An implicit budget constraint reflects the hidden limitations on your spending based on non-monetary factors such as time, resources, or opportunity costs, rather than explicit monetary values. Understanding this concept helps optimize decision-making by revealing how intangible restrictions impact your consumption choices. Explore the rest of the article to uncover how implicit budget constraints influence your financial and personal planning.

Table of Comparison

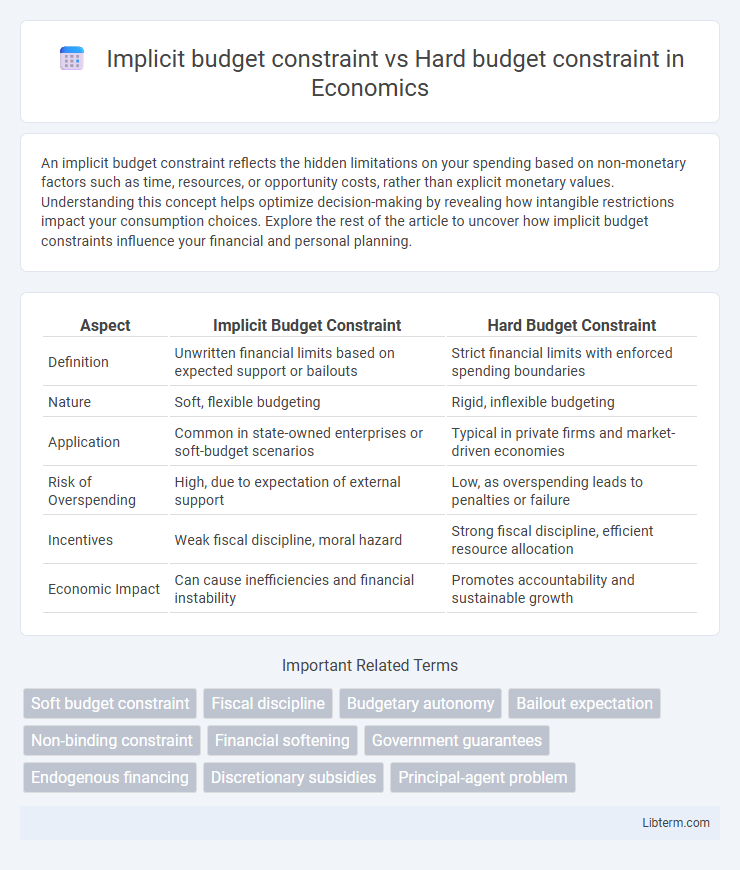

| Aspect | Implicit Budget Constraint | Hard Budget Constraint |

|---|---|---|

| Definition | Unwritten financial limits based on expected support or bailouts | Strict financial limits with enforced spending boundaries |

| Nature | Soft, flexible budgeting | Rigid, inflexible budgeting |

| Application | Common in state-owned enterprises or soft-budget scenarios | Typical in private firms and market-driven economies |

| Risk of Overspending | High, due to expectation of external support | Low, as overspending leads to penalties or failure |

| Incentives | Weak fiscal discipline, moral hazard | Strong fiscal discipline, efficient resource allocation |

| Economic Impact | Can cause inefficiencies and financial instability | Promotes accountability and sustainable growth |

Introduction to Budget Constraints

Implicit budget constraints reflect unspoken or estimated financial limits often influenced by social norms or future expectations, shaping consumer behavior without explicit accounting. Hard budget constraints involve strict, legally binding limits on spending, commonly seen in organizational or governmental financial planning where overspending is not permissible. Understanding these distinctions is crucial for accurately modeling economic decisions and predicting fiscal discipline in various economic agents.

Defining Implicit Budget Constraint

Implicit budget constraint refers to the non-explicit, often informal financial limits that govern an entity's spending based on expected future resources or soft borrowing arrangements, unlike hard budget constraints which strictly enforce spending limits through formal rules or direct funding caps. It reflects the anticipated ability to finance deficits through adjustments, external support, or revenue increases, allowing flexibility in economic behavior. Understanding implicit budget constraints is crucial in analyzing fiscal policies where actual borrowing limits are not legally binding but influence decision-making and resource allocation.

