The sunk cost fallacy occurs when you continue investing time, money, or effort into a project based on previously invested resources rather than current benefits or outcomes. This cognitive bias can lead to poor decision-making, causing you to ignore better alternatives and escalate losses. Explore the rest of the article to understand how to recognize and overcome the sunk cost fallacy in your decisions.

Table of Comparison

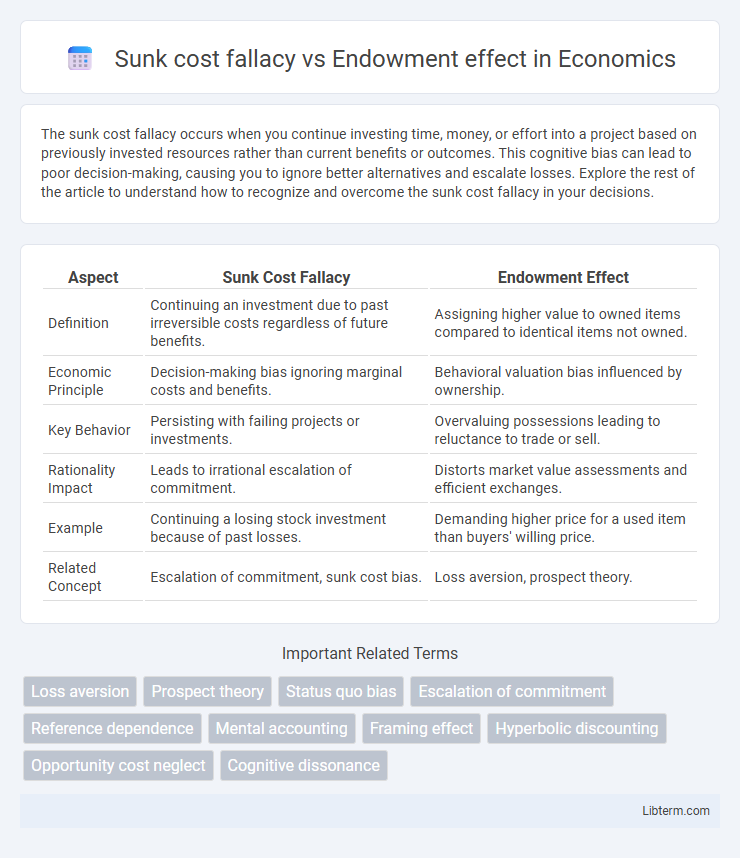

| Aspect | Sunk Cost Fallacy | Endowment Effect |

|---|---|---|

| Definition | Continuing an investment due to past irreversible costs regardless of future benefits. | Assigning higher value to owned items compared to identical items not owned. |

| Economic Principle | Decision-making bias ignoring marginal costs and benefits. | Behavioral valuation bias influenced by ownership. |

| Key Behavior | Persisting with failing projects or investments. | Overvaluing possessions leading to reluctance to trade or sell. |

| Rationality Impact | Leads to irrational escalation of commitment. | Distorts market value assessments and efficient exchanges. |

| Example | Continuing a losing stock investment because of past losses. | Demanding higher price for a used item than buyers' willing price. |

| Related Concept | Escalation of commitment, sunk cost bias. | Loss aversion, prospect theory. |

Understanding Cognitive Biases: Sunk Cost Fallacy vs Endowment Effect

The sunk cost fallacy drives individuals to continue investing in a losing endeavor based on prior investments, despite future costs outweighing benefits, while the endowment effect causes people to overvalue possessions simply because they own them. Both cognitive biases distort rational decision-making by anchoring value on past costs or ownership rather than objective assessments of present or future utility. Recognizing the distinct mechanisms of these biases is essential for improving economic decisions and avoiding financial losses rooted in emotional attachment or irrational commitment.

