Monopolistic competition describes a market structure where numerous firms sell similar but not identical products, leading to differentiated offerings and some degree of price-setting power. Companies compete through product quality, branding, and marketing strategies rather than just price, creating a dynamic environment for both businesses and consumers. Discover more insights on how monopolistic competition affects market dynamics and your choices in the full article.

Table of Comparison

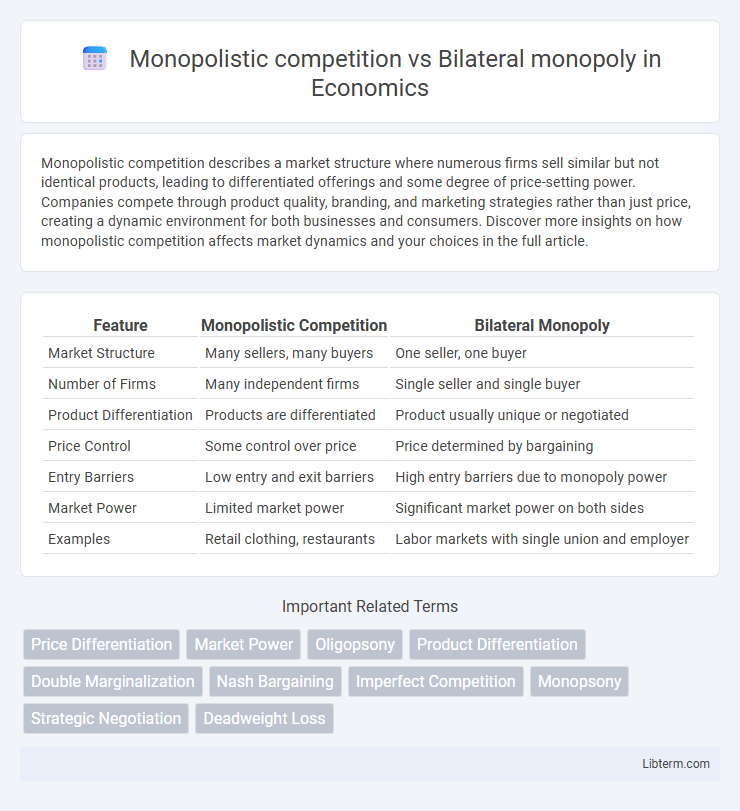

| Feature | Monopolistic Competition | Bilateral Monopoly |

|---|---|---|

| Market Structure | Many sellers, many buyers | One seller, one buyer |

| Number of Firms | Many independent firms | Single seller and single buyer |

| Product Differentiation | Products are differentiated | Product usually unique or negotiated |

| Price Control | Some control over price | Price determined by bargaining |

| Entry Barriers | Low entry and exit barriers | High entry barriers due to monopoly power |

| Market Power | Limited market power | Significant market power on both sides |

| Examples | Retail clothing, restaurants | Labor markets with single union and employer |

Introduction to Market Structures

Monopolistic competition features many firms selling differentiated products, allowing some control over pricing while maintaining market entry freedom. Bilateral monopoly involves a single seller and a single buyer, creating a unique negotiation dynamic that influences pricing and output decisions. These market structures illustrate contrasting scenarios in market power distribution and competitive strategies.

Defining Monopolistic Competition

Monopolistic competition is a market structure characterized by many firms selling differentiated products, allowing each to have some price-setting power within a competitive environment. Firms face downward-sloping demand curves due to product differentiation, leading to non-price competition through advertising and product variety. Unlike bilateral monopoly, where a single buyer and single seller dominate, monopolistic competition features multiple sellers and buyers without exclusive market control.

Understanding Bilateral Monopoly

Bilateral monopoly occurs when a single supplier (monopoly) and a single buyer (monopsony) control the market, creating a unique power dynamic where both parties negotiate terms of trade. Unlike monopolistic competition, characterized by many sellers offering differentiated products in a competitive market, a bilateral monopoly's outcome depends heavily on bargaining power and strategic negotiation between the two entities. Understanding bilateral monopoly involves analyzing how price and quantity are determined through the interplay of supplier monopoly and buyer monopsony pressures.

Key Characteristics of Monopolistic Competition

Monopolistic competition features many sellers offering differentiated products, allowing for some price-setting power without total market control. Firms face relatively elastic demand curves due to the availability of close substitutes, encouraging non-price competition through advertising and product differentiation. Unlike a bilateral monopoly, which involves a single buyer and seller, monopolistic competition includes multiple buyers and sellers interacting in the market.

Main Features of Bilateral Monopoly

Bilateral monopoly occurs when a single seller (monopolist) and a single buyer (monopsonist) dominate the market, creating unique bargaining dynamics. The seller sets the price or quantity, while the buyer holds purchasing power, leading to negotiation outcomes that differ from pure monopoly or monopsony. This market structure results in price and output levels determined by the relative bargaining strength of both parties rather than by perfect competition or monopoly alone.

Price Determination in Monopolistic Competition

In monopolistic competition, price determination is influenced by product differentiation and the presence of many sellers, leading firms to have some control over pricing while still facing competitive pressure. Firms set prices above marginal cost but below monopoly levels, adjusting based on demand elasticity and the entry or exit of competitors. This contrasts with bilateral monopoly, where a single seller and buyer engage in strategic negotiation to determine price.

Wage and Price Negotiations in Bilateral Monopoly

Wage and price negotiations in a bilateral monopoly involve direct bargaining between a single employer and a single labor union, creating a unique power dynamic that contrasts with the multiple firms and buyers in monopolistic competition. The bilateral monopoly's negotiation process is marked by strategic concessions and wage-setting influenced by both parties' threat points, often leading to equilibrium outcomes distinct from competitive market forces. This concentrated market structure amplifies the role of negotiation tactics, with wages and prices reflecting mutual interdependence rather than market-driven supply and demand.

Efficiency and Consumer Welfare Comparison

Monopolistic competition promotes efficiency through product differentiation and competitive pricing, leading to higher consumer welfare by offering diverse choices and innovation. In contrast, a bilateral monopoly often results in inefficiencies due to bargaining power struggles between the single seller and single buyer, causing potential price distortions and reduced consumer surplus. Consumer welfare is generally higher in monopolistic competition because market dynamics drive prices closer to marginal costs, unlike the negotiated equilibrium in bilateral monopolies that may deviate from optimal allocation.

Real-World Examples and Case Studies

Monopolistic competition is exemplified by industries like restaurants and apparel brands where numerous firms offer differentiated products, evident in the diverse strategies of global chains such as Starbucks and Nike that leverage brand loyalty and innovation to gain market share. Bilateral monopoly occurs in unique cases like the labor market for professional athletes, where a single players' union negotiates wages with a sole league owner group, demonstrated by the NFL Players Association's collective bargaining with the National Football League. Real-world case studies such as the U.S. automobile industry for monopolistic competition and the coal industry historically for bilateral monopoly highlight the distinct negotiation dynamics and pricing power in these market structures.

Conclusion: Implications for Market Dynamics

Monopolistic competition fosters dynamic market environments characterized by product differentiation and numerous sellers, driving innovation and consumer choice. Bilateral monopoly, with a single buyer and seller, creates unique negotiation dynamics that can lead to price rigidity and strategic bargaining power imbalances. These contrasting structures significantly influence market efficiency, pricing mechanisms, and the overall competitive landscape.

Monopolistic competition Infographic

libterm.com

libterm.com