Mobile wallets offer a convenient and secure way to store payment information on your smartphone, enabling quick transactions without carrying cash or cards. These digital wallets use encryption and biometric authentication to protect your financial data from unauthorized access. Explore the full article to discover how mobile wallets can simplify your payments and enhance your purchasing experience.

Table of Comparison

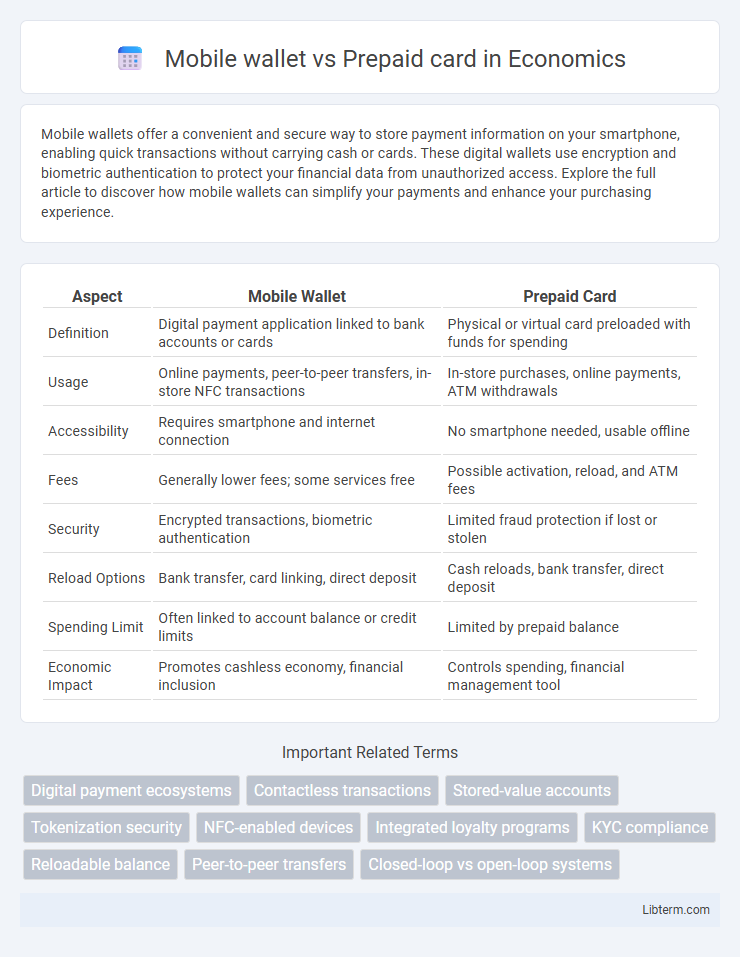

| Aspect | Mobile Wallet | Prepaid Card |

|---|---|---|

| Definition | Digital payment application linked to bank accounts or cards | Physical or virtual card preloaded with funds for spending |

| Usage | Online payments, peer-to-peer transfers, in-store NFC transactions | In-store purchases, online payments, ATM withdrawals |

| Accessibility | Requires smartphone and internet connection | No smartphone needed, usable offline |

| Fees | Generally lower fees; some services free | Possible activation, reload, and ATM fees |

| Security | Encrypted transactions, biometric authentication | Limited fraud protection if lost or stolen |

| Reload Options | Bank transfer, card linking, direct deposit | Cash reloads, bank transfer, direct deposit |

| Spending Limit | Often linked to account balance or credit limits | Limited by prepaid balance |

| Economic Impact | Promotes cashless economy, financial inclusion | Controls spending, financial management tool |

Introduction to Mobile Wallets and Prepaid Cards

Mobile wallets store digital versions of payment cards on smartphones, enabling fast and contactless transactions through NFC technology or QR codes. Prepaid cards are physical or virtual cards preloaded with funds, offering controlled spending without requiring a bank account. Both solutions enhance payment convenience but differ in accessibility, security features, and usage scenarios for consumers.

