General equilibrium describes a state in economics where supply and demand balance across multiple markets simultaneously, leading to an efficient allocation of resources. This concept helps explain how various individual decisions interact to determine prices and quantities in an entire economy. Explore the rest of the article to understand how general equilibrium theory impacts your economic perspectives and decision-making.

Table of Comparison

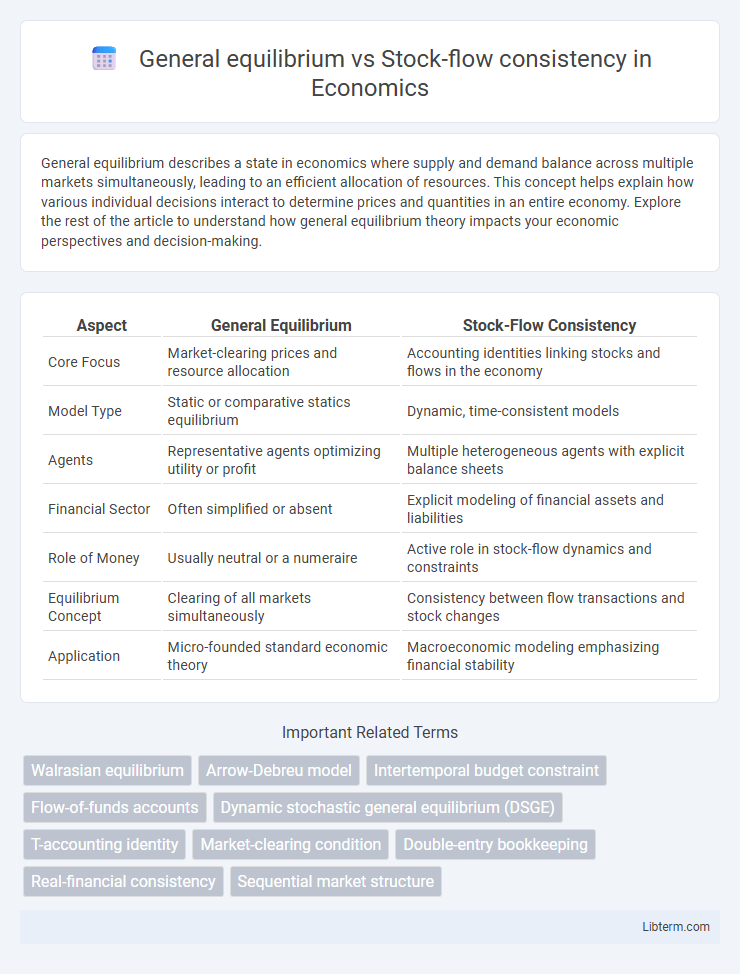

| Aspect | General Equilibrium | Stock-Flow Consistency |

|---|---|---|

| Core Focus | Market-clearing prices and resource allocation | Accounting identities linking stocks and flows in the economy |

| Model Type | Static or comparative statics equilibrium | Dynamic, time-consistent models |

| Agents | Representative agents optimizing utility or profit | Multiple heterogeneous agents with explicit balance sheets |

| Financial Sector | Often simplified or absent | Explicit modeling of financial assets and liabilities |

| Role of Money | Usually neutral or a numeraire | Active role in stock-flow dynamics and constraints |

| Equilibrium Concept | Clearing of all markets simultaneously | Consistency between flow transactions and stock changes |

| Application | Micro-founded standard economic theory | Macroeconomic modeling emphasizing financial stability |

Introduction to General Equilibrium and Stock-Flow Consistency

General Equilibrium theory models the simultaneous determination of prices and quantities across multiple markets to achieve a state where supply equals demand under perfect competition. Stock-Flow Consistency (SFC) emphasizes the accounting framework ensuring that all stocks and flows in an economic system are consistently integrated, highlighting the dynamic interactions between real and financial sectors over time. Combining General Equilibrium with SFC enhances the understanding of macroeconomic stability by linking market-clearing conditions with rigorous financial balance constraints.

Core Concepts: Understanding General Equilibrium

General equilibrium analyzes how supply and demand simultaneously determine prices and quantities across multiple interconnected markets, ensuring that all markets clear without excess supply or demand. Stock-flow consistency emphasizes the accounting identities linking stocks (wealth, debt) and flows (income, expenditure) over time to maintain macroeconomic balance. Understanding general equilibrium requires grasping how agent optimization and market clearing conditions interact to produce an overall stable economic system.

