The notional amount represents the total value underlying a financial derivative contract, such as options or swaps, and is crucial for calculating payments without exchanging the principal. It helps investors assess the scale of their exposure and potential risk in financial transactions. Discover how understanding the notional amount can enhance your grasp of derivatives by reading the full article.

Table of Comparison

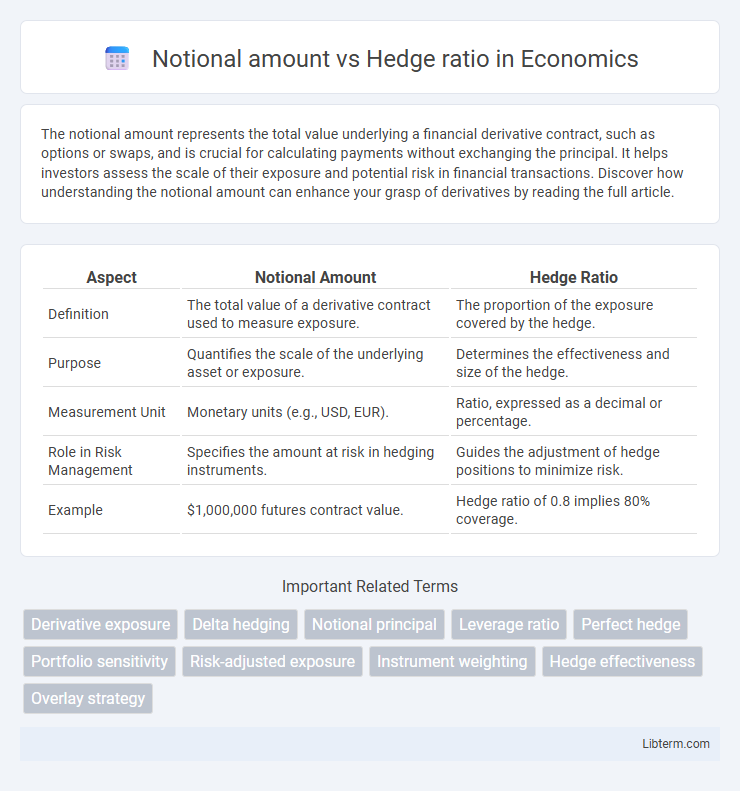

| Aspect | Notional Amount | Hedge Ratio |

|---|---|---|

| Definition | The total value of a derivative contract used to measure exposure. | The proportion of the exposure covered by the hedge. |

| Purpose | Quantifies the scale of the underlying asset or exposure. | Determines the effectiveness and size of the hedge. |

| Measurement Unit | Monetary units (e.g., USD, EUR). | Ratio, expressed as a decimal or percentage. |

| Role in Risk Management | Specifies the amount at risk in hedging instruments. | Guides the adjustment of hedge positions to minimize risk. |

| Example | $1,000,000 futures contract value. | Hedge ratio of 0.8 implies 80% coverage. |

Introduction to Notional Amount and Hedge Ratio

Notional amount refers to the total value of a leveraged position in derivatives or other financial instruments, representing the underlying quantity on which payments are based. Hedge ratio measures the proportion of the exposure that is covered or offset by the hedge, typically expressed as a ratio between the size of the position being hedged and the size of the hedging instrument. Understanding the relationship between notional amount and hedge ratio is crucial for effective risk management and minimizing potential losses in financial markets.

Defining Notional Amount in Financial Contracts

Notional amount in financial contracts represents the total nominal or face value underlying a derivative or financial instrument, serving as the reference amount for calculating payments and exposures without actual exchange of principal. It is crucial for determining the scale of risk exposure in instruments such as interest rate swaps, options, and futures. Unlike the hedge ratio, which measures the effectiveness of a hedging position relative to the underlying risk, the notional amount solely quantifies the contract's size.

Understanding Hedge Ratio: Concept and Calculation

The hedge ratio measures the proportion of an asset's exposure that is covered by a hedging instrument and is calculated by dividing the notional amount of the hedge by the value or quantity of the underlying asset being hedged. Understanding the hedge ratio is essential for minimizing risk in financial portfolios, as it determines the effectiveness of the hedge in offsetting potential losses. Accurate calculation requires precise data on both the notional amount and the exposure size to optimize risk management strategies.

Key Differences Between Notional Amount and Hedge Ratio

The notional amount represents the total value of a leveraged position in derivatives or the underlying asset size on which payments are based, while the hedge ratio measures the proportion of the exposure being hedged relative to the total risk. Key differences include that the notional amount is an absolute value indicating scale, whereas the hedge ratio is a relative measure expressed as a decimal or percentage. Understanding the distinction is crucial for effective risk management, as the hedge ratio helps determine how much of the notional amount requires protection to minimize potential losses.

Importance of Notional Amount in Derivatives Trading

The notional amount represents the total value of the underlying asset in derivatives trading, serving as a key metric for determining contract size and potential exposure. Its importance lies in accurately quantifying the scale of the hedge, directly impacting risk management and pricing strategies. Traders rely on the notional amount to calibrate the hedge ratio, ensuring effective mitigation of price fluctuations in the underlying market.

Role of Hedge Ratio in Managing Portfolio Risk

The hedge ratio plays a critical role in managing portfolio risk by determining the proportion of the notional amount required to offset potential losses in the underlying asset. It quantifies the sensitivity of the portfolio to price changes and guides investors in adjusting their hedge positions effectively to maintain desired risk exposure. Accurate calculation of the hedge ratio ensures optimal risk mitigation, reducing volatility and enhancing portfolio stability in various market conditions.

Practical Examples: Notional Amount vs Hedge Ratio

Notional amount represents the total value of assets or liabilities involved in a hedge, while the hedge ratio quantifies the proportion of exposure covered by the hedge. For example, if an investor holds $1 million in foreign currency assets and hedges $800,000 using forward contracts, the hedge ratio is 0.8, reflecting an 80% hedge of the notional amount. Adjusting the notional amount without changing the exposure can impact the hedge effectiveness, emphasizing the importance of aligning the hedge ratio with risk management objectives.

Common Misconceptions and Pitfalls

Confusing notional amount with hedge ratio often leads to ineffective risk management, as the notional amount represents the total value underlying a derivative contract while the hedge ratio indicates the proportion of exposure actually hedged. A common misconception is assuming a one-to-one relationship between these two metrics, which can result in either over-hedging or under-hedging positions. Properly calculating the hedge ratio requires considering factors such as correlation, volatility, and the specific characteristics of the assets involved to avoid pitfalls in financial risk strategies.

Strategic Use of Both Metrics in Hedging

Notional amount quantifies the total value of the underlying asset in a hedge, serving as a baseline for exposure measurement. Hedge ratio determines the proportion of exposure hedged, optimizing risk management by aligning the hedge position to actual risk levels. Combining both metrics strategically enhances precision in hedging decisions, preventing over- or under-hedging and improving financial stability.

Conclusion: Choosing the Right Metric for Your Strategy

Selecting between notional amount and hedge ratio depends on the specific goals and risk management needs of your hedging strategy. Notional amount provides a straightforward measure of the total value exposed to risk, ideal for setting clear limits and budget controls. Hedge ratio offers precision in balancing risk exposure relative to the underlying asset, making it essential for dynamic portfolio adjustments and optimizing hedge effectiveness.

Notional amount Infographic

libterm.com

libterm.com