Financial liberalization refers to the process of reducing restrictions on financial markets and institutions to promote efficiency, competition, and growth. It typically involves removing controls on interest rates, easing restrictions on foreign investments, and allowing free capital movement across borders to enhance market integration. Discover how financial liberalization can impact your economy and investment opportunities by exploring the rest of this article.

