Private goods are items that are both excludable and rivalrous, meaning only those who pay can consume them, and one person's use reduces availability for others. Examples include clothing, food, and electronics, which are essential in everyday life and economic transactions. Discover more about how private goods impact markets and your consumption choices in the rest of the article.

Table of Comparison

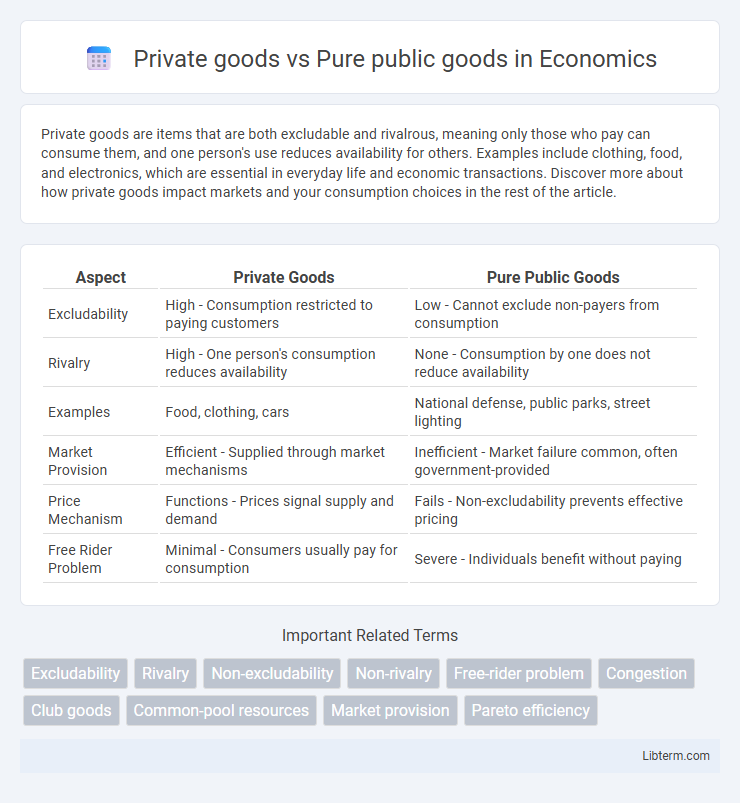

| Aspect | Private Goods | Pure Public Goods |

|---|---|---|

| Excludability | High - Consumption restricted to paying customers | Low - Cannot exclude non-payers from consumption |

| Rivalry | High - One person's consumption reduces availability | None - Consumption by one does not reduce availability |

| Examples | Food, clothing, cars | National defense, public parks, street lighting |

| Market Provision | Efficient - Supplied through market mechanisms | Inefficient - Market failure common, often government-provided |

| Price Mechanism | Functions - Prices signal supply and demand | Fails - Non-excludability prevents effective pricing |

| Free Rider Problem | Minimal - Consumers usually pay for consumption | Severe - Individuals benefit without paying |

Definition of Private Goods

Private goods are defined by their excludability and rivalry in consumption, meaning individuals can be prevented from using them and one person's use reduces availability for others. These goods, such as food, clothing, and cars, are typically sold in markets where consumers purchase them based on price and preference. The nature of private goods contrasts sharply with pure public goods, which are non-excludable and non-rivalrous, like national defense and public broadcasting.

Definition of Pure Public Goods

Pure public goods are defined by their characteristics of non-excludability and non-rivalry, meaning no individual can be prevented from accessing the benefits, and one person's use does not reduce availability for others. These goods include national defense, clean air, and public parks, which require government provision or collective financing due to market failure in private sectors. Unlike private goods, pure public goods do not have a direct price mechanism, leading to challenges in efficient allocation and free-rider problems.

Key Characteristics: Private vs. Public Goods

Private goods exhibit exclusivity and rivalry, meaning consumption by one individual reduces availability for others and access is limited to paying customers. Pure public goods feature non-excludability and non-rivalry, allowing unlimited consumption without diminishing availability and no barriers to access. These fundamental distinctions impact market efficiency, resource allocation, and government intervention strategies.

Examples of Private Goods

Private goods such as smartphones, clothing, and cars are characterized by excludability and rivalry, meaning consumption by one individual reduces availability for others. These goods require payment for ownership or use, ensuring clear property rights and market transactions. Popular examples include groceries, personal electronics, and housing, contrasting with pure public goods like national defense and public broadcasting which are non-excludable and non-rivalrous.

Examples of Pure Public Goods

Pure public goods include national defense, public parks, and street lighting, all characterized by non-excludability and non-rivalrous consumption. These goods cannot exclude individuals from use and one person's consumption does not reduce availability for others, making them distinct from private goods like food or clothing. The provision of pure public goods often relies on government funding due to the free-rider problem inherent in their consumption.

Rivalry and Excludability Explained

Private goods are characterized by both rivalry and excludability, meaning consumption by one individual reduces availability for others and access can be restricted through pricing mechanisms. Pure public goods exhibit non-rivalry and non-excludability, where one person's use does not diminish availability for others and it is impossible or impractical to exclude anyone from benefiting. Understanding these distinctions is crucial for economic policy and resource allocation decisions related to market efficiency and public welfare.

Economic Implications of Private Goods

Private goods, characterized by excludability and rivalry, directly impact market efficiency through price mechanisms that balance supply and demand. The ability to exclude non-payers and the depletion of goods upon consumption create incentives for producers to innovate and allocate resources effectively, leading to economic growth and efficient resource distribution. However, private goods may also result in market failures like monopolies or under-provision of socially desirable goods without government intervention.

Economic Implications of Public Goods

Private goods are excludable and rivalrous, allowing markets to allocate resources efficiently through supply and demand mechanisms. Pure public goods, characterized by non-excludability and non-rivalry, often lead to market failures due to free-rider problems and under-provision. Government intervention and public financing become necessary to ensure adequate supply and optimal economic welfare in the presence of public goods.

Challenges in Providing Public Goods

Providing pure public goods, such as national defense and clean air, faces significant challenges because these goods are non-excludable and non-rivalrous, leading to free-rider problems where individuals consume benefits without paying. Governments struggle to allocate resources efficiently due to difficulties in measuring demand and preventing under-provision. The absence of private market incentives results in funding gaps, necessitating taxation and public policy intervention to ensure adequate supply.

Policy Approaches to Private and Public Goods

Policy approaches to private goods emphasize market-driven mechanisms, where pricing, property rights, and competition regulate supply and demand efficiently. In contrast, public goods require government intervention through funding, regulation, and provision since they are non-excludable and non-rivalrous, leading to challenges like free-riding. Effective policies for pure public goods include taxation and public investment to ensure optimal provision and equitable access.

Private goods Infographic

libterm.com

libterm.com