A deflation gap occurs when aggregate demand falls short of aggregate supply, leading to decreased economic output and lower price levels. This imbalance can result in higher unemployment and reduced consumer spending, negatively impacting overall economic growth. Explore the rest of the article to understand how a deflation gap affects Your economy and the measures to address it.

Table of Comparison

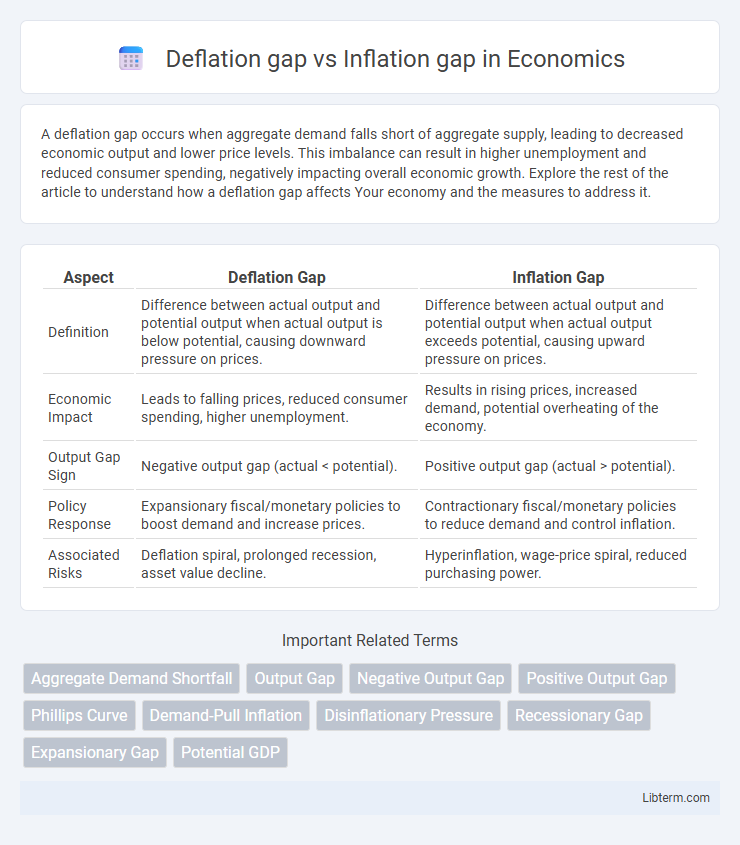

| Aspect | Deflation Gap | Inflation Gap |

|---|---|---|

| Definition | Difference between actual output and potential output when actual output is below potential, causing downward pressure on prices. | Difference between actual output and potential output when actual output exceeds potential, causing upward pressure on prices. |

| Economic Impact | Leads to falling prices, reduced consumer spending, higher unemployment. | Results in rising prices, increased demand, potential overheating of the economy. |

| Output Gap Sign | Negative output gap (actual < potential). | Positive output gap (actual > potential). |

| Policy Response | Expansionary fiscal/monetary policies to boost demand and increase prices. | Contractionary fiscal/monetary policies to reduce demand and control inflation. |

| Associated Risks | Deflation spiral, prolonged recession, asset value decline. | Hyperinflation, wage-price spiral, reduced purchasing power. |

Introduction to Deflation Gap and Inflation Gap

Deflation gap occurs when aggregate demand falls short of aggregate supply, leading to a decrease in overall price levels and economic output. Inflation gap arises when aggregate demand exceeds aggregate supply, causing upward pressure on prices and resulting in inflation. Both gaps highlight the imbalance between demand and supply, impacting economic stability and policy decisions.

Definitions: Deflation Gap vs Inflation Gap

The deflation gap refers to the shortfall in aggregate demand that causes actual output to fall below potential output, leading to downward pressure on prices and economic contraction. The inflation gap occurs when aggregate demand exceeds potential output, creating upward pressure on prices and resulting in inflationary conditions. Both gaps highlight deviations from economic equilibrium, with deflation gaps signaling underutilization of resources and inflation gaps indicating overextension.

