Flow-of-funds analysis tracks the movement of money within an economy or organization to identify trends, sources, and uses of funds. Understanding these flows helps investors and managers assess financial stability, liquidity, and the impact of economic policies on cash availability. Explore the rest of the article to learn how flow-of-funds analysis can enhance your financial decision-making.

Table of Comparison

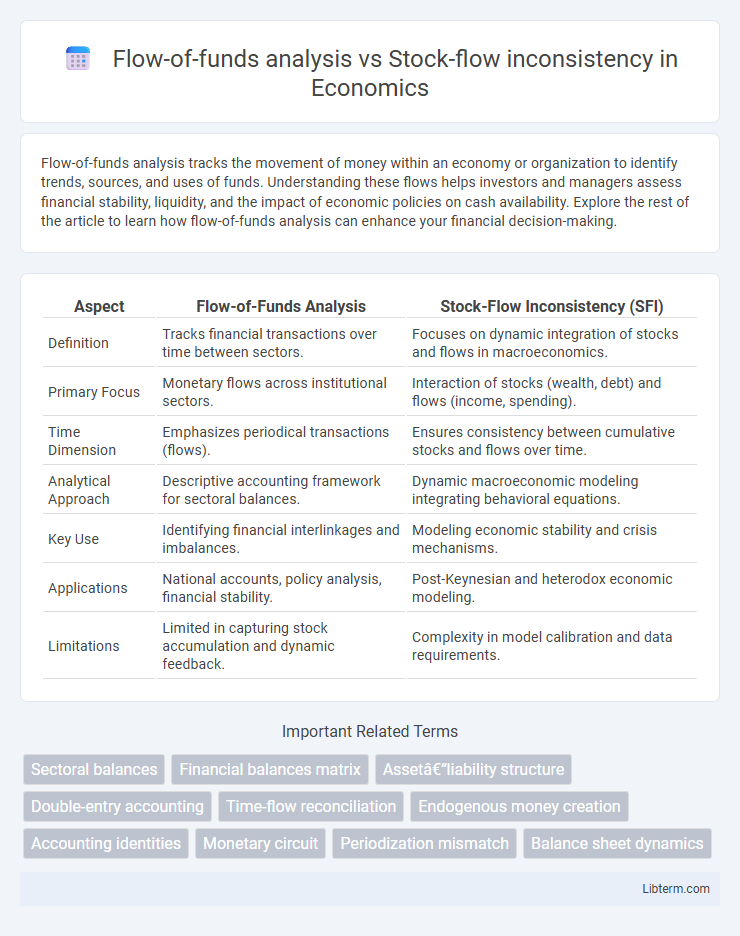

| Aspect | Flow-of-Funds Analysis | Stock-Flow Inconsistency (SFI) |

|---|---|---|

| Definition | Tracks financial transactions over time between sectors. | Focuses on dynamic integration of stocks and flows in macroeconomics. |

| Primary Focus | Monetary flows across institutional sectors. | Interaction of stocks (wealth, debt) and flows (income, spending). |

| Time Dimension | Emphasizes periodical transactions (flows). | Ensures consistency between cumulative stocks and flows over time. |

| Analytical Approach | Descriptive accounting framework for sectoral balances. | Dynamic macroeconomic modeling integrating behavioral equations. |

| Key Use | Identifying financial interlinkages and imbalances. | Modeling economic stability and crisis mechanisms. |

| Applications | National accounts, policy analysis, financial stability. | Post-Keynesian and heterodox economic modeling. |

| Limitations | Limited in capturing stock accumulation and dynamic feedback. | Complexity in model calibration and data requirements. |

Introduction to Flow-of-Funds Analysis

Flow-of-funds analysis tracks the movement of money between sectors within an economy, providing a detailed account of financial transactions over a specific period. It highlights the sources and uses of funds, enabling analysts to understand the connections between saving, investment, and borrowing within households, businesses, and governments. In contrast, stock-flow inconsistency refers to discrepancies that arise when flows and stock variables are not aligned, often pointing to modeling or data errors in economic analysis.

Understanding Stock-Flow Consistency and Inconsistency

Stock-flow consistency ensures that all financial stocks and flows within an economic model are accurately accounted for, maintaining balance between accumulated assets and the corresponding changes over time. Flow-of-funds analysis traces the movement of money between sectors, providing detailed insights into financial transactions but may overlook discrepancies arising from inconsistent stock accumulation. Understanding stock-flow inconsistency highlights potential errors where recorded stocks do not align with integrated flows, emphasizing the importance of coherent accounting frameworks in macroeconomic modeling and financial stability assessment.