Fundamentals of Stock-Flow Consistency

Stock-flow consistency (SFC) ensures that all economic stocks and flows are accounted for across sectors, maintaining accounting identities and balance sheet coherence. Unlike general equilibrium models, which assume instantaneous market clearing and representative agents, SFC models emphasize the dynamic interplay between stock accumulation and flow variables over time. Fundamental to SFC is the integration of sectoral balance sheets with transaction flows, enabling realistic simulations of macroeconomic processes and financial stability.

Key Assumptions in General Equilibrium Models

General equilibrium models assume agents have perfect information, rational expectations, and markets clear continuously, leading to equilibrium where supply equals demand across all markets. These models typically rely on representative agents and abstract from financial stocks, focusing instead on flows and prices to ensure consistency in allocation. The key assumption of market clearing excludes the possibility of persistent disequilibria or stock imbalances, differentiating it fundamentally from stock-flow consistent frameworks.

Structural Foundations of Stock-Flow Consistent Models

Stock-flow consistent (SFC) models emphasize the comprehensive accounting of all stocks and flows within the economy, ensuring that every financial asset corresponds to a liability, which provides a solid structural foundation absent in traditional general equilibrium frameworks. Unlike general equilibrium models that assume instantaneous market clearing and representative agents, SFC models incorporate detailed sectoral balance sheets and transaction flows, allowing for a dynamic, endogenous evolution of economic variables. This structural emphasis enhances the realism and robustness of SFC models in capturing macroeconomic dynamics, financial constraints, and the interplay between real and financial sectors.

Comparative Analysis: Equilibrium vs. Consistency Approaches

General equilibrium models emphasize market-clearing conditions and price adjustments to achieve economic balance, relying on assumptions of rational agents and perfect information. Stock-flow consistent (SFC) models integrate financial stocks and flows over time, ensuring accounting identities and behavioral consistency, which capture dynamic interactions often absent in equilibrium frameworks. Comparative analysis reveals that while equilibrium models offer analytical simplicity, SFC approaches provide richer insights into macroeconomic dynamics by explicitly modeling monetary and financial constraints.

Strengths and Limitations of General Equilibrium Models

General equilibrium models excel in capturing the interdependencies between multiple markets and agents, providing comprehensive insights into how shocks propagate through an economy. Their mathematical tractability allows for precise predictions and policy simulations under assumptions of market clearing and rational expectations. However, these models often face limitations due to unrealistic assumptions like perfect information, neglect of financial stock-flow dynamics, and difficulty in incorporating out-of-equilibrium processes, which can reduce their applicability to real-world economic fluctuations and crises.

Advantages and Challenges of Stock-Flow Consistency

Stock-flow consistency models excel in capturing the dynamic interactions between stocks and flows in an economy, ensuring accounting identities are maintained, which enhances macroeconomic realism and prevents inconsistencies in financial and real variables. Their advantages include the ability to model financial instability and sectoral balances with precision, offering insights into debt accumulation and economic cycles absent in traditional general equilibrium frameworks. Challenges stem from increased complexity, computational intensity, and the need for detailed data, which can hinder model calibration and limit widespread adoption compared to the more abstract and equilibrium-focused general equilibrium models.

Applications in Macroeconomic Theory and Policy

General equilibrium models emphasize the simultaneous determination of prices and quantities in multiple markets, enabling analysis of optimal allocation of resources under perfect competition and equilibrium conditions. Stock-flow consistent models integrate real and financial sectors by ensuring all stocks and flows are accounted for, providing insights into macroeconomic dynamics such as wealth accumulation, financial instability, and policy impacts. Applications in macroeconomic theory and policy highlight general equilibrium's role in long-term growth and welfare analysis, while stock-flow consistency is crucial for understanding monetary policy effects, debt sustainability, and systemic risk in economic systems.

Conclusion: Bridging General Equilibrium and Stock-Flow Consistency

Bridging General Equilibrium (GE) and Stock-Flow Consistency (SFC) frameworks enhances macroeconomic modeling by integrating equilibrium conditions with accounting identities, ensuring both market clearing and financial balance. Merging GE's focus on optimizing agents' behavior with SFC's rigorous tracking of stocks and flows captures dynamic economic interactions more realistically. This synthesis promotes robust policy analysis by reflecting monetary, real, and financial sectors cohesively within a unified theoretical structure.

General equilibrium Infographic

libterm.com

libterm.com