The two-sector model divides the economy into two distinct sectors, typically agriculture and manufacturing, to analyze structural transformation and economic development. It highlights how labor shifts from the traditional sector to the modern sector, influencing productivity and growth patterns. Discover how this model impacts your understanding of economic dynamics by exploring the rest of the article.

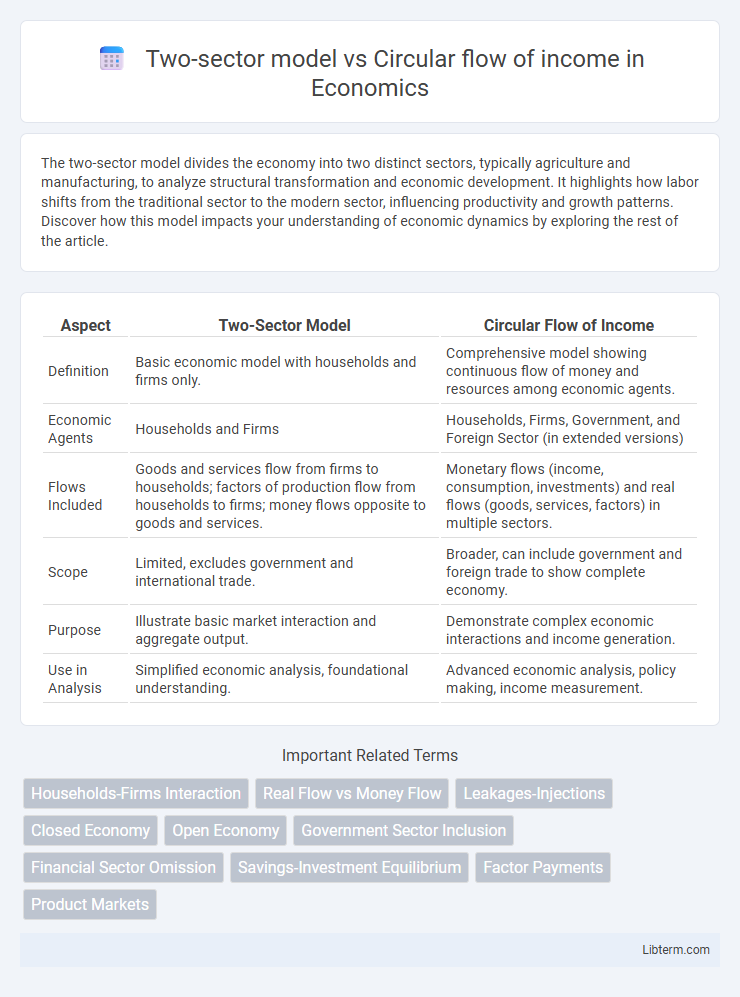

Table of Comparison

| Aspect | Two-Sector Model | Circular Flow of Income |

|---|---|---|

| Definition | Basic economic model with households and firms only. | Comprehensive model showing continuous flow of money and resources among economic agents. |

| Economic Agents | Households and Firms | Households, Firms, Government, and Foreign Sector (in extended versions) |

| Flows Included | Goods and services flow from firms to households; factors of production flow from households to firms; money flows opposite to goods and services. | Monetary flows (income, consumption, investments) and real flows (goods, services, factors) in multiple sectors. |

| Scope | Limited, excludes government and international trade. | Broader, can include government and foreign trade to show complete economy. |

| Purpose | Illustrate basic market interaction and aggregate output. | Demonstrate complex economic interactions and income generation. |

| Use in Analysis | Simplified economic analysis, foundational understanding. | Advanced economic analysis, policy making, income measurement. |

Introduction to Economic Models

The two-sector model simplifies the economy into households and firms, illustrating basic interactions through production and consumption without government or foreign trade influence. The circular flow of income expands this by depicting the continuous movement of money, resources, and goods between households, firms, government, and foreign sectors, capturing a more comprehensive economic system. Both models serve as foundational tools in economic analysis, with the two-sector model focusing on core market exchanges while the circular flow highlights the overall economic dynamics and interdependencies.