Key Concepts: Stocks vs Flows in Economics

Flow-of-funds analysis emphasizes the tracking of financial flows between sectors to understand economic dynamics, while stock-flow inconsistency highlights discrepancies between accumulated stocks and flows over time. Stocks represent the wealth or assets at a given point, and flows signify transactions or changes during a period, making their consistent measurement crucial for accurate economic modeling. Addressing stock-flow consistency ensures that recorded financial inflows and outflows align with changes in asset and liability stocks, providing a coherent view of economic activity.

Methodologies of Flow-of-Funds Analysis

Flow-of-funds analysis employs detailed accounting frameworks to trace financial transactions among economic agents, leveraging balance sheets and transaction flow matrices to map asset and liability changes over time. This methodology emphasizes double-entry bookkeeping principles to ensure consistency and capture the dynamic interactions between sectors within an economy, enabling a comprehensive assessment of liquidity, credit creation, and financial stability. In contrast, stock-flow inconsistency frameworks focus on the discrepancies between accumulated stocks and flows, often highlighting disequilibria in macroeconomic models but lacking the granular transaction-level accounting inherent to flow-of-funds analysis.

Identifying and Measuring Stock-Flow Inconsistencies

Flow-of-funds analysis tracks financial transactions across sectors to reveal discrepancies between changes in stocks and recorded flows, facilitating the identification of stock-flow inconsistencies. Measuring these inconsistencies involves comparing the variation in stock variables, such as wealth or debt levels, against the cumulative net flows reported over the period, highlighting mismatches caused by data errors or timing differences. Accurate identification and quantification of stock-flow inconsistencies improve the reliability of macroeconomic and financial statistics, supporting better economic modeling and policy formulation.

Comparative Analysis: Flow-of-Funds vs Stock-Flow Inconsistency

Flow-of-funds analysis systematically tracks financial transactions between sectors, capturing the dynamic movement of capital and providing clarity on liquidity and fiscal flows. In contrast, stock-flow inconsistency highlights discrepancies between changes in stock variables and corresponding flows, often identifying data mismatches or behavioral anomalies in economic models. Comparing the two, flow-of-funds emphasizes transaction-level tracking and monetary integration, whereas stock-flow inconsistency focuses on validating coherence between aggregate stocks and cumulative flows to ensure model accuracy.

Implications for Macroeconomic Modeling

Flow-of-funds analysis provides a comprehensive framework for tracking financial transactions across sectors, enhancing the accuracy of macroeconomic models by ensuring all flows are internally consistent. Stock-flow inconsistency occurs when changes in stocks do not align with corresponding flows, leading to potential inaccuracies and misrepresentations in economic dynamics. Addressing stock-flow inconsistencies is crucial for improving the reliability of macroeconomic forecasting and policy evaluation within flow-of-funds frameworks.

Policy Relevance and Economic Forecasting

Flow-of-funds analysis offers detailed insights into financial transactions and asset movements, enhancing economic forecasting by providing real-time data on liquidity and credit flows vital for policy decisions. In contrast, stock-flow inconsistency models emphasize the accounting coherence between stock variables and flows, crucial for identifying imbalances that may signal systemic risks or economic imbalances in policy design. Policymakers use flow-of-funds data for immediate monetary and fiscal interventions, while stock-flow inconsistency frameworks inform long-term structural policies to ensure sustainable economic stability.

Common Challenges and Limitations

Flow-of-funds analysis faces challenges such as data aggregation errors, timing mismatches, and difficulties in capturing informal financial transactions. Stock-flow inconsistency often arises from discrepancies between measured stocks and recorded flows, leading to errors in economic modeling and forecasting. Both methods struggle with data integration issues, limited real-time accuracy, and potential biases in financial reporting, impacting their reliability in policy analysis.

Future Directions in Flow-of-Funds and Stock-Flow Research

Future directions in flow-of-funds and stock-flow inconsistency research emphasize integrating high-frequency financial data with macroeconomic models to improve predictive accuracy. Advancements in computational methods enable dynamic simulation of stock-flow consistent frameworks, enhancing policy impact assessments under uncertainty. Emerging studies prioritize linking micro-level financial transactions to aggregate flow-of-funds sectors for a holistic understanding of systemic risk and economic stability.

Flow-of-funds analysis Infographic

libterm.com

libterm.com