A Pigovian tax is designed to correct market inefficiencies by imposing a tax on activities that generate negative externalities, such as pollution. This economic tool encourages producers and consumers to reduce harmful behaviors by internalizing social costs, leading to more sustainable outcomes. Discover how implementing a Pigovian tax can impact your environment and economy by reading the full article.

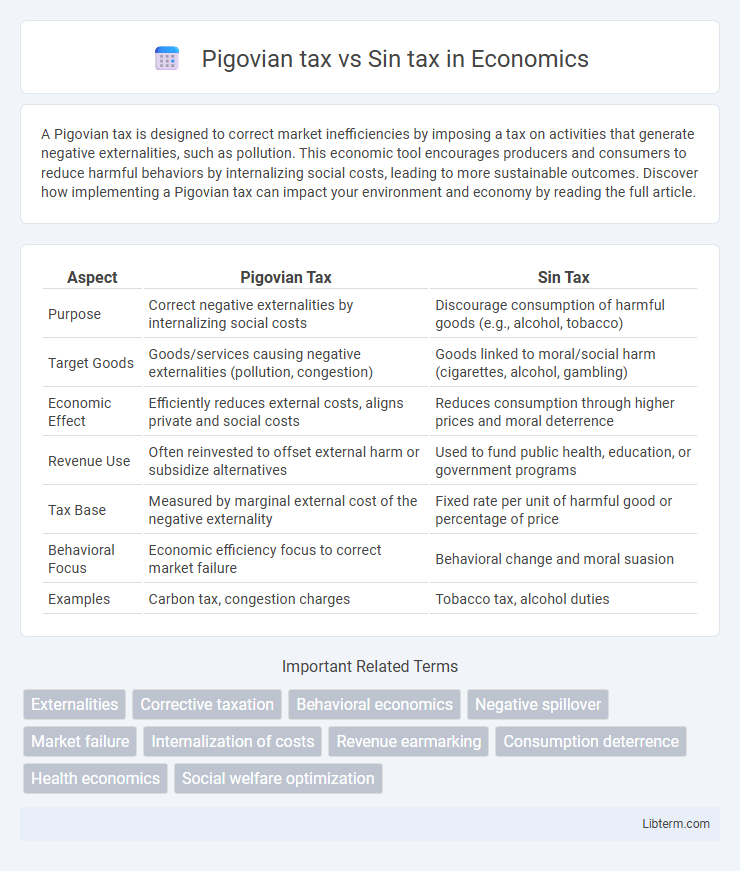

Table of Comparison

| Aspect | Pigovian Tax | Sin Tax |

|---|---|---|

| Purpose | Correct negative externalities by internalizing social costs | Discourage consumption of harmful goods (e.g., alcohol, tobacco) |

| Target Goods | Goods/services causing negative externalities (pollution, congestion) | Goods linked to moral/social harm (cigarettes, alcohol, gambling) |

| Economic Effect | Efficiently reduces external costs, aligns private and social costs | Reduces consumption through higher prices and moral deterrence |

| Revenue Use | Often reinvested to offset external harm or subsidize alternatives | Used to fund public health, education, or government programs |

| Tax Base | Measured by marginal external cost of the negative externality | Fixed rate per unit of harmful good or percentage of price |

| Behavioral Focus | Economic efficiency focus to correct market failure | Behavioral change and moral suasion |

| Examples | Carbon tax, congestion charges | Tobacco tax, alcohol duties |

Introduction to Pigovian Tax and Sin Tax

Pigovian tax targets negative externalities by imposing costs on activities that generate social harm, such as pollution, to correct market failures and improve social welfare. Sin tax specifically applies to goods and behaviors deemed harmful to health or morality, like tobacco, alcohol, and gambling, aiming to reduce consumption and raise government revenue. Both taxes internalize external costs but differ in scope and intent, with Pigovian tax broadly addressing externalities and sin tax focusing on public health and ethical concerns.

