Carbon tax is a financial charge imposed on the carbon content of fossil fuels, aimed at reducing greenhouse gas emissions by encouraging cleaner energy use and innovation. By putting a price on carbon emissions, it incentivizes businesses and individuals to adopt sustainable practices that lower their environmental impact. Discover how a carbon tax can reshape your energy choices and contribute to combating climate change in the rest of this article.

Table of Comparison

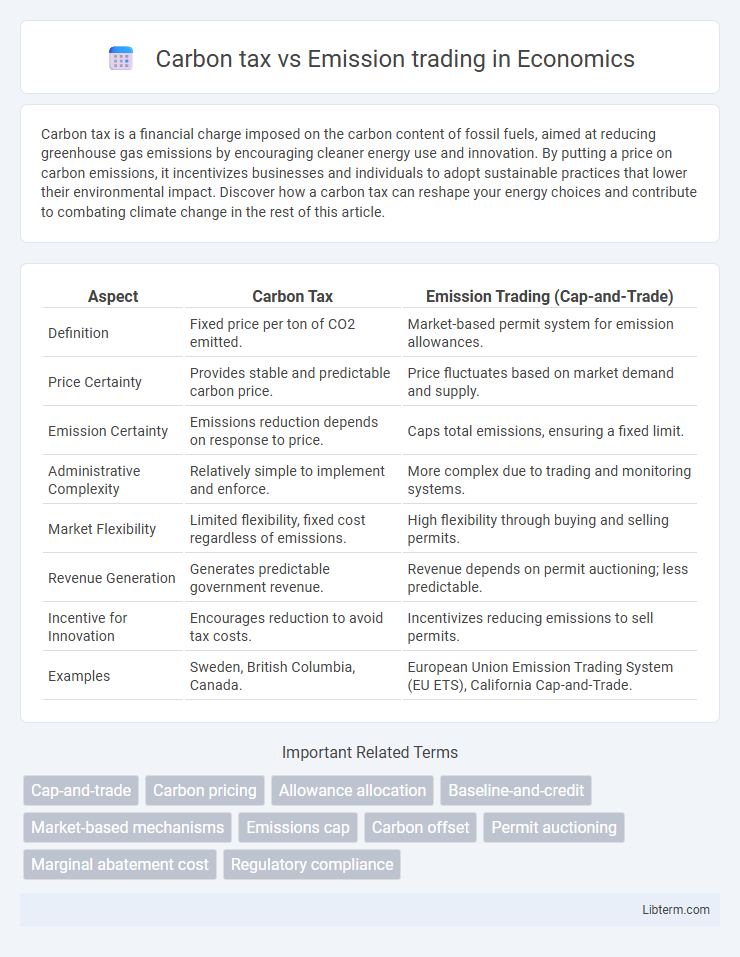

| Aspect | Carbon Tax | Emission Trading (Cap-and-Trade) |

|---|---|---|

| Definition | Fixed price per ton of CO2 emitted. | Market-based permit system for emission allowances. |

| Price Certainty | Provides stable and predictable carbon price. | Price fluctuates based on market demand and supply. |

| Emission Certainty | Emissions reduction depends on response to price. | Caps total emissions, ensuring a fixed limit. |

| Administrative Complexity | Relatively simple to implement and enforce. | More complex due to trading and monitoring systems. |

| Market Flexibility | Limited flexibility, fixed cost regardless of emissions. | High flexibility through buying and selling permits. |

| Revenue Generation | Generates predictable government revenue. | Revenue depends on permit auctioning; less predictable. |

| Incentive for Innovation | Encourages reduction to avoid tax costs. | Incentivizes reducing emissions to sell permits. |

| Examples | Sweden, British Columbia, Canada. | European Union Emission Trading System (EU ETS), California Cap-and-Trade. |

Understanding Carbon Tax and Emission Trading

Carbon tax directly sets a fixed price on carbon emissions, providing businesses predictable costs to reduce greenhouse gases, while emission trading, also known as cap-and-trade, establishes a market for carbon allowances that limits total emissions and incentivizes reduction through trading. The carbon tax ensures steady revenue for governments and straightforward implementation but may lack flexibility in emission targets. Emission trading offers environmental certainty by capping emissions but can experience price volatility and requires robust monitoring systems.