How Mobile Wallets Work

Mobile wallets store digital versions of credit, debit, or prepaid card information securely on smartphones or other devices using encryption and tokenization technology. Users can make contactless payments by tapping their device at NFC-enabled terminals or by scanning QR codes, enhancing convenience and speed. Mobile wallets often integrate with banking apps and loyalty programs, providing real-time transaction updates and additional security features such as biometric authentication.

How Prepaid Cards Function

Prepaid cards function by loading a specific amount of money onto the card, which users can then spend until the balance reaches zero, providing a controlled budgeting tool without requiring a bank account. Unlike mobile wallets that rely on digital payment platforms and internet access, prepaid cards operate through physical or virtual card networks like Visa or MasterCard, allowing transactions at most merchants and ATMs worldwide. This functionality offers convenience and security, as users are protected from overdraft fees and can avoid carrying cash while managing spending limits effectively.

Key Features Comparison

Mobile wallets offer seamless integration with smartphones, enabling contactless payments, real-time transaction tracking, and secure biometric authentication. Prepaid cards function as physical payment tools with fixed limits and can be used offline, providing controlled spending without the need for a bank account. Both options enhance financial flexibility, but mobile wallets prioritize convenience and digital security, while prepaid cards emphasize straightforward usage and budgeting control.

Security and Fraud Protection

Mobile wallets employ advanced encryption and biometric authentication, significantly enhancing security by minimizing unauthorized access, while prepaid cards rely on PIN protection and limited balance to reduce fraud exposure. Mobile wallets offer real-time transaction alerts and remote disabling features, enabling immediate response to suspicious activities, whereas prepaid cards typically lack such dynamic fraud detection capabilities. Both tools limit financial risk by capping spending, but mobile wallets integrate multi-layer security protocols that provide superior fraud protection compared to the static security measures of prepaid cards.

Accessibility and Convenience

Mobile wallets provide instant access through smartphones, enabling easy payments anytime and anywhere without carrying physical cards. Prepaid cards require physical possession but can be used widely wherever card payments are accepted, including ATMs for cash withdrawals. Mobile wallets often offer additional convenience features like contactless payments and transaction tracking, enhancing overall user accessibility.

Costs and Fees

Mobile wallets generally offer lower transaction fees compared to prepaid cards, making them a cost-effective choice for frequent digital payments. Prepaid cards often involve activation fees, monthly maintenance charges, and ATM withdrawal costs, increasing the overall expenses for users. Users seeking minimal costs should consider mobile wallets due to their reduced or zero fees for sending money, receiving payments, and making purchases.

International Usage Considerations

Mobile wallets offer seamless international usage by supporting multiple currencies and instant currency conversion, reducing foreign transaction fees and providing real-time exchange rates. Prepaid cards provide a secure alternative with fixed loaded amounts, often accepted globally but may incur higher fees for currency conversion and ATM withdrawals abroad. Choosing between the two depends on factors like ease of use, fee structures, and availability of local support in the destination country.

Pros and Cons of Each Option

Mobile wallets offer quick, contactless payments and enhanced security through encryption and biometric authentication, but rely on smartphone availability and battery life. Prepaid cards provide a widely accepted, tangible payment method with controlled spending limits, though they can incur fees and lack the convenience of instant mobile transactions. Choosing between mobile wallets and prepaid cards depends on preferences for ease of use, security features, and payment flexibility.

Choosing Between a Mobile Wallet and Prepaid Card

Choosing between a mobile wallet and a prepaid card depends on convenience, security, and usage preferences. Mobile wallets, such as Apple Pay and Google Pay, offer seamless digital payments with instant transactions and enhanced encryption, while prepaid cards provide wider acceptance at merchants that may not support mobile payments and offer easier budgeting control without linking to bank accounts. Evaluating your spending habits, preferred payment environments, and security features will help determine whether a mobile wallet or prepaid card aligns better with your financial needs.

Mobile wallet Infographic

libterm.com

libterm.com