Option price reflects the premium you pay for the right to buy or sell an asset at a specified strike price before expiration. This price is influenced by factors such as the underlying asset's price, time to expiration, volatility, and interest rates. Discover more details about how each factor impacts your option price in the rest of this article.

Table of Comparison

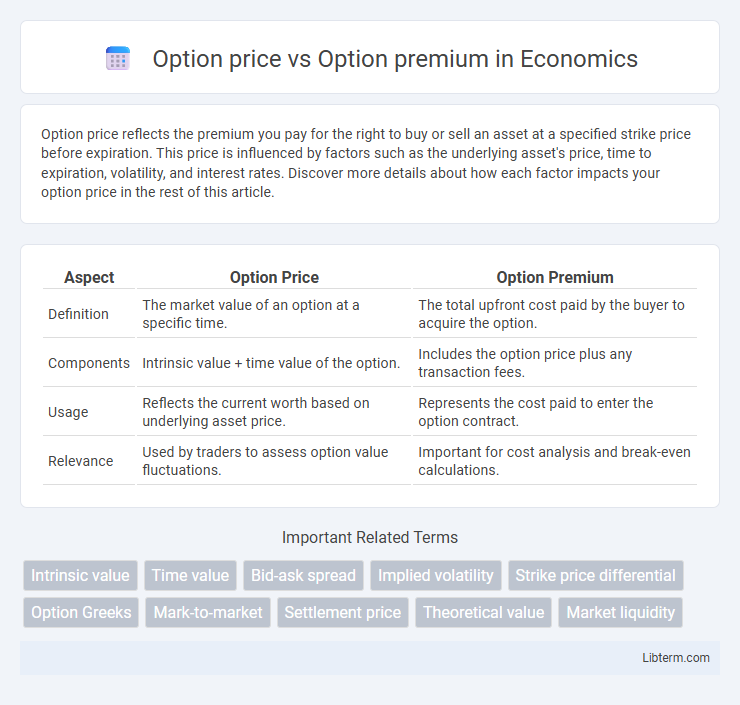

| Aspect | Option Price | Option Premium |

|---|---|---|

| Definition | The market value of an option at a specific time. | The total upfront cost paid by the buyer to acquire the option. |

| Components | Intrinsic value + time value of the option. | Includes the option price plus any transaction fees. |

| Usage | Reflects the current worth based on underlying asset price. | Represents the cost paid to enter the option contract. |

| Relevance | Used by traders to assess option value fluctuations. | Important for cost analysis and break-even calculations. |

Understanding Option Price and Option Premium

Option price refers to the current market value at which an option contract can be bought or sold, reflecting factors such as intrinsic value and time value. Option premium represents the total cost paid by the buyer to acquire the option, encompassing intrinsic value, time value, and implied volatility. Understanding the distinction helps traders evaluate the fair cost of entering an options position and manage potential risks effectively.

Key Differences Between Option Price and Option Premium

Option price represents the market value at which an option can be bought or sold, directly influenced by factors such as the underlying asset's price, time to expiration, and volatility. Option premium, however, encompasses the option price plus any additional costs or fees associated with acquiring the option, reflecting the total expenditure by the buyer. The key difference lies in the option price being the intrinsic market value, while the option premium is the full price paid, including external costs beyond just the option's market value.

Components of an Option Premium

The option premium comprises two key components: intrinsic value and time value. Intrinsic value represents the difference between the underlying asset's current price and the option's strike price when favorable, while time value reflects the potential for further price movement before expiration. Factors such as volatility, time until expiration, and interest rates significantly influence the time value portion of the option premium.

How Option Price is Determined

Option price is determined by several key factors including the underlying asset's current market price, strike price, time to expiration, volatility, interest rates, and dividends. The intrinsic value and time value collectively form the option premium, where intrinsic value reflects the immediate exercise gain and time value accounts for potential future gains. Advanced models like the Black-Scholes and Binomial models are widely used to calculate the theoretical option price by quantifying these variables.

Intrinsic Value vs. Extrinsic Value

Option price consists of intrinsic value and extrinsic value, where intrinsic value represents the difference between the underlying asset's current price and the option's strike price, reflecting immediate exercise profit. Extrinsic value, also called time value, accounts for factors like time until expiration, volatility, and market demand, influencing the additional premium beyond intrinsic value. Understanding this distinction helps traders assess option pricing and potential profitability more effectively.

Factors Influencing Option Premium

Option premium is the market price paid by buyers to acquire the right embedded in an option contract, while the option price often refers to the intrinsic value derived from the difference between the underlying asset's price and the strike price. Factors influencing option premium include the underlying asset's current price, strike price, time to expiration, volatility, interest rates, and dividends. Elevated volatility and longer time horizons generally increase the option premium, reflecting greater uncertainty and potential for profit.

The Role of Time Value in Option Pricing

Option price consists of intrinsic value and time value, where time value represents the potential for the option to increase in worth before expiration. The time value diminishes as the expiration date approaches, a process known as time decay, impacting the overall option premium. Understanding the role of time value is crucial for traders to assess the true cost and profitability of an option contract.

Market Forces Impacting Option Price and Premium

Option price and option premium both reflect the cost of acquiring an option contract, yet the premium comprises intrinsic value and time value, driven by market forces like underlying asset volatility, time to expiration, and interest rates. Market demand and supply dynamics heavily influence option premiums, where increased demand or heightened volatility can elevate the premium despite unchanged intrinsic value. Changes in implied volatility and underlying security price shifts continuously impact option prices, causing premiums to fluctuate as traders adjust to new market information.

Common Misconceptions About Option Pricing

Option price and option premium are often mistakenly used interchangeably, but the option price specifically refers to the intrinsic value, while the option premium includes both intrinsic value and time value. Many investors confuse the option premium as solely the cost of the option, overlooking the impact of volatility, time until expiration, and interest rates embedded in the premium. Misunderstanding these factors can lead to incorrect decisions about option trading strategies and risk assessments.

Practical Examples: Option Price vs. Option Premium

Option price refers to the intrinsic value and time value combined, representing the cost to buy or sell the underlying asset at the strike price, while the option premium is the total price paid by the buyer to the seller for the option contract itself. For example, if a call option on a stock is priced at $5, with an intrinsic value of $3 and a time value of $2, the option premium is $5, which includes both components. Traders analyzing option price versus option premium consider factors like volatility, time to expiration, and underlying asset price movements to make informed decisions.

Option price Infographic

libterm.com

libterm.com