Understanding Hard Budget Constraint

A hard budget constraint strictly limits organizational or governmental spending to available financial resources, preventing deficit financing and ensuring fiscal discipline. In contrast, an implicit budget constraint allows for overspending with the expectation of future bailouts or financial support, often leading to inefficient resource allocation. Understanding a hard budget constraint highlights the importance of adherence to spending limits to maintain economic stability and avoid chronic debt accumulation.

Key Differences between Implicit and Hard Budget Constraints

Implicit budget constraints operate through unspoken expectations or informal limits, often relying on future financial support or flexibility, whereas hard budget constraints enforce strict, non-negotiable limits on spending and resource allocation. Implicit constraints allow entities to overspend temporarily, anticipating external bailouts or adjustments, while hard constraints mandate strict adherence to predefined budgets with direct consequences for overspending. The key difference lies in flexibility and enforcement, with hard budget constraints imposing rigid fiscal discipline, and implicit constraints allowing adaptability based on trust or future funding.

Economic Implications of Implicit Constraints

Implicit budget constraints shape economic behavior by creating informal limits based on expected support or future adjustments, influencing investment and consumption decisions without legal enforcement. These constraints often lead to inefficient resource allocation as agents rely on anticipated bailouts or subsidies, reducing incentives for fiscal discipline and risk management. The economic implications include increased moral hazard, distorted market signals, and potential fiscal instability, as governments or firms might intervene to prevent budget breaches despite explicit constraints.

Policy Impact of Hard Budget Constraints

Hard budget constraints enforce strict limits on public or corporate spending, preventing entities from incurring deficits and compelling efficient resource allocation. This policy impact promotes fiscal discipline, discourages excessive borrowing, and enhances accountability in government or organizational budgets. Unlike implicit budget constraints, hard budget constraints reduce moral hazard by making financial consequences unavoidable.

Real-world Examples of Budget Constraints

Implicit budget constraints often appear in family households where spending decisions are guided by informal agreements rather than strict limits, allowing some flexibility in resource allocation. Hard budget constraints are common in corporate finance, where companies must adhere strictly to predetermined financial limits set by lenders or internal policies to avoid insolvency. In government budgets, hard constraints manifest through legally mandated spending caps, whereas implicit constraints arise from political negotiations and shifting priorities impacting resource distribution.

Effects on Organizational Behavior

Implicit budget constraints influence organizational behavior by encouraging managers to operate with an expectation of future budget adjustments, which often leads to strategic resource allocation and a focus on long-term outcomes. Hard budget constraints impose strict financial limits, driving organizations to prioritize efficiency, reduce waste, and enhance accountability in spending decisions. The presence of an implicit budget constraint typically results in more flexible decision-making, whereas a hard budget constraint fosters rigorous control and short-term financial discipline.

Challenges in Enforcing Budget Constraints

Enforcing implicit budget constraints poses significant challenges due to their reliance on informal agreements and reputational factors, leading to difficulties in monitoring and ensuring compliance. Hard budget constraints, characterized by strict legal and financial limits, face enforcement issues stemming from institutional weaknesses and potential political interference that undermine fiscal discipline. Both types of constraints require robust oversight mechanisms and transparent accountability frameworks to effectively prevent budget overruns and financial mismanagement.

Conclusion: Choosing the Right Budget Constraint Approach

Implicit budget constraints offer flexibility by allowing adjustments based on evolving financial conditions, promoting adaptability in resource allocation. Hard budget constraints enforce strict spending limits, ensuring discipline and preventing overspending but potentially reducing operational agility. Selecting the appropriate budget constraint depends on organizational goals, financial stability, and the need for either control or flexibility in managing expenditures.

Implicit budget constraint Infographic

libterm.com

libterm.com