Quantity adjustment is essential in inventory management to align stock levels with fluctuating demand and avoid overstocking or shortages. Implementing effective quantity adjustments can reduce carrying costs and improve cash flow management. Discover how optimizing this process can enhance Your business operations by reading the full article.

Table of Comparison

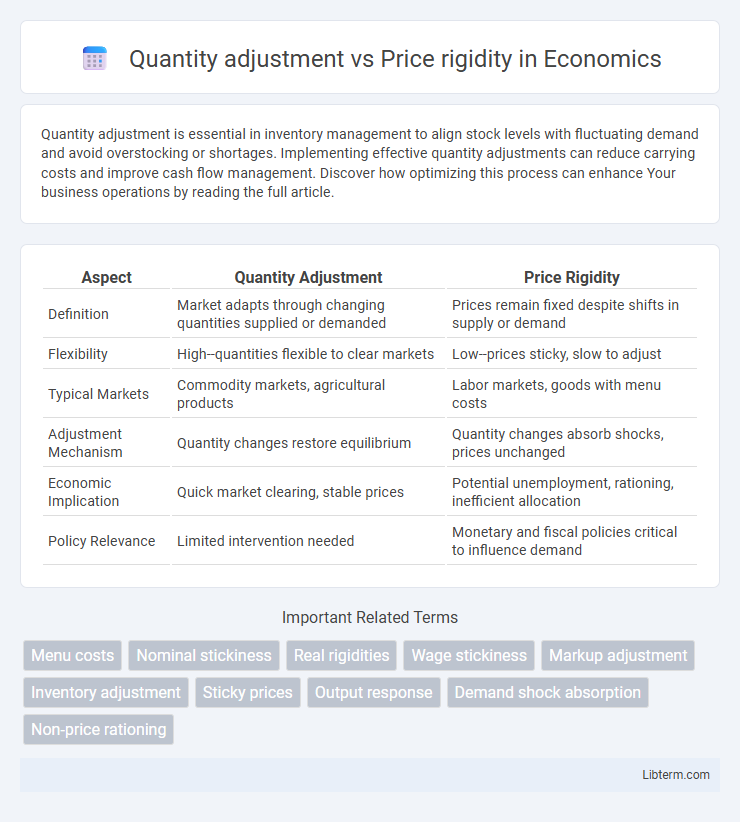

| Aspect | Quantity Adjustment | Price Rigidity |

|---|---|---|

| Definition | Market adapts through changing quantities supplied or demanded | Prices remain fixed despite shifts in supply or demand |

| Flexibility | High--quantities flexible to clear markets | Low--prices sticky, slow to adjust |

| Typical Markets | Commodity markets, agricultural products | Labor markets, goods with menu costs |

| Adjustment Mechanism | Quantity changes restore equilibrium | Quantity changes absorb shocks, prices unchanged |

| Economic Implication | Quick market clearing, stable prices | Potential unemployment, rationing, inefficient allocation |

| Policy Relevance | Limited intervention needed | Monetary and fiscal policies critical to influence demand |

Understanding Quantity Adjustment and Price Rigidity

Quantity adjustment refers to changes in the amount of goods or services produced or sold in response to market conditions, enabling firms to align supply with fluctuating demand. Price rigidity occurs when prices remain fixed despite changes in demand or supply, often due to menu costs, contract stipulations, or market power, limiting the immediate adjustment of prices. Understanding the interplay between quantity adjustment and price rigidity is crucial for analyzing how markets achieve equilibrium and respond to economic shocks.

Economic Theories Underpinning Price Rigidity

Economic theories underpinning price rigidity emphasize factors such as menu costs, which are the expenses businesses incur when changing prices, leading to infrequent price adjustments despite shifts in demand or supply. Additionally, the Taylor model highlights firms' reluctance to alter prices due to uncertainty about market conditions, resulting in quantity adjustments to restore equilibrium rather than price changes. Furthermore, the presence of implicit contracts between firms and customers fosters price stability by encouraging adjustments in output quantities rather than deviations in agreed-upon prices.

Mechanisms of Quantity Adjustment in Markets

Quantity adjustment in markets operates through mechanisms such as inventory changes, flexible labor allocation, and variable production schedules, allowing firms to respond to demand fluctuations without altering prices. Firms often adjust output levels to optimize capacity utilization and manage supply-demand imbalances, maintaining price stability. This process contrasts with price rigidity, where prices remain fixed due to menu costs, contractual constraints, or strategic considerations, necessitating quantity adjustments to restore market equilibrium.

Causes of Price Stickiness in Various Industries

Price rigidity in various industries often results from menu costs, contractual obligations, and customer relationship concerns that make frequent price changes costly or undesirable. Quantity adjustment serves as a flexible response, allowing firms to manage supply without altering prices, common in sectors like manufacturing and retail where long-term price stability is crucial. Behavioral factors such as fair pricing perceptions and coordination failures between suppliers and buyers further contribute to price stickiness across markets.

Historical Perspectives: Quantity vs. Price Responses

Historical perspectives reveal that quantity adjustment often dominated market responses during early economic shifts, as producers altered output levels to match demand fluctuations. Price rigidity, characterized by sticky or inflexible prices, emerged notably during periods of wage contracts and menu costs, limiting market price adjustments. Empirical studies from the mid-20th century emphasize that quantity responses facilitated supply-demand equilibrium in contrast to the observed prevalence of price stickiness in imperfectly competitive markets.

Impact on Supply and Demand Equilibrium

Quantity adjustment affects supply and demand equilibrium by allowing firms to respond flexibly to changes in market conditions, stabilizing output and prices over time. Price rigidity, often caused by menu costs or contractual obligations, limits price changes and can lead to persistent disequilibria, causing either excess supply or unmet demand. Markets with flexible quantity adjustments typically achieve faster equilibrium restoration compared to those constrained by price stickiness.

Role of Government Policies in Adjusting Quantities and Prices

Government policies play a critical role in addressing quantity adjustment and price rigidity by implementing regulatory measures such as quotas, subsidies, and price controls to stabilize markets. These interventions help correct market failures, manage supply and demand imbalances, and reduce the negative impacts of price stickiness on economic efficiency. Effective policy design ensures that quantity adjustments align with social welfare objectives while mitigating adverse effects on producers and consumers.

Business Strategies When Facing Price Rigidity

Businesses encountering price rigidity often pivot to quantity adjustment as a strategic response to maintain profitability and market share. By altering production levels, inventory, and sales volumes, firms can adapt to demand fluctuations without changing fixed prices. This approach minimizes customer resistance and competitive backlash while optimizing operational efficiency and revenue under constrained pricing conditions.

Case Studies: Real-World Examples of Quantity Adjustment

Quantity adjustment plays a crucial role in industries facing price rigidity, as companies often modify output levels to manage market demand without changing prices. Case studies from the airline industry show how carriers adjust seat availability to optimize revenue while maintaining fare stability. Similarly, manufacturing firms use inventory control and production scaling to respond to fluctuating demand, avoiding price cuts that can erode brand value and profit margins.

Implications for Inflation, Employment, and Economic Stability

Quantity adjustment allows firms to respond to demand fluctuations by changing output levels, helping stabilize employment but potentially causing supply-side inflationary pressures. Price rigidity, characterized by slow price changes, can dampen inflation volatility but may lead to prolonged unemployment during demand shocks due to inflexible wage and price structures. These dynamics influence overall economic stability as flexible quantity adjustments support quick market clearing, while price rigidity often results in allocative inefficiencies and cyclical unemployment.

Quantity adjustment Infographic

libterm.com

libterm.com