Double-entry bookkeeping records each financial transaction in two accounts, ensuring that debits equal credits to maintain balanced books. This method provides a clear, accurate view of your organization's financial health, facilitating error detection and financial analysis. Explore the rest of the article to understand how double-entry bookkeeping can improve your accounting accuracy.

Table of Comparison

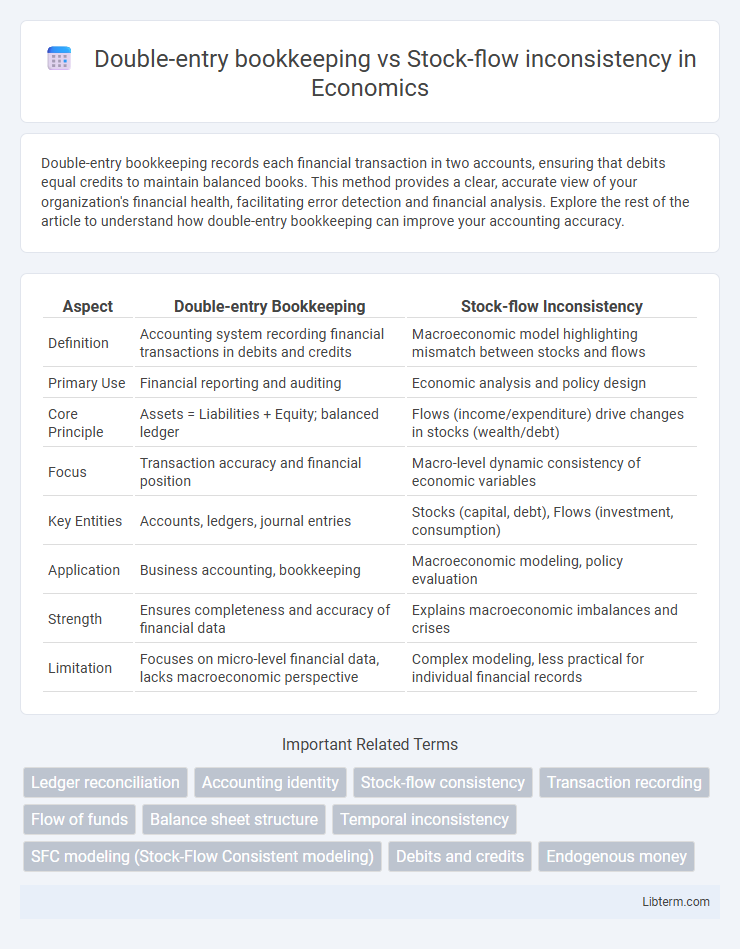

| Aspect | Double-entry Bookkeeping | Stock-flow Inconsistency |

|---|---|---|

| Definition | Accounting system recording financial transactions in debits and credits | Macroeconomic model highlighting mismatch between stocks and flows |

| Primary Use | Financial reporting and auditing | Economic analysis and policy design |

| Core Principle | Assets = Liabilities + Equity; balanced ledger | Flows (income/expenditure) drive changes in stocks (wealth/debt) |

| Focus | Transaction accuracy and financial position | Macro-level dynamic consistency of economic variables |

| Key Entities | Accounts, ledgers, journal entries | Stocks (capital, debt), Flows (investment, consumption) |

| Application | Business accounting, bookkeeping | Macroeconomic modeling, policy evaluation |

| Strength | Ensures completeness and accuracy of financial data | Explains macroeconomic imbalances and crises |

| Limitation | Focuses on micro-level financial data, lacks macroeconomic perspective | Complex modeling, less practical for individual financial records |

Introduction to Double-Entry Bookkeeping

Double-entry bookkeeping records every financial transaction as equal debits and credits, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced. This systematic approach provides accurate financial statements and helps detect errors or fraudulent activities. Unlike stock-flow inconsistency issues in economic models, double-entry bookkeeping maintains internal consistency within organizational accounts.

Understanding Stock-Flow Inconsistency

Stock-flow inconsistency occurs when changes in stocks, such as capital or inventory levels, are not properly matched by corresponding flows, leading to inaccuracies in financial and economic analysis. Unlike double-entry bookkeeping, which ensures that every transaction is recorded in two accounts to maintain balance, stock-flow inconsistency highlights the dynamic mismatch between stock variables and flow variables over time. Understanding this inconsistency is crucial for accurate macroeconomic modeling and for policymakers aiming to maintain economic stability.

