Pareto efficiency occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off, ensuring optimal distribution and economic efficiency. Understanding this concept helps You evaluate the impact of policy decisions and allocate resources more effectively. Explore the rest of this article to uncover how Pareto efficiency shapes economic outcomes and influences real-world trade-offs.

Table of Comparison

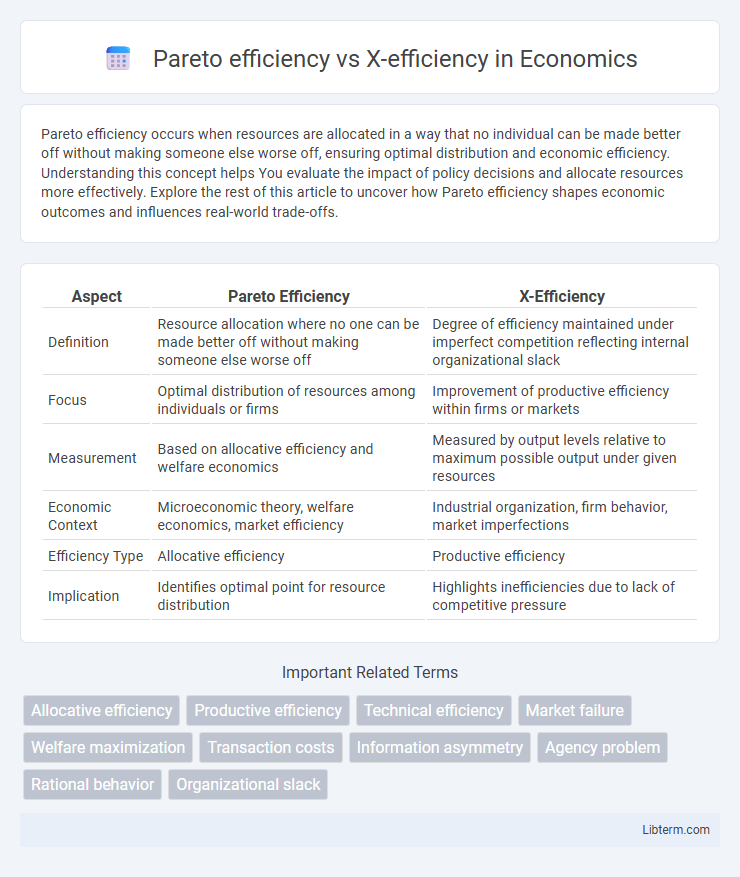

| Aspect | Pareto Efficiency | X-Efficiency |

|---|---|---|

| Definition | Resource allocation where no one can be made better off without making someone else worse off | Degree of efficiency maintained under imperfect competition reflecting internal organizational slack |

| Focus | Optimal distribution of resources among individuals or firms | Improvement of productive efficiency within firms or markets |

| Measurement | Based on allocative efficiency and welfare economics | Measured by output levels relative to maximum possible output under given resources |

| Economic Context | Microeconomic theory, welfare economics, market efficiency | Industrial organization, firm behavior, market imperfections |

| Efficiency Type | Allocative efficiency | Productive efficiency |

| Implication | Identifies optimal point for resource distribution | Highlights inefficiencies due to lack of competitive pressure |

Introduction to Efficiency Concepts in Economics

Pareto efficiency occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off, representing an ideal state of economic efficiency. X-efficiency, on the other hand, measures how well resources are utilized within a firm, focusing on reducing inefficiencies due to organizational slack or lack of competitive pressure. Understanding these concepts helps economists analyze optimal resource distribution versus actual performance in markets and firms.

Defining Pareto Efficiency

Pareto efficiency occurs when resources are allocated so that no individual can be made better off without making someone else worse off, representing an optimal state of allocation. It emphasizes the absence of allocative inefficiency in economic systems, ensuring maximum possible output given the resource constraints. X-efficiency, by contrast, deals with achieving maximum productive efficiency within firms, focusing on minimizing waste and inefficiency rather than optimal allocation across agents.