Core Principles: How Each System Works

Carbon tax sets a fixed price per ton of carbon dioxide emitted, providing predictable costs to incentivize emission reductions by making fossil fuel use more expensive. Emission trading, or cap-and-trade, establishes a total emission limit and distributes or auctions permits that companies can buy or sell, creating a market-driven price for emissions. Both systems aim to reduce greenhouse gas emissions but differ in cost certainty: carbon tax offers price certainty, while trading guarantees emission quantity.

Economic Impacts of Carbon Tax Versus Emission Trading

Carbon tax provides price certainty by setting a fixed cost per ton of CO2 emitted, enabling businesses to plan long-term investments with predictable expenses, which may lead to steady economic growth. Emission trading, or cap-and-trade systems, set a cap on total emissions and allow trading of allowances, creating a market-driven price for carbon that can fluctuate, potentially causing economic uncertainty but encouraging cost-effective emissions reductions. Studies show that carbon taxes tend to generate more stable government revenues, while emission trading can foster innovation through market incentives but may require complex regulatory oversight to prevent volatility and market manipulation.

Effectiveness in Reducing Greenhouse Gas Emissions

Carbon tax sets a fixed price on emissions, providing certainty in costs and incentivizing continuous reduction of greenhouse gases by making pollution more expensive. Emission trading, or cap-and-trade, limits total emissions with tradable allowances, encouraging companies to innovate and reduce emissions below the cap for financial gain. Studies show emission trading offers flexibility and cost-effectiveness, while carbon tax guarantees predictable price signals, both proving effective in achieving significant greenhouse gas reductions when properly implemented.

Cost Predictability and Market Stability

Carbon tax offers high cost predictability by setting a fixed price on emissions, enabling businesses to forecast expenses and plan investments effectively. Emission trading systems provide market stability through a cap on total emissions but introduce cost variability as permit prices fluctuate based on demand and supply dynamics. Policymakers balance the fixed cost certainty of carbon taxes against the flexible market-driven incentives of trading schemes to achieve emissions reduction goals.

Policy Design: Flexibility and Implementation

Carbon tax offers simplicity and price certainty, allowing policymakers to set a fixed cost per ton of CO2 emitted, promoting straightforward administration and predictable business costs. Emission trading systems provide flexibility by capping total emissions and enabling market-driven allowance trading, which incentivizes cost-effective reductions but requires complex monitoring and allocation mechanisms. Effective policy design balances the administrative ease of carbon taxes with the dynamic market flexibility of emission trading to optimize environmental and economic outcomes.

Administrative Complexity and Compliance

Carbon tax systems generally have lower administrative complexity due to fixed pricing and straightforward collection mechanisms, while emission trading schemes require intricate monitoring, reporting, and verification to manage fluctuating permit markets. Compliance under carbon taxes is simpler since entities pay a known tax rate on emissions, whereas emission trading demands continuous tracking of allowances, trading activities, and potential market volatility. Regulatory oversight for emission trading involves complex infrastructure to enforce caps and facilitate transactions, increasing administrative burdens compared to the more predictable, uniform tax administration.

Global Adoption: Key Examples and Case Studies

Carbon tax systems have been effectively implemented in countries like Sweden, where a high tax rate on carbon emissions correlates with significant reductions in CO2 levels since the 1990s. Emission trading schemes (ETS) are prominently adopted in the European Union, covering over 11,000 power stations and industrial plants, driving a 35% reduction in emissions in covered sectors by 2030 targets. Notable case studies include Canada's British Columbia adopting a carbon tax with predictable pricing, while China's national ETS influences the world's largest carbon market, focusing on the power generation industry.

Addressing Equity and Social Implications

Carbon tax provides predictable costs for emissions, allowing governments to design rebates or subsidies targeting low-income households to address equity concerns. Emission trading systems create market-driven costs for pollution, but price volatility can disproportionately impact vulnerable communities if revenue recycling mechanisms are inadequate. Effective policy design in both approaches requires transparent revenue redistribution and inclusion of social safeguards to mitigate adverse effects on disadvantaged populations.

Future Outlook: Integrating Both Approaches

Future outlook for climate policy emphasizes integrating carbon tax and emission trading systems to enhance flexibility and cost-effectiveness in reducing greenhouse gas emissions. Hybrid models leverage carbon tax stability with emission trading market dynamics, enabling adaptive responses to economic and environmental fluctuations. This integration is expected to accelerate decarbonization efforts while providing clear price signals and minimizing compliance costs for industries globally.

Carbon tax Infographic

libterm.com

libterm.com