Defining the Sunk Cost Fallacy

The sunk cost fallacy occurs when individuals continue investing time, money, or effort into a project based on previously incurred costs rather than current benefits. This cognitive bias leads to irrational decision-making, as past expenses are irrecoverable and should not influence ongoing commitments. In contrast, the endowment effect describes how people assign greater value to objects simply because they own them, impacting perceptions of worth rather than investment continuation.

What Is the Endowment Effect?

The endowment effect is a cognitive bias where individuals assign higher value to items they own compared to identical items they do not possess. This psychological phenomenon contrasts with the sunk cost fallacy, which involves continuing an endeavor due to previously invested resources rather than current value. Understanding the endowment effect is crucial for decision-making in economics and behavioral finance, as it explains why people irrationally overvalue their belongings.

Psychological Mechanisms Behind Each Bias

The sunk cost fallacy arises from a cognitive bias where individuals continue investing in a decision based on prior investments rather than future benefits, driven by loss aversion and the desire to avoid regret. The endowment effect occurs because ownership increases the perceived value of an item, influenced by emotional attachment and self-identity, leading to inflated valuation compared to non-owners. Both biases reflect underlying psychological mechanisms related to how people process losses, ownership, and decision-making under uncertainty.

Real-Life Examples of Sunk Cost Fallacy

The sunk cost fallacy often appears in real-life situations such as continuing to invest time and money in a failing project simply because of prior investments, like holding onto a depreciating car instead of selling it. Another common example is finishing a bad movie or book to justify the time already spent, despite a lack of enjoyment or benefit. These behaviors contrast with the endowment effect, where individuals value owned items higher than their market value, influencing decisions like overpricing personal belongings during sales.

Real-World Cases of the Endowment Effect

The endowment effect, where individuals value owned items higher than non-owned ones, is evident in real-world cases such as homeowners overpricing their properties or consumers demanding higher prices to sell products they possess. This behavioral bias contrasts with the sunk cost fallacy, which involves continuing a failing endeavor due to prior investments rather than actual value. Market transactions, legal disputes over asset valuations, and consumer resale markets consistently demonstrate the impact of the endowment effect on economic decisions and pricing.

Key Differences Between Sunk Cost Fallacy and Endowment Effect

The sunk cost fallacy occurs when individuals continue an endeavor due to previously invested resources, despite new evidence suggesting a different course of action is more beneficial. The endowment effect refers to the tendency for people to ascribe higher value to objects they own compared to those they do not, leading to reluctance in parting with possessions. Key differences include that the sunk cost fallacy is driven by past investments influencing future decisions, while the endowment effect is driven by ownership bias impacting valuation and willingness to trade.

How These Biases Influence Financial Decisions

The sunk cost fallacy leads individuals to continue investing in losing ventures due to prior irreversible investments, distorting rational financial decision-making by valuing past costs over future benefits. The endowment effect causes people to overvalue assets simply because they own them, often resulting in reluctance to sell or trade at market value. Both cognitive biases impair objective evaluation of investments, increasing the risk of suboptimal portfolio management and financial losses.

Strategies to Overcome Sunk Cost Fallacy and Endowment Effect

To overcome the sunk cost fallacy, focus on making decisions based on future benefits rather than past investments by regularly reassessing project viability with objective criteria and setting predetermined stopping points. Combat the endowment effect by seeking external feedback and comparing owned items with market alternatives to reduce emotional attachment and ensure rational valuation. Implementing cognitive debiasing techniques and fostering awareness of these biases enhances decision-making efficiency in both personal finance and business contexts.

Implications for Business, Investing, and Personal Life

The sunk cost fallacy causes individuals and businesses to irrationally continue investing resources based on past, unrecoverable costs, leading to poor financial decisions and missed opportunities. The endowment effect, where people overvalue owned assets, impacts negotiating, pricing strategies, and investment decisions by creating biases that distort perceived value. Understanding these cognitive biases helps optimize resource allocation, enhances decision-making in investing, and improves personal financial management by fostering more objective evaluations of costs and benefits.

Sunk cost fallacy Infographic

libterm.com

libterm.com