Understanding X-Efficiency

X-efficiency refers to the degree to which firms minimize costs and maximize output given their available resources, highlighting inefficiencies due to lack of competitive pressure or organizational slack. Unlike Pareto efficiency, which emphasizes optimal allocation of resources where no one can be made better off without making others worse off, X-efficiency focuses on internal operational performance and productivity gaps within firms. Understanding X-efficiency is critical for identifying potential improvements in firm-level efficiency beyond traditional market equilibrium concepts.

Key Differences Between Pareto Efficiency and X-Efficiency

Pareto efficiency occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off, highlighting optimal resource distribution. X-efficiency refers to the degree of efficiency maintained by firms under imperfect competition, focusing on minimizing waste and maximizing productive efficiency within organizations. The key difference lies in Pareto efficiency's emphasis on optimal allocation across agents, whereas X-efficiency centers on internal operational efficiency and cost minimization within firms.

Real-World Examples of Pareto Efficiency

Pareto efficiency occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off, exemplified by competitive markets like stock exchanges where trades benefit participants without losses. In contrast, X-efficiency highlights inefficiencies within firms due to lack of competitive pressure, such as monopolies producing below optimal output. Real-world examples of Pareto efficiency include auction markets, where bidding reveals true valuations, and perfectly competitive agricultural markets, ensuring optimal distribution of goods without wasted resources.

Real-World Examples of X-Efficiency

X-efficiency occurs when firms fail to minimize costs due to factors like lack of competition or poor management, unlike Pareto efficiency which denotes optimal resource allocation where no one can be made better without making someone worse off. Real-world examples of X-efficiency include government monopolies where bureaucratic inefficiencies lead to higher operational costs, and inefficient public utilities that lack competitive pressure to innovate or reduce waste. In contrast, competitive markets such as the airline industry often push firms towards higher X-efficiency by incentivizing cost reduction and process improvements.

Impact of Market Structures on Efficiency

Market structures significantly influence Pareto efficiency and X-efficiency by shaping resource allocation and cost management. Perfect competition promotes Pareto efficiency through optimal resource distribution, while monopolies often lead to inefficiency by limiting output and raising prices. X-efficiency, reflecting firms' ability to minimize costs, tends to be higher in competitive markets where pressure forces innovation, whereas less competitive markets exhibit greater organizational slack and reduced performance.

Policy Implications: Choosing Between Efficiency Types

Policy implications of choosing between Pareto efficiency and X-efficiency involve balancing optimal resource allocation with practical cost minimization in real-world markets. Pareto efficiency emphasizes allocative efficiency, guiding policies toward maximizing overall welfare without making any party worse off, often suitable for competitive markets. X-efficiency focuses on reducing inefficiencies within firms, influencing regulatory frameworks to enhance productivity and cost-effectiveness in industries prone to managerial slack or market imperfections.

Efficiency in Practice: Limitations and Criticisms

Pareto efficiency measures optimal resource allocation where no individual can be better off without making someone worse off, but it ignores the actual performance and productivity levels within firms, which X-efficiency addresses by highlighting inefficiencies caused by lack of competitive pressure or organizational slack. X-efficiency reflects real-world deviations from ideal efficiency, emphasizing how managerial motivation, information asymmetry, and market structure contribute to suboptimal output, making it more practical for analyzing firm-level performance. Criticisms of Pareto efficiency focus on its abstract nature and inability to account for equity or technological constraints, while X-efficiency faces challenges in quantifying inefficiencies and isolating causes within complex organizational environments.

Conclusion: Comparing Pareto Efficiency and X-Efficiency

Pareto efficiency emphasizes optimal resource allocation where no individual can be made better off without making someone else worse off, reflecting allocative efficiency in ideal markets. X-efficiency highlights the importance of minimizing inefficiencies within firms due to organizational or motivational factors, addressing real-world deviations from optimal performance. Comparing both concepts underscores that achieving Pareto efficiency requires overcoming X-inefficiencies to ensure resources are not only well allocated but also productively utilized.

Pareto efficiency Infographic

libterm.com

libterm.com