The investment multiplier measures how initial investments lead to a greater overall increase in national income through successive rounds of spending. It highlights the powerful impact that your investment decisions can have on economic growth by amplifying the initial expenditure's effects. Explore the rest of the article to understand how the investment multiplier influences financial policies and personal investment strategies.

Table of Comparison

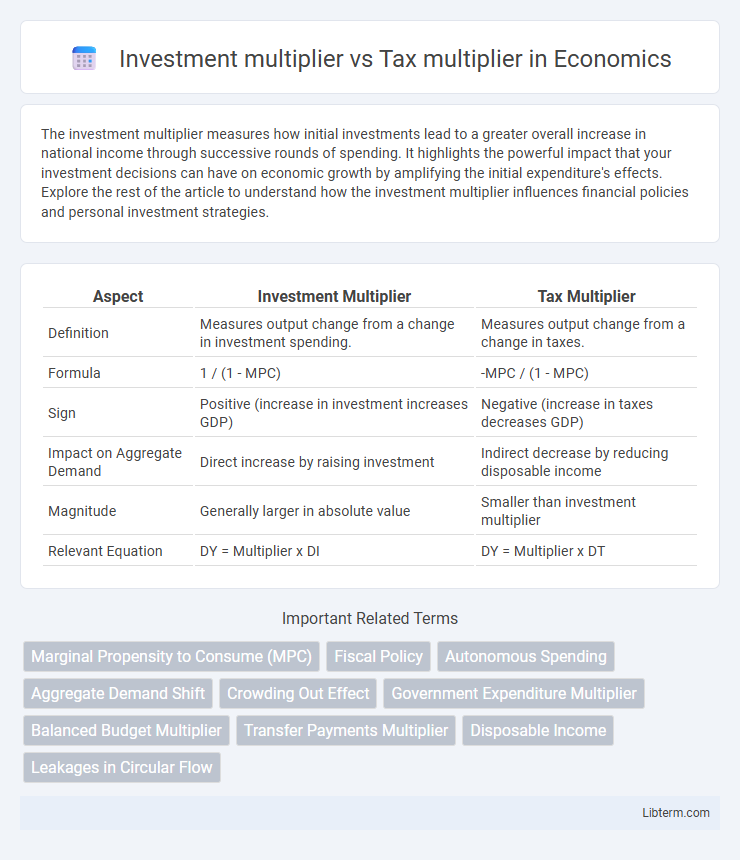

| Aspect | Investment Multiplier | Tax Multiplier |

|---|---|---|

| Definition | Measures output change from a change in investment spending. | Measures output change from a change in taxes. |

| Formula | 1 / (1 - MPC) | -MPC / (1 - MPC) |

| Sign | Positive (increase in investment increases GDP) | Negative (increase in taxes decreases GDP) |

| Impact on Aggregate Demand | Direct increase by raising investment | Indirect decrease by reducing disposable income |

| Magnitude | Generally larger in absolute value | Smaller than investment multiplier |

| Relevant Equation | DY = Multiplier x DI | DY = Multiplier x DT |

Introduction to Multipliers in Economics

The investment multiplier measures the change in aggregate income resulting from an initial change in investment, reflecting how increased spending stimulates economic growth. The tax multiplier quantifies the impact of a change in taxes on overall economic output, typically showing a smaller effect compared to the investment multiplier because tax changes influence disposable income and consumption indirectly. Both multipliers are crucial in Keynesian economics for understanding fiscal policy's role in stabilizing and stimulating the economy.

Defining the Investment Multiplier

The Investment Multiplier quantifies how initial increases in investment spending lead to a more than proportional rise in aggregate income, based on the marginal propensity to consume (MPC). This multiplier effect occurs because new investment generates income, which in turn fuels further consumption and economic activity. In contrast, the Tax Multiplier measures the impact of changes in taxation on aggregate demand, typically producing a smaller change in income than the Investment Multiplier due to direct reductions in disposable income.