Causes of Deflation Gap

A deflation gap occurs when aggregate demand falls short of aggregate supply, resulting in downward pressure on prices and economic contraction. Causes of a deflation gap include reduced consumer spending, high unemployment, decreased investment, and tight monetary policy that restricts money supply. In contrast, an inflation gap arises when aggregate demand exceeds supply, leading to rising prices and economic overheating.

Causes of Inflation Gap

An inflation gap occurs when aggregate demand exceeds the economy's potential output, causing upward pressure on prices and leading to inflation. Key causes include increased consumer spending, expansionary fiscal policies such as higher government expenditure or tax cuts, and monetary policies that lower interest rates, boosting investment and consumption. Supply shocks, like rising commodity prices, and expectations of future inflation also contribute to widening the inflation gap by increasing production costs and accelerating price increases.

Economic Indicators and Measurement

The deflation gap occurs when actual inflation falls below the target inflation rate, indicating weaker demand and lower economic output, often measured by negative deviations in the Consumer Price Index (CPI) or Producer Price Index (PPI). Conversely, the inflation gap arises when actual inflation exceeds the target rate, reflecting overheating in the economy, assessed through rising CPI, PPI, and core inflation rates excluding volatile food and energy prices. Key economic indicators for both gaps include GDP growth rates, unemployment rates, and wage inflation, which together help quantify the economy's departure from equilibrium inflation levels.

Effects on Aggregate Demand and Supply

Deflation gap occurs when aggregate demand falls short of aggregate supply, leading to decreased prices and output, higher unemployment, and reduced consumer spending. Inflation gap arises when aggregate demand exceeds aggregate supply, causing upward pressure on prices, increased output temporarily, but eventually leading to resource shortages and wage inflation. Both gaps disrupt economic equilibrium, with deflation gaps suppressing demand and inflation gaps overstimulating it, affecting overall economic stability and growth.

Impact on Employment and Output

A deflation gap occurs when aggregate demand falls short of potential output, leading to decreased employment and reduced production as businesses cut back due to lower consumer spending. In contrast, an inflation gap arises when aggregate demand exceeds potential output, causing firms to increase output and hire more workers, which can temporarily boost employment but may lead to inflationary pressures. Both gaps disrupt economic equilibrium, with deflation gaps causing unemployment and output decline, while inflation gaps push the economy beyond sustainable capacity, risking overheating.

Policy Responses to Deflation Gap

Deflation gaps occur when aggregate demand falls short of aggregate supply, leading to falling prices and economic contraction, requiring expansionary monetary and fiscal policies to stimulate demand, such as lowering interest rates and increasing government spending. Inflation gaps arise when aggregate demand exceeds aggregate supply, causing rising prices and overheating, prompting contractionary policies like raising interest rates and reducing public expenditure. Policy responses to a deflation gap prioritize boosting consumption and investment to avoid prolonged deflation and economic stagnation.

Policy Responses to Inflation Gap

The inflation gap occurs when actual inflation exceeds the target inflation rate, signaling an overheated economy and prompting central banks to tighten monetary policy by raising interest rates to reduce spending and control price increases. Fiscal policy responses may include reducing government spending or increasing taxes to decrease aggregate demand and curb inflationary pressures. Supply-side measures such as improving productivity and reducing production costs also help address the inflation gap by easing upward price pressures.

Key Differences Between Deflation Gap and Inflation Gap

The deflation gap occurs when aggregate demand is insufficient to reach full employment, leading to falling prices and reduced economic output, while the inflation gap arises from aggregate demand exceeding full employment, causing rising prices and overheating of the economy. Key differences include the direction of price changes--deflation in the deflation gap versus inflation in the inflation gap--and their impact on unemployment, where the deflation gap typically correlates with higher unemployment and the inflation gap with lower unemployment. Policymakers address these gaps using contrasting measures: expansionary fiscal or monetary policies to close a deflation gap and contractionary policies to reduce an inflation gap.

Deflation gap Infographic

libterm.com

libterm.com