Adverse selection occurs when one party in a transaction has more information than the other, leading to a disproportionate risk for the less-informed party. This phenomenon often affects insurance markets, where individuals with higher risks are more likely to purchase coverage, driving up costs for everyone. Explore the rest of the article to understand how adverse selection impacts your financial decisions and ways to mitigate its effects.

Table of Comparison

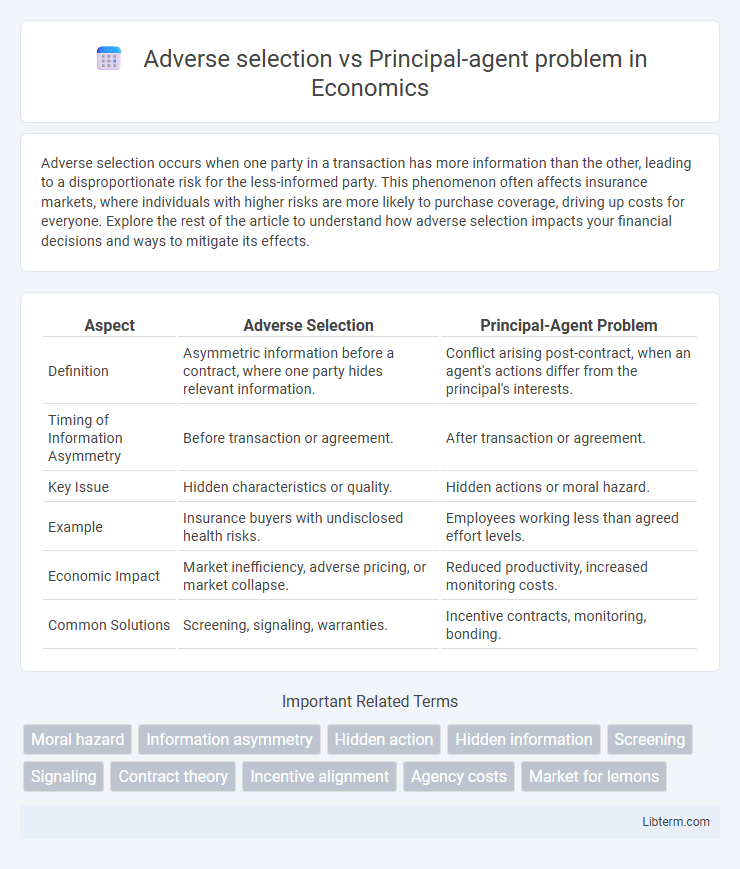

| Aspect | Adverse Selection | Principal-Agent Problem |

|---|---|---|

| Definition | Asymmetric information before a contract, where one party hides relevant information. | Conflict arising post-contract, when an agent's actions differ from the principal's interests. |

| Timing of Information Asymmetry | Before transaction or agreement. | After transaction or agreement. |

| Key Issue | Hidden characteristics or quality. | Hidden actions or moral hazard. |

| Example | Insurance buyers with undisclosed health risks. | Employees working less than agreed effort levels. |

| Economic Impact | Market inefficiency, adverse pricing, or market collapse. | Reduced productivity, increased monitoring costs. |

| Common Solutions | Screening, signaling, warranties. | Incentive contracts, monitoring, bonding. |

Introduction to Adverse Selection and Principal-Agent Problem

Adverse selection occurs when one party in a transaction possesses hidden information that the other party cannot access, leading to suboptimal market outcomes. The principal-agent problem arises when an agent, entrusted to act on behalf of a principal, has incentives that diverge from the principal's best interests, often due to asymmetric information and conflicting goals. Both concepts are fundamental in economics and contract theory, highlighting challenges in information asymmetry and incentive alignment.

Defining Adverse Selection

Adverse selection refers to a market condition where asymmetric information causes one party, typically the buyer or seller, to select transactions that favor their interests at the expense of the other party, often leading to suboptimal outcomes. This problem commonly arises before a contract is signed, affecting markets such as insurance, where individuals with higher risks are more likely to seek coverage. In contrast, the principal-agent problem occurs after a contract is established, involving conflicts of interest and hidden actions between a principal and an agent.