Understanding the Tax Multiplier

The tax multiplier measures the change in aggregate output resulting from a change in taxes, typically producing a smaller impact than the investment multiplier because it influences disposable income rather than direct spending. A tax increase reduces consumer spending by lowering disposable income, leading to a multiplied decrease in aggregate demand but less pronounced than the investment multiplier effect. Understanding the tax multiplier is crucial for fiscal policy as it highlights how tax changes indirectly affect economic activity and aggregate demand through consumption adjustments.

Mathematical Formulas and Calculation Methods

The investment multiplier is calculated using the formula \( k = \frac{1}{1 - MPC} \), where MPC represents the marginal propensity to consume, indicating how initial investment changes total income. In contrast, the tax multiplier is given by \( k_t = \frac{-MPC}{1 - MPC} \), reflecting the impact of tax changes on aggregate demand and total output. Both multipliers are derived from the Keynesian consumption function and measure the sensitivity of national income to fiscal policy adjustments.

Key Differences Between Investment and Tax Multipliers

The investment multiplier measures the change in aggregate output resulting from a change in investment spending, typically greater than one, indicating a more pronounced effect on GDP due to induced consumption. In contrast, the tax multiplier represents the impact of a change in taxes on aggregate demand, usually negative and smaller in magnitude since tax changes indirectly influence consumption by altering disposable income. Key differences include the direction of impact--investment increases aggregate demand directly, while taxes reduce disposable income--and the relative size, with the investment multiplier generally larger because investment directly stimulates production, whereas tax changes have a more muted effect through consumer behavior.

Factors Influencing Multiplier Magnitude

The investment multiplier magnitude depends on the marginal propensity to consume (MPC), with higher MPC values leading to a larger multiplier effect due to increased consumer spending from initial investments. The tax multiplier is influenced by the net effect of tax changes on disposable income, where a higher MPC also amplifies the tax multiplier but typically results in a smaller absolute value compared to the investment multiplier because not all taxed income is withdrawn from the economy. Both multipliers are affected by factors such as the state of the economy, openness to trade, and the presence of automatic stabilizers that can dampen or enhance their overall impact on aggregate demand.

Real-World Applications and Examples

The investment multiplier amplifies the initial change in investment spending through increased aggregate demand, exemplified by government infrastructure projects that stimulate economic growth and job creation. In contrast, the tax multiplier measures the impact of changes in taxation on disposable income and consumption, as seen when tax cuts boost household spending and drive demand in consumer-driven economies. Real-world applications demonstrate that investment multipliers tend to be larger than tax multipliers in economies with unused capacity, where direct spending injections have more substantial effects on GDP than changes in taxation.

Policy Implications: Fiscal Stimulus vs Tax Cuts

The investment multiplier typically exceeds the tax multiplier, indicating that direct government spending on infrastructure or projects generates a larger increase in aggregate demand compared to equivalent tax cuts. Fiscal stimulus through increased investment directly raises employment and production, creating a cascading effect on income and consumption. Tax cuts, while boosting disposable income, may result in higher savings, making their impact on economic output less immediate and potent in comparison to targeted investment policies.

Limitations and Assumptions of Multiplier Effects

The investment multiplier assumes constant marginal propensity to consume and neglects factors like inflation and capacity constraints that limit its real-world applicability. The tax multiplier presupposes a uniform response in consumption following tax changes, disregarding variations in income distribution and tax avoidance behaviors. Both multipliers also rely on closed-economy models, ignoring external influences such as trade balance and capital flows that impact fiscal policy effectiveness.

Conclusion: Choosing the Right Multiplier for Economic Growth

The investment multiplier typically generates a stronger impact on economic growth due to its direct stimulation of aggregate demand and capital formation, resulting in sustained increases in output and employment. In contrast, the tax multiplier tends to have a smaller, often negative effect since tax changes influence disposable income and consumption less predictably. Policymakers should prioritize leveraging the investment multiplier to achieve more robust, long-term economic expansion.

Investment multiplier Infographic

libterm.com

libterm.com