Overview of the Two-Sector Model

The Two-Sector Model simplifies the economy into households and firms, highlighting the flow of goods, services, and money between these sectors. Households supply factors of production to firms, receiving wages, rent, and profits in return, which they then use to purchase goods and services produced by firms. This model forms the foundation for the Circular Flow of Income by illustrating the continuous movement of resources and income within a closed economy without government or foreign trade.

Key Components of the Two-Sector Model

The Two-Sector Model simplifies the economy by focusing on households and firms, highlighting key components such as households providing factors of production and receiving income, and firms producing goods and services by utilizing these inputs. It emphasizes the flow of money through consumption expenditure from households to firms and income payments from firms back to households. This model excludes government and foreign sectors, making it a foundational framework for understanding the basic circular flow of income.

Assumptions Underlying the Two-Sector Model

The Two-Sector Model assumes only households and firms participate in the economy, excluding government and foreign trade, which simplifies income flow analysis by focusing solely on consumption and production activities. It presumes no savings, taxes, or investments, ensuring that all income earned by households is spent on goods and services produced by firms, leading to a closed-loop economic system. These assumptions contrast with the Circular Flow of Income, which incorporates additional sectors and leakages, providing a more comprehensive depiction of economic activity.

Introduction to Circular Flow of Income

The circular flow of income illustrates the continuous movement of money, goods, and services between households and firms, highlighting key economic activities and resource exchanges. The two-sector model simplifies this flow by focusing exclusively on households as consumers and firms as producers, emphasizing the interactions that drive income generation and expenditure. Understanding this fundamental framework helps explain how income circulates within an economy, linking production with consumption and saving with investment.

Structure of the Circular Flow of Income

The two-sector model simplifies the circular flow of income by focusing on households and firms, where households provide factors of production and receive income, while firms produce goods and services. In this structure, money flows from firms to households as wages and returns, and back to firms as consumption expenditure, creating a continuous loop that highlights basic economic activities. Unlike more complex models, the two-sector framework excludes government and foreign sectors, emphasizing core market interactions in the economy.

Comparison of Two-Sector Model and Circular Flow

The Two-sector model simplifies the economy by focusing exclusively on households and firms, emphasizing production and consumption without government or foreign trade involvement. The circular flow of income expands this framework by incorporating additional sectors such as government and foreign trade, illustrating a more comprehensive flow of money, goods, and services throughout the economy. While the Two-sector model highlights basic economic interactions, the circular flow provides a detailed depiction of income distribution and economic interdependencies across multiple sectors.

Strengths and Limitations of Each Model

The two-sector model simplifies economic analysis by focusing on households and firms, highlighting basic income flow and enabling clear understanding of production and consumption relationships, but it neglects government and foreign trade impacts, limiting real-world applicability. The circular flow of income model expands this by incorporating government, financial markets, and foreign sectors, offering a comprehensive view of economic interactions and leakage injections, though its complexity can obscure simple cause-effect analysis. Both models serve as foundational tools in macroeconomics, with the two-sector model excelling in educational clarity and the circular flow model providing a more realistic representation of economic dynamics.

Real-World Applications

The two-sector model, encompassing households and firms, serves as a foundational framework for analyzing simplified economies, particularly in early economic education and basic policy simulations. In contrast, the circular flow of income extends this model by incorporating government and foreign sectors, making it more applicable for understanding real-world economic interactions, fiscal policies, and international trade dynamics. Economists and policymakers utilize the circular flow to assess the impact of taxation, government spending, and export-import activities on overall economic equilibrium and national income.

Conclusion and Key Insights

The Two-sector model simplifies economic interactions by focusing solely on household and business sectors, highlighting the core mechanics of production and consumption without government or foreign trade variables. In contrast, the Circular Flow of Income offers a more comprehensive framework by illustrating the continuous movement of money, goods, and services across multiple sectors, including government and international trade, providing a broader understanding of economic dynamics. Both models emphasize the importance of income generation and expenditure, but the circular flow model delivers deeper insights into economic equilibrium and policy implications.

Two-sector model Infographic

libterm.com

libterm.com