Historical Background of Both Concepts

Double-entry bookkeeping originated in 15th-century Italy, pioneered by Luca Pacioli, establishing a systematic method for recording financial transactions by balancing debits and credits. Stock-flow inconsistency emerged in the 20th century within macroeconomic theory, highlighting discrepancies between accumulated stocks and corresponding flows that challenge traditional economic models. While double-entry bookkeeping stabilizes financial recording through historical accounting practices, stock-flow inconsistency addresses dynamic economic imbalances in modern financial systems.

Core Principles of Double-Entry Bookkeeping

Double-entry bookkeeping relies on the core principle that every financial transaction affects at least two accounts, ensuring that total debits always equal total credits, thereby maintaining the accounting equation: Assets = Liabilities + Equity. This system enhances accuracy by systematically recording dual aspects of transactions, enabling clear financial statements and balanced ledgers. In contrast, stock-flow inconsistency arises when changes in stock variables (e.g., assets, liabilities) are not properly aligned with corresponding flow variables (e.g., income, expenses), a problem inherently mitigated by the rigorous entry and balancing rules of double-entry bookkeeping.

Foundations of Stock-Flow Consistency and Inconsistency

Double-entry bookkeeping ensures that every financial transaction is recorded with equal debits and credits, maintaining internal accounting consistency and accurate balance sheets. Stock-flow consistency extends this principle to macroeconomic modeling, requiring that all stocks (assets, liabilities) and flows (transactions, income, expenditures) in an economy are matched to prevent discrepancies in financial accounts. Foundations of stock-flow inconsistency arise when flows do not properly update stocks or when unrecorded transactions create imbalances, leading to errors that can distort economic analysis and forecasting.

Comparative Analysis: Accounting Methods

Double-entry bookkeeping ensures balanced financial records by recording each transaction as both a debit and credit, promoting accuracy in asset and liability tracking. In contrast, stock-flow inconsistency highlights mismatches between recorded stock levels and their corresponding flow transactions, often revealing measurement errors or timing discrepancies in accounting data. Comparing these methods underscores double-entry bookkeeping's structured precision against stock-flow inconsistency's diagnostic role in identifying accounting anomalies and improving data coherence.

Implications for Financial Transparency

Double-entry bookkeeping ensures accurate financial records by systematically recording each transaction as both a debit and a credit, which enhances financial transparency through balanced accounts. In contrast, stock-flow inconsistency exposes discrepancies between assets, liabilities, and flows over time, undermining the reliability of financial statements. Addressing stock-flow inconsistencies within double-entry systems is crucial to improve the integrity and clarity of economic data for stakeholders.

Impact on Economic Modeling and Forecasting

Double-entry bookkeeping ensures that every financial transaction is recorded twice, maintaining balance between assets and liabilities, which enhances accuracy in economic data reporting. Stock-flow inconsistency arises when the stock variables (such as wealth or capital) do not align with the flows (such as income or expenditures), leading to discrepancies in model calibration. Addressing stock-flow inconsistency in economic modeling improves forecasting reliability by providing a coherent integration of financial stocks with flow data, enabling better policy analysis and economic predictions.

Common Pitfalls and Misconceptions

Double-entry bookkeeping ensures every financial transaction is recorded twice, maintaining balanced accounts and preventing errors, yet common pitfalls include misclassifying entries and failing to reconcile ledgers properly. Stock-flow inconsistency arises when changes in stock variables are not accurately matched with flows, often leading to misleading economic analyses and flawed financial forecasts. Misconceptions include confusing accrual accounting adjustments with stock-flow synchronization and overlooking the dynamic interaction between balance sheets and income statements.

Moving Towards Integrated Accounting Approaches

Double-entry bookkeeping provides a standardized method for recording financial transactions, ensuring accuracy and balance in accounting records. In contrast, stock-flow inconsistency highlights discrepancies between measured stocks and recorded flows, often revealing gaps in traditional accounting systems. Moving towards integrated accounting approaches combines the rigor of double-entry bookkeeping with comprehensive stock-flow analysis, enhancing financial transparency and economic modeling accuracy.

Double-entry bookkeeping Infographic

libterm.com

libterm.com