Understanding the Principal-Agent Problem

The Principal-Agent problem arises when a principal delegates decision-making authority to an agent whose interests may diverge from the principal's, leading to potential conflicts and inefficiencies. It is characterized by asymmetric information where the agent possesses more information about their actions or intentions than the principal, complicating monitoring and enforcement. Effective contract design, incentive alignment, and performance monitoring are essential to mitigate moral hazard and ensure agents act in the principal's best interest.

Key Differences Between Adverse Selection and Principal-Agent Problem

Adverse selection occurs before a transaction, involving asymmetric information where one party possesses hidden information that affects decision-making, such as buyers knowing risks unknown to sellers. The principal-agent problem arises after a contract is established, where the agent's actions are unobservable and may diverge from the principal's interests due to moral hazard. Key differences include the timing of information asymmetry--ex-ante in adverse selection versus ex-post in the principal-agent problem--and the nature of the hidden actions or information affecting outcomes.

Causes and Contributing Factors to Adverse Selection

Adverse selection arises from asymmetric information where one party in a transaction possesses more or better information than the other, leading to high-risk individuals being more likely to participate. Key contributing factors include hidden characteristics before the transaction, such as an insurance applicant's true health status or an employee's productivity, which remain unknown to the principal. This information imbalance distorts market outcomes by attracting undesirable participants, contrasting with the principal-agent problem, which primarily involves hidden actions post-contract.

Root Causes of the Principal-Agent Problem

The root causes of the principal-agent problem stem from asymmetric information and differing incentives between principals (owners) and agents (managers), where agents possess more information about their actions and intentions than principals. This information imbalance leads to moral hazard, as agents may act in their own interest rather than maximizing shareholder value. Unlike adverse selection, which occurs before a contract is made due to hidden information, the principal-agent problem arises post-contract due to hidden actions and the challenge of monitoring agent behavior effectively.

Real-World Examples of Adverse Selection

Adverse selection occurs when buyers or sellers possess asymmetric information, leading to market inefficiencies, such as in the health insurance industry where individuals with high health risks are more likely to purchase extensive coverage, driving up premiums for everyone. Another real-world example is the used car market, famously described by the "lemons problem," where sellers have more information about vehicle quality than buyers, resulting in a predominance of low-quality cars and reduced market trust. In contrast, the principal-agent problem arises when agents (e.g., company managers) do not perfectly align with principals' (e.g., shareholders') interests, often due to hidden actions or information after contracts are agreed upon.

Real-World Examples of Principal-Agent Problem

The principal-agent problem frequently occurs in corporate governance, where executives (agents) may prioritize personal gains over shareholders' (principals) interests, leading to misaligned incentives and inefficient decision-making. In real estate, agents might focus on quick sales rather than maximizing clients' property value, creating conflicts of interest. Government bureaucracy also exemplifies this issue when officials pursue personal agendas rather than serving public needs, resulting in resource misallocation.

Solutions and Mitigation Strategies for Both Issues

Addressing adverse selection involves enhancing information symmetry through mechanisms such as mandatory disclosures, screening processes, and signaling to reveal private information accurately. Mitigating principal-agent problems requires aligning incentives via performance-based contracts, monitoring systems, and fostering trust through transparent communication between principals and agents. Employing these strategies reduces information asymmetry and moral hazard, improving decision-making quality in markets and organizations.

Conclusion: Comparing Impacts on Markets and Organizations

Adverse selection and the principal-agent problem both distort market efficiency but affect different stages of transactions; adverse selection occurs before a deal is made due to asymmetric information about product quality, while the principal-agent problem arises post-contract through divergent interests and hidden actions. Markets facing adverse selection often experience reduced participation and pricing inefficiencies, whereas organizations grappling with principal-agent issues encounter reduced productivity and increased monitoring costs. Understanding these distinctions enables more targeted mechanisms, such as screening in markets or incentive alignment in firms, to mitigate their respective impacts effectively.

Adverse selection Infographic

libterm.com

libterm.com