Defining Pigovian Taxes

Pigovian taxes are levies imposed on activities that generate negative externalities, aiming to correct market inefficiencies by internalizing social costs. These taxes are designed to reflect the true societal cost of goods or services, such as pollution or congestion, encouraging producers and consumers to reduce harmful behaviors. Unlike sin taxes that primarily target moral consumption choices like tobacco or alcohol, Pigovian taxes focus on economic externalities to achieve optimal resource allocation.

Understanding Sin Taxes

Sin taxes target products like tobacco, alcohol, and sugary drinks to reduce consumption and generate government revenue, addressing health and social costs. These taxes are often imposed at high rates to discourage harmful behaviors, contrasting with Pigovian taxes that precisely internalize externalities by equating tax to the social cost of a negative externality. Understanding sin taxes involves recognizing their dual role in public health policy and fiscal strategy, emphasizing behavioral change and cost recovery for societal harm.

Key Differences Between Pigovian and Sin Taxes

Pigovian taxes target negative externalities by imposing costs proportional to the social harm caused, encouraging producers and consumers to reduce harmful activities like pollution. Sin taxes specifically focus on discouraging consumption of socially undesirable goods such as tobacco, alcohol, or sugary drinks, often emphasizing health-related costs rather than broader externalities. The primary difference lies in Pigovian taxes' economic rationale based on external cost correction, whereas sin taxes are primarily designed for moral or public health objectives.

Economic Theories Behind Pigovian Taxes

Pigovian taxes stem from the economic theory addressing externalities, specifically designed to correct market inefficiencies by imposing a cost equivalent to the negative externality, such as pollution. These taxes incentivize producers and consumers to reduce harmful activities, aligning private costs with social costs and thus promoting allocative efficiency. In contrast, sin taxes primarily target goods like tobacco and alcohol for moral or health reasons, focusing less on correcting externalities and more on reducing consumption through higher prices.

Social and Moral Objectives of Sin Taxes

Sin taxes primarily target goods like tobacco, alcohol, and gambling to discourage harmful behaviors and promote public health and social welfare. These taxes align with social and moral objectives by reducing consumption of products that contribute to addiction, disease, and societal costs, while generating revenue for health programs and social services. Unlike Pigovian taxes, which correct externalities through economic incentives, sin taxes emphasize changing moral behavior and addressing public harm through fiscal disincentives.

Examples of Pigovian Taxes in Practice

Pigovian taxes are levied to correct negative externalities, with carbon taxes on greenhouse gas emissions being prominent examples implemented in countries like Sweden and Canada. Another example includes congestion charges in cities such as London and Singapore, designed to reduce traffic pollution and improve air quality. These taxes directly target social costs not reflected in market prices, encouraging behavior that mitigates environmental harm.

Common Sin Tax Applications Globally

Common sin tax applications globally target products and behaviors deemed harmful, such as tobacco, alcohol, and sugary beverages, with the goal of reducing consumption and generating revenue for public health initiatives. Unlike Pigovian taxes, which specifically address externalities by imposing costs equivalent to the social harm caused, sin taxes often serve dual purposes of deterrence and fiscal benefit. Countries like Mexico, the United Kingdom, and Norway implement high sin taxes on cigarettes and alcohol to curb addiction rates and offset healthcare expenses.

Effectiveness of Pigovian vs Sin Taxes

Pigovian taxes are designed to internalize externalities by directly targeting the social costs of harmful activities, making them more effective in correcting market failures than sin taxes, which primarily aim to reduce consumption of specific goods like tobacco or alcohol. The effectiveness of Pigovian taxes lies in their ability to reflect precise social costs, encouraging behavioral changes that optimize overall welfare. Sin taxes, while effective in decreasing demand for harmful products, often lack the nuanced pricing mechanism necessary to address the broader externality impacts comprehensively.

Policy Implications and Future Trends

Pigovian taxes target negative externalities by imposing costs equivalent to the societal harm caused, promoting efficient resource allocation through behavior correction. Sin taxes specifically target goods like tobacco and alcohol to reduce consumption and generate government revenue, often prioritizing public health outcomes. Future trends indicate an increased use of digital tools for tax administration, broader application to environmental pollutants, and integration with behavioral economics to optimize policy effectiveness and social welfare.

Pigovian tax Infographic

libterm.com

libterm.com