The Bretton Woods system established a framework for international monetary exchange based on fixed currency parities tied to the US dollar, which was convertible to gold. This arrangement aimed to promote global economic stability and facilitate post-World War II reconstruction through regulated exchange rates and financial cooperation. Discover how the Bretton Woods system shaped today's financial institutions and what lessons it offers for Your economic understanding.

Table of Comparison

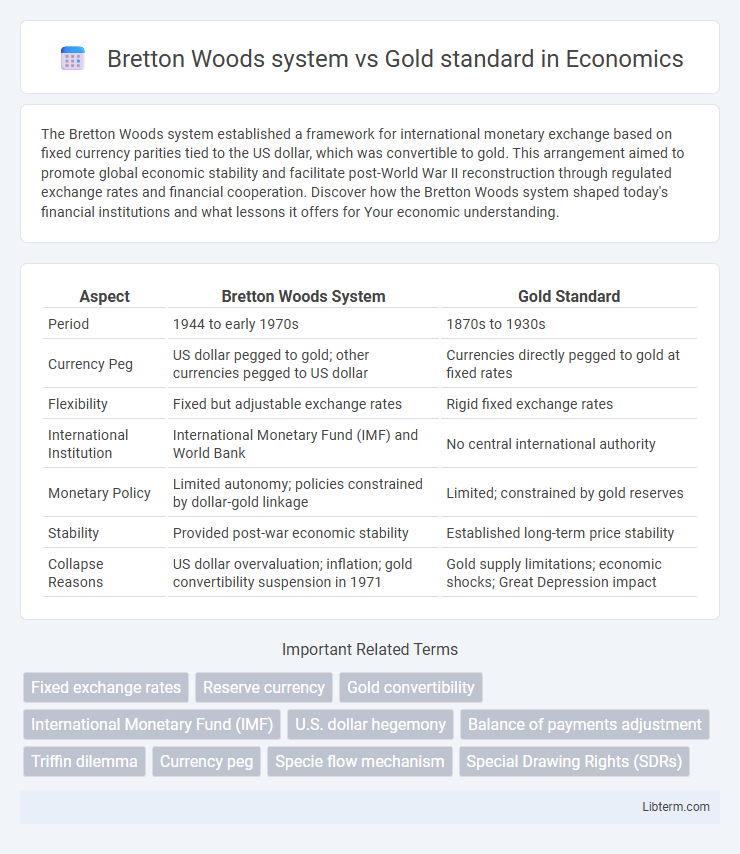

| Aspect | Bretton Woods System | Gold Standard |

|---|---|---|

| Period | 1944 to early 1970s | 1870s to 1930s |

| Currency Peg | US dollar pegged to gold; other currencies pegged to US dollar | Currencies directly pegged to gold at fixed rates |

| Flexibility | Fixed but adjustable exchange rates | Rigid fixed exchange rates |

| International Institution | International Monetary Fund (IMF) and World Bank | No central international authority |

| Monetary Policy | Limited autonomy; policies constrained by dollar-gold linkage | Limited; constrained by gold reserves |

| Stability | Provided post-war economic stability | Established long-term price stability |

| Collapse Reasons | US dollar overvaluation; inflation; gold convertibility suspension in 1971 | Gold supply limitations; economic shocks; Great Depression impact |

Introduction to Bretton Woods System and Gold Standard

The Bretton Woods system, established in 1944, created a fixed exchange rate framework where currencies were pegged to the US dollar, which was convertible to gold at $35 per ounce, fostering global economic stability post-World War II. The gold standard, a monetary system used primarily during the 19th and early 20th centuries, fixed currencies directly to a specific amount of gold, promoting long-term price stability and limiting inflation. While the gold standard emphasized gold as the sole basis for currency value, the Bretton Woods system introduced a hybrid approach using the US dollar as the central reserve currency backed by gold reserves.

Historical Background of Both Monetary Systems

The Bretton Woods system, established in 1944 during World War II, aimed to create a stable international monetary order by pegging currencies to the US dollar, which was convertible to gold at $35 per ounce, replacing the interwar gold standard. The gold standard, dominant from the 19th century until the early 20th century, fixed currency values directly to gold to ensure long-term price stability but collapsed largely due to the economic pressures of World War I and the Great Depression. Both systems reflect historical efforts to balance monetary stability with economic flexibility, with Bretton Woods marking a shift towards managed exchange rates and international financial cooperation.

Core Principles of the Gold Standard

The Gold Standard is based on fixed exchange rates where currencies are convertible into a specific amount of gold, ensuring long-term price stability and limiting inflation by restricting money supply growth. The Bretton Woods system, established post-World War II, implemented fixed exchange rates tied primarily to the US dollar, which was convertible into gold, but allowed for greater flexibility through adjustable rates and IMF interventions. Core principles of the Gold Standard emphasize automatic adjustment of trade imbalances via gold flows, monetary discipline, and currency stability rooted in tangible gold reserves.

Key Features of the Bretton Woods System

The Bretton Woods system established fixed exchange rates by pegging currencies to the US dollar, which was convertible to gold at $35 per ounce, creating a stable international monetary framework. It introduced the International Monetary Fund (IMF) to oversee currency stability and provide financial assistance to countries facing balance of payments deficits. Unlike the gold standard, which relied solely on gold reserves for currency backing, Bretton Woods combined gold and US dollar reserves, allowing greater flexibility in global economic management.

Comparison of Currency Stability and Exchange Rates

The Bretton Woods system established fixed exchange rates by pegging currencies to the U.S. dollar, which was convertible to gold, providing greater currency stability than the classical gold standard's rigid gold convertibility. Under Bretton Woods, central banks could adjust exchange rates within a narrow band to address imbalances, enhancing flexibility compared to the gold standard's automatic and often disruptive adjustments. Currency stability during Bretton Woods was maintained through coordinated international monetary cooperation, contrasting with the gold standard's reliance on individual countries' gold reserves and automatic mechanisms.

Impact on International Trade and Global Economy

The Bretton Woods system established fixed exchange rates tied to the US dollar, facilitating stable international trade by reducing currency risk and promoting economic cooperation among participating countries. Unlike the gold standard, which limited monetary policy flexibility and constrained global liquidity, Bretton Woods allowed for controlled adjustability, supporting post-World War II economic reconstruction and expansion. This system boosted global economic growth by enhancing capital flows and trade stability until its collapse in the early 1970s, when fluctuating exchange rates became the norm.

Collapse and Legacy of the Gold Standard

The Bretton Woods system, established in 1944, aimed to create fixed exchange rates anchored by the US dollar convertible to gold, contrasting with the classical Gold Standard's direct gold convertibility. The Gold Standard collapsed during the Great Depression as deflationary pressures and bank failures made adherence untenable, leading to its abandonment by most countries by the early 1930s. Its legacy influenced Bretton Woods by highlighting the risks of rigid gold convertibility, prompting a more flexible international monetary framework that, despite its eventual collapse in 1971, paved the way for modern exchange rate regimes.

Decline and End of the Bretton Woods Era

The Bretton Woods system declined in the early 1970s due to persistent U.S. balance of payments deficits and the inability to maintain the fixed gold exchange rate of $35 per ounce. The system officially ended in 1971 when President Nixon suspended the convertibility of the U.S. dollar into gold, effectively dissolving the gold-dollar link central to Bretton Woods. This marked a shift to floating exchange rates and the abandonment of the rigid gold standard, reshaping international monetary policy.

Lessons Learned for Modern Monetary Policy

The Bretton Woods system demonstrated the benefits of fixed exchange rates combined with adjustable pegs, providing stability while allowing for policy flexibility, unlike the rigid gold standard. It highlighted the importance of international cooperation and institutions like the IMF in managing global liquidity and preventing competitive devaluations. Modern monetary policy draws from these lessons by balancing currency stability with the need for independent monetary interventions to address economic shocks.

Conclusion: Which System Was More Effective?

The Bretton Woods system proved more effective in promoting global economic stability and growth by combining fixed exchange rates with adjustable mechanisms and international institutions like the IMF. In contrast, the gold standard's rigidity often led to deflationary pressures and limited monetary policy flexibility, contributing to economic downturns. Consequently, Bretton Woods fostered post-World War II recovery and sustained international cooperation, outperforming the gold standard in adaptability and crisis management.

Bretton Woods system Infographic

libterm.com

libterm.com