barriers shape market power, pricing strategies, and overall competition intensity in each market structure.

Efficiency and Welfare Implications

Oligopoly markets often lead to lower allocative and productive efficiency compared to perfect competition due to restricted output and higher prices, reducing consumer surplus and overall welfare. In contrast, perfect competition achieves maximum efficiency where price equals marginal cost, ensuring optimal resource allocation and maximizing social welfare. However, oligopolies may invest more in innovation, potentially enhancing dynamic efficiency despite short-term welfare losses.

Role of Consumer Choice and Product Differentiation

In an oligopoly, consumer choice is heavily influenced by product differentiation, as firms strategically develop unique features, branding, and pricing to capture market share and foster brand loyalty. In contrast, perfect competition features homogenous products, limiting consumer choice to price as the primary decision factor due to the lack of product differentiation. This stark contrast affects market dynamics, with oligopolies leveraging differentiated products to reduce price sensitivity and enhance market power, while perfect competition relies on transparent pricing and identical goods to maximize consumer welfare.

Real-World Examples of Oligopoly and Perfect Competition

Oligopoly markets like the U.S. automobile industry, featuring major players such as Ford, General Motors, and Toyota, illustrate limited competition with significant market control and product differentiation. Perfect competition is exemplified by agricultural markets like wheat or corn farming, where numerous farmers sell homogeneous products and no single producer can influence market prices. These real-world examples highlight the differences in market power, pricing strategies, and barriers to entry between oligopoly and perfect competition.

Summary: Which Market Structure is More Beneficial?

Perfect competition fosters maximum consumer benefits through lower prices, higher output, and efficient resource allocation due to numerous sellers and free entry. Oligopoly, characterized by few dominant firms, may lead to higher prices and reduced output but can drive innovation and economies of scale. Overall, perfect competition is more beneficial for consumer welfare, while oligopoly may benefit firms through market power and strategic behavior.

Oligopoly Infographic

libterm.com

libterm.com