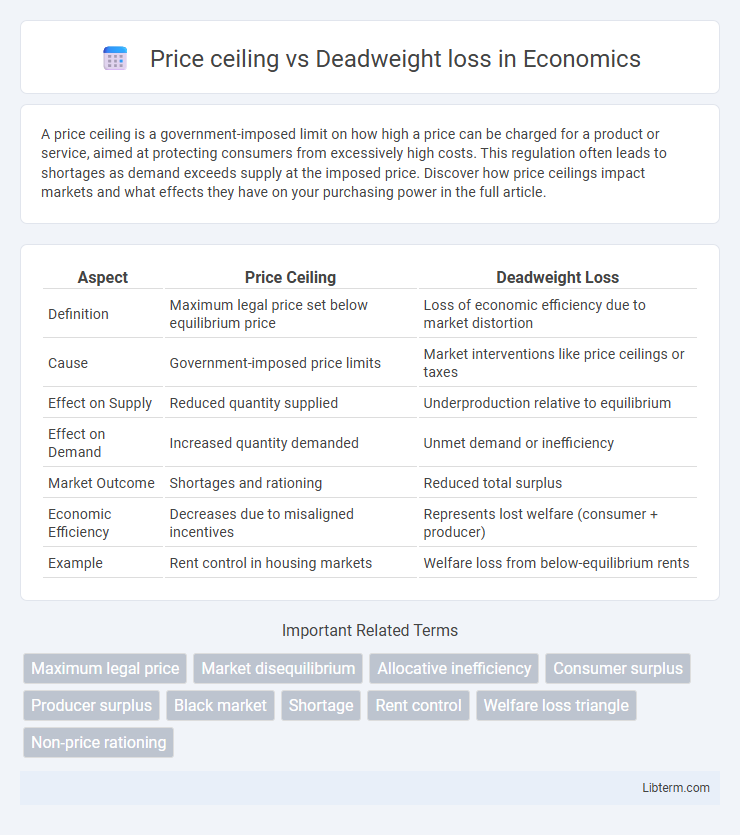

A price ceiling is a government-imposed limit on how high a price can be charged for a product or service, aimed at protecting consumers from excessively high costs. This regulation often leads to shortages as demand exceeds supply at the imposed price. Discover how price ceilings impact markets and what effects they have on your purchasing power in the full article.

Table of Comparison

| Aspect | Price Ceiling | Deadweight Loss |

|---|---|---|

| Definition | Maximum legal price set below equilibrium price | Loss of economic efficiency due to market distortion |

| Cause | Government-imposed price limits | Market interventions like price ceilings or taxes |

| Effect on Supply | Reduced quantity supplied | Underproduction relative to equilibrium |

| Effect on Demand | Increased quantity demanded | Unmet demand or inefficiency |

| Market Outcome | Shortages and rationing | Reduced total surplus |

| Economic Efficiency | Decreases due to misaligned incentives | Represents lost welfare (consumer + producer) |

| Example | Rent control in housing markets | Welfare loss from below-equilibrium rents |

Introduction to Price Ceilings and Deadweight Loss

Price ceilings are government-imposed limits on how high a price can be charged for a good or service, aimed at protecting consumers from excessive costs. When set below the market equilibrium price, price ceilings lead to shortages and a reduction in the quantity supplied. These distortions create deadweight loss, which represents the loss of economic efficiency due to unmet demand and misallocation of resources.

Defining Price Ceilings: Economic Implications

A price ceiling is a legally imposed maximum price on a good or service, typically set below the market equilibrium to make essential goods more affordable. This artificial cap creates a shortage by increasing demand while reducing supply, leading to inefficient market outcomes. The resulting deadweight loss represents the lost economic welfare due to transactions that no longer occur, highlighting the trade-offs between affordability and market efficiency.

What is Deadweight Loss?

Deadweight loss refers to the loss of economic efficiency that occurs when the equilibrium outcome is not achieved, often due to market distortions like price ceilings. A price ceiling, set below the market equilibrium price, creates shortages by limiting how much sellers can charge, leading to reduced supply and increased demand. This imbalance results in deadweight loss, representing lost consumer and producer surplus that neither party gains.

How Price Ceilings Create Deadweight Loss

Price ceilings set below equilibrium price lead to shortages by limiting supply and increasing demand, resulting in inefficient allocation of resources. This market distortion eliminates mutually beneficial trades, generating deadweight loss that reflects the lost consumer and producer surplus. The severity of deadweight loss grows as the price ceiling deviates further from the equilibrium price, exacerbating inefficiencies in the market.

Real-World Examples of Price Ceilings

Price ceilings set below equilibrium prices often lead to deadweight loss by creating shortages and reducing market efficiency, as seen in rent control policies in cities like New York, where artificially low rents deter investment and reduce housing supply. Another example is the gasoline price caps implemented during crises, which lead to long queues and black markets as demand exceeds the controlled supply. These instances illustrate how price ceilings, while intended to protect consumers, can inadvertently cause economic inefficiencies and welfare losses.

Graphical Analysis: Price Ceilings and Market Efficiency

Price ceilings set below equilibrium price create shortages by limiting quantity supplied, leading to a deadweight loss represented graphically as a triangle between supply and demand curves. This deadweight loss indicates the loss of total surplus, illustrating inefficiency where mutually beneficial trades fail to occur. The area of deadweight loss on the graph quantifies the welfare cost caused by the price ceiling restricting market equilibrium.

Short-Term vs Long-Term Effects of Price Ceilings

Price ceilings create deadweight loss by causing shortages, reducing the quantity supplied below market equilibrium in the short term. Over the long term, persistent price ceilings discourage investment and innovation, leading to decreased supply capacity and structural inefficiencies. This worsening of supply constraints amplifies deadweight loss as the gap between consumer demand and available goods widens over time.

Winners and Losers: Distributional Impact

Price ceilings create winners among consumers who can purchase goods at lower prices, while producers lose due to reduced revenues and incentives. Deadweight loss emerges as market inefficiencies cause unmet demand and supply shortages, resulting in lost economic value shared by both consumers and producers. The distributional impact highlights a transfer of surplus from producers to consumers, but with an overall net loss to society due to decreased market efficiency.

Policy Alternatives to Price Ceilings

Price ceilings often lead to deadweight loss by causing shortages and reducing market efficiency. Policy alternatives such as targeted subsidies or direct cash transfers can improve consumer welfare without distorting market equilibrium. Implementing price floors combined with supply-side incentives helps maintain production levels while minimizing welfare losses.

Conclusion: Balancing Regulation and Efficiency

Price ceilings, when set below equilibrium, often create deadweight loss by reducing market efficiency and causing shortages. Balancing regulation involves carefully setting price limits to protect consumers without significantly disrupting supply and demand dynamics. Effective policy minimizes deadweight loss while ensuring affordability and market stability.

Price ceiling Infographic

libterm.com

libterm.com