Status quo bias leads individuals to prefer the current state of affairs, often resisting change even when alternatives may offer better outcomes. This cognitive bias can significantly impact decision-making in personal finance, health, and business strategy. Explore the rest of the article to understand how overcoming status quo bias can improve Your choices and outcomes.

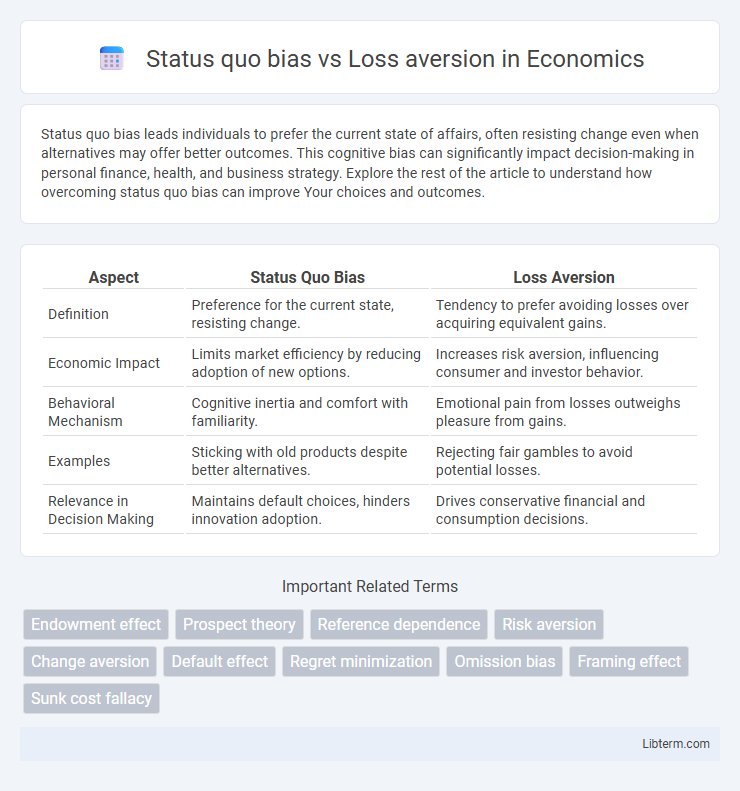

Table of Comparison

| Aspect | Status Quo Bias | Loss Aversion |

|---|---|---|

| Definition | Preference for the current state, resisting change. | Tendency to prefer avoiding losses over acquiring equivalent gains. |

| Economic Impact | Limits market efficiency by reducing adoption of new options. | Increases risk aversion, influencing consumer and investor behavior. |

| Behavioral Mechanism | Cognitive inertia and comfort with familiarity. | Emotional pain from losses outweighs pleasure from gains. |

| Examples | Sticking with old products despite better alternatives. | Rejecting fair gambles to avoid potential losses. |

| Relevance in Decision Making | Maintains default choices, hinders innovation adoption. | Drives conservative financial and consumption decisions. |

Understanding Status Quo Bias

Status quo bias reflects a preference for maintaining current conditions rather than making changes, driven by the perceived risk or effort involved in change. It often results in decision-making inertia, where individuals stick with familiar options even when better alternatives exist. Understanding this bias helps explain why people resist change despite potential gains, distinguishing it from loss aversion, which centers on avoiding losses rather than preserving current states.

Defining Loss Aversion

Loss aversion, a fundamental concept in behavioral economics, refers to the tendency for individuals to prefer avoiding losses rather than acquiring equivalent gains, highlighting the psychological impact of losses as more painful than the pleasure of gains. This bias causes decision-makers to weigh potential losses more heavily than potential benefits, often leading to risk-averse behavior and resistance to change. Distinct from status quo bias, which is the preference for maintaining current conditions, loss aversion specifically emphasizes the disproportionate sensitivity to potential losses in economic and psychological decision contexts.

Origins and Psychological Roots

Status quo bias originates from the human preference for stability and familiarity, deeply rooted in cognitive heuristics that favor maintaining current conditions to avoid the mental effort of change. Loss aversion stems from prospect theory, highlighting the brain's stronger emotional response to potential losses over equivalent gains, driven by evolutionary mechanisms that prioritize survival by minimizing risk. Both biases reflect fundamental psychological processes where fear of uncertainty and asymmetrical valuation of losses versus gains shape decision-making behavior.

Key Differences Between Status Quo Bias and Loss Aversion

Status quo bias refers to the preference for maintaining current decisions or conditions, while loss aversion describes the tendency to strongly prefer avoiding losses over acquiring equivalent gains. The key difference lies in scope: status quo bias emphasizes resistance to change inherent in decision-making, whereas loss aversion centers on the emotional impact of potential losses versus gains. Understanding these distinctions clarifies how individuals evaluate risk and preserve existing states despite possible benefits.

How Status Quo Bias Influences Decision-Making

Status quo bias leads individuals to prefer maintaining current conditions instead of making changes, even when alternatives offer potential benefits, due to an inherent comfort with familiarity. This bias impacts decision-making by causing inertia, reducing willingness to explore options, and skewing risk assessment towards avoiding perceived losses associated with change. Understanding status quo bias is crucial in fields like behavioral economics and marketing, as it explains resistance to innovation and influences consumer behavior.

The Impact of Loss Aversion on Choices

Loss aversion significantly influences decision-making by causing individuals to disproportionately weigh potential losses over equivalent gains, often leading to risk-averse behavior. This psychological tendency results in the preference for maintaining the current state, reinforcing status quo bias by making changes seem more threatening due to feared losses. Understanding loss aversion helps explain why people resist switching options, even when alternatives offer greater benefits.

Real-World Examples: Status Quo Bias vs Loss Aversion

Status quo bias leads individuals to prefer maintaining their current situation, even when better options exist, such as employees resisting new workplace software despite its efficiency. Loss aversion drives decision-making by emphasizing the fear of losing what one already has, exemplified by investors holding onto declining stocks to avoid realizing losses. These biases significantly influence behaviors in finance, healthcare, and consumer choices, where people often prioritize avoiding losses or change over potential gains.

Overcoming Biases in Everyday Life

Overcoming status quo bias requires actively challenging the comfort of existing routines by evaluating options based on future benefits rather than past habits. Loss aversion can be mitigated by reframing potential losses as opportunities for gain, encouraging risk-taking in decision-making processes. Techniques such as scenario analysis and seeking diverse perspectives help reduce the influence of these cognitive biases in everyday choices.

Practical Implications for Business and Policy

Status quo bias leads consumers to prefer existing products or policies, making market entry and change initiatives challenging for businesses and policymakers. Loss aversion intensifies resistance by amplifying perceived negative outcomes of switching, driving customer loyalty but also hindering innovation adoption. Understanding these biases enables targeted strategies like framing changes to minimize perceived losses and gradual implementation to improve acceptance in both commercial and regulatory environments.

Strategies to Mitigate Bias Effects

Implementing decision frameworks such as cost-benefit analysis and pre-commitment strategies can effectively reduce the impact of status quo bias by encouraging objective evaluation of alternatives. Loss aversion can be mitigated through reframing techniques that emphasize potential gains rather than potential losses, as well as by setting incremental goals that reduce the perceived risk of change. Behavioral nudges like default option adjustments and providing comprehensive information also support overcoming these cognitive biases in decision-making processes.

Status quo bias Infographic

libterm.com

libterm.com