The spot rate represents the current exchange rate at which a currency can be bought or sold for immediate delivery. It fluctuates based on market demand, geopolitical events, and economic indicators, impacting international trade and investments. Explore the rest of the article to understand how the spot rate affects your financial decisions.

Table of Comparison

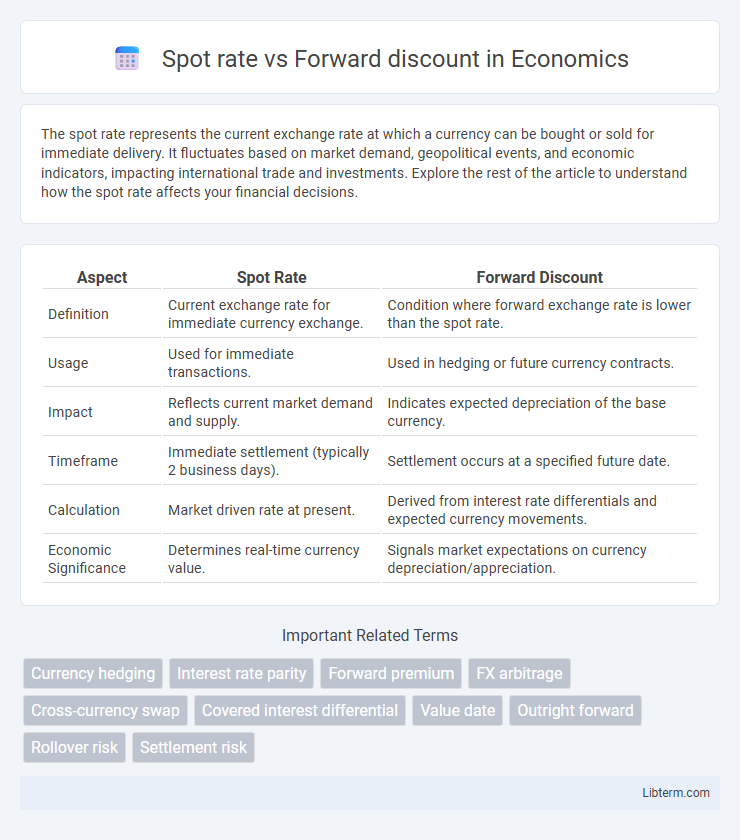

| Aspect | Spot Rate | Forward Discount |

|---|---|---|

| Definition | Current exchange rate for immediate currency exchange. | Condition where forward exchange rate is lower than the spot rate. |

| Usage | Used for immediate transactions. | Used in hedging or future currency contracts. |

| Impact | Reflects current market demand and supply. | Indicates expected depreciation of the base currency. |

| Timeframe | Immediate settlement (typically 2 business days). | Settlement occurs at a specified future date. |

| Calculation | Market driven rate at present. | Derived from interest rate differentials and expected currency movements. |

| Economic Significance | Determines real-time currency value. | Signals market expectations on currency depreciation/appreciation. |

Introduction to Spot Rate and Forward Discount

Spot rate represents the current exchange rate at which a currency can be bought or sold for immediate delivery, reflecting real-time market conditions. Forward discount occurs when the forward exchange rate is lower than the spot rate, indicating the currency is expected to depreciate relative to another currency over the forward contract period. Understanding the spot rate and forward discount is essential for managing foreign exchange risk and making informed currency trading decisions.

Definitions: Spot Rate vs Forward Rate

The spot rate refers to the current exchange rate at which a currency can be bought or sold for immediate delivery, reflecting real-time market conditions. The forward rate is the agreed-upon exchange rate for a currency transaction that will occur at a specified future date, often used to hedge against currency risk. Forward discount occurs when the forward rate is lower than the spot rate, indicating the currency is expected to depreciate relative to the other currency over the contract period.

How Spot Rates are Determined

Spot rates are determined by the current supply and demand for a currency in the foreign exchange market, influenced by factors such as interest rates, economic indicators, geopolitical events, and market sentiment. Central banks, traders, and financial institutions continuously adjust spot rates through active trading, reflecting real-time currency values. These rates serve as the foundation for calculating forward discounts or premiums, which represent the difference between forward rates and spot rates based on interest rate differentials between two currencies.

Understanding Forward Discounts and Premiums

Forward discounts and premiums reflect the difference between the spot exchange rate and the forward exchange rate for a currency pair. A forward discount occurs when the forward rate is lower than the spot rate, indicating the base currency is expected to depreciate relative to the quote currency. Understanding forward discounts and premiums helps investors hedge currency risk and anticipate market expectations of currency movements.

Factors Influencing Spot and Forward Rates

Interest rate differentials between two countries significantly influence spot rates and forward discounts, as higher domestic interest rates relative to foreign rates often lead to a forward discount on the domestic currency. Expectations of future inflation and economic stability affect currency demand, impacting spot rates, while political risk and market sentiment can cause fluctuations in forward rates by altering investor confidence. Central bank interventions and monetary policy decisions also play a crucial role by adjusting liquidity and influencing interest rate expectations, thereby affecting both spot exchange rates and forward discount levels.

Calculating Forward Discounts

Calculating forward discounts involves determining the percentage difference between the forward exchange rate and the spot exchange rate, typically expressed on an annualized basis. The formula used is ((Spot Rate - Forward Rate) / Spot Rate) x (360 / Number of days in the forward contract) x 100%, which quantifies the cost or benefit of entering a forward contract. Accurate calculation of forward discounts is essential for investors and businesses to hedge currency risk and forecast financial outcomes in foreign exchange markets.

Implications for Currency Traders

Spot rate fluctuations directly impact immediate currency exchange transactions, while forward discounts indicate a currency is expected to depreciate relative to another in the future. Currency traders use forward discounts to hedge against unfavorable spot rate movements and to speculate on potential currency depreciation. Understanding the relationship between spot rates and forward discounts helps traders optimize risk management and forecast currency price trends effectively.

Spot Rate vs Forward Discount: Practical Examples

The spot rate represents the current exchange rate at which currencies can be exchanged immediately, while the forward discount occurs when the forward exchange rate is lower than the spot rate, indicating a currency is expected to depreciate. For example, if the USD/EUR spot rate is 1.20 and the 6-month forward rate is 1.18, the forward discount suggests the euro is expected to strengthen against the dollar. Traders and businesses use these rates to hedge currency risk or speculate on future currency movements in forex markets.

Risks and Opportunities in Forward Contracts

Spot rate fluctuations directly impact the value of forward contracts, creating risks such as potential losses if the market moves unfavorably beyond the agreed forward rate. Forward discount offers opportunities for hedging against expected depreciation of a currency, allowing businesses to lock in costs or revenues at predetermined rates. However, forward contracts carry counterparty risk and opportunity cost if the spot rate moves favorably beyond the locked forward price, limiting potential gains.

Conclusion: Choosing Between Spot and Forward Rates

Selecting between spot and forward rates depends on the specific risk tolerance and market outlook of the investor or business. Spot rates offer immediate exchange at current market prices, ideal for transactions needing instant settlement, while forward rates provide a locked-in exchange rate for future dates, mitigating exposure to currency fluctuations. Utilizing forward discounts can protect against anticipated currency depreciation, making forward contracts a strategic tool for managing forex risk in volatile markets.

Spot rate Infographic

libterm.com

libterm.com