A random walk is a mathematical concept describing a path consisting of a series of random steps, often used to model unpredictable phenomena in fields such as finance, physics, and biology. This process helps analyze stock market fluctuations, particle diffusion, and evolutionary patterns by providing insights into the probabilistic movement within a given space. Explore the rest of the article to understand how random walks impact various scientific and practical applications.

Table of Comparison

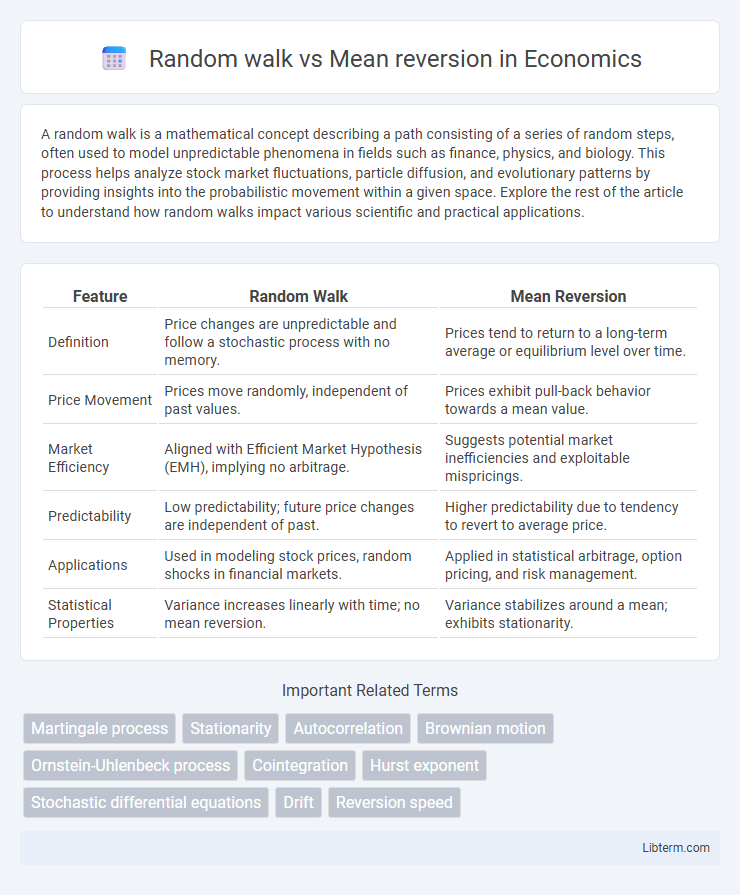

| Feature | Random Walk | Mean Reversion |

|---|---|---|

| Definition | Price changes are unpredictable and follow a stochastic process with no memory. | Prices tend to return to a long-term average or equilibrium level over time. |

| Price Movement | Prices move randomly, independent of past values. | Prices exhibit pull-back behavior towards a mean value. |

| Market Efficiency | Aligned with Efficient Market Hypothesis (EMH), implying no arbitrage. | Suggests potential market inefficiencies and exploitable mispricings. |

| Predictability | Low predictability; future price changes are independent of past. | Higher predictability due to tendency to revert to average price. |

| Applications | Used in modeling stock prices, random shocks in financial markets. | Applied in statistical arbitrage, option pricing, and risk management. |

| Statistical Properties | Variance increases linearly with time; no mean reversion. | Variance stabilizes around a mean; exhibits stationarity. |

Introduction to Random Walk and Mean Reversion

Random walk theory suggests that stock prices move unpredictably, following a path generated by random steps, making future price movements impossible to forecast based on past data. Mean reversion theory argues that prices tend to return to their historical average or mean over time, implying predictable corrections after significant deviations. Understanding these contrasting models is essential for investors when developing trading strategies and risk management approaches.

Defining the Random Walk Theory

The Random Walk Theory posits that stock prices change randomly and unpredictably, making it impossible to consistently forecast future price movements based on past data. This theory implies that markets are efficient, reflecting all available information instantly in asset prices. Unlike mean reversion, which assumes prices will return to an average level over time, random walk suggests price changes follow a stochastic process without predictable patterns.

Understanding Mean Reversion

Mean reversion is a financial theory suggesting that asset prices and returns eventually move back towards their historical average or mean level. This concept is pivotal in trading strategies where deviations from the mean signal potential opportunities to buy undervalued or sell overvalued assets. Unlike random walk theory, which assumes price changes are unpredictable and independent, mean reversion highlights the tendency of prices to revert to a stable average over time.

Key Differences Between Random Walk and Mean Reversion

Random walk models assume asset prices follow a path where future movements are independent and unpredictable, reflecting a lack of memory in price changes. Mean reversion suggests prices fluctuate around a long-term average, implying that deviations will eventually reverse toward that mean. Key differences include predictability, with mean reversion offering potential forecasting advantages due to tendencies to revert, whereas random walk implies price changes are entirely random and non-predictive.

Mathematical Foundations of Both Concepts

Random walk models are based on the theory that price changes are independent and identically distributed, often modeled using stochastic processes like Brownian motion, reflecting a lack of predictable patterns. Mean reversion assumes that asset prices or returns fluctuate around a long-term average level, mathematically represented by Ornstein-Uhlenbeck processes and governed by differential equations that pull values back towards a mean. The distinction lies in their underlying stochastic calculus frameworks: random walks rely on martingale properties, while mean reversion incorporates drift terms that enforce a tendency to revert to historical averages.

Applications in Financial Markets

Random walk models are widely used in financial markets to describe asset price movements that follow unpredictable and independent steps, supporting the Efficient Market Hypothesis and guiding strategies like index fund investing. Mean reversion strategies exploit the tendency of asset prices to return to their historical averages, making them popular in statistical arbitrage, pairs trading, and risk management frameworks. Quantitative analysts apply random walk assumptions for option pricing models, while mean reversion underpins technical indicators such as Bollinger Bands to identify potential entry and exit points in trading.

Random Walk vs Mean Reversion in Stock Price Movements

Random walk and mean reversion represent two contrasting hypotheses in stock price movements. Random walk suggests stock prices follow an unpredictable path influenced by new information, making future prices independent of past trends. Mean reversion implies stock prices tend to move back toward a historical average or intrinsic value over time, indicating predictable fluctuations around a long-term mean.

Empirical Evidence and Case Studies

Empirical evidence from financial markets reveals mixed results, showing some asset prices follow a random walk, implying price changes are independent and unpredictable, while others exhibit mean reversion, where prices tend to return to historical averages over time. Case studies in equity markets, such as the analysis of stock indices during volatility clusters, highlight mean-reverting behavior in periods of market inefficiencies and investor overreaction. Conversely, studies of efficient markets and high-frequency trading data often support the random walk hypothesis, reinforcing the unpredictability of short-term price movements.

Implications for Trading Strategies

Random walk implies price changes are unpredictable and follow a path with no clear direction, which challenges the efficacy of trend-following trading strategies. Mean reversion suggests prices tend to return to an average level, supporting strategies that capitalize on identifying overbought or oversold conditions. Understanding whether an asset exhibits random walk behavior or mean reversion is crucial for selecting appropriate trading models and risk management approaches.

Limitations and Criticisms of Each Approach

Random walk models face criticism for oversimplifying market behavior by assuming price changes are entirely unpredictable and ignoring underlying economic factors. Mean reversion approaches are limited due to the assumption that prices will consistently return to an average, which may not hold true during prolonged trends or structural shifts. Both methods struggle with accurately capturing market anomalies and volatility clustering, leading to potential mispricing and ineffective risk management.

Random walk Infographic

libterm.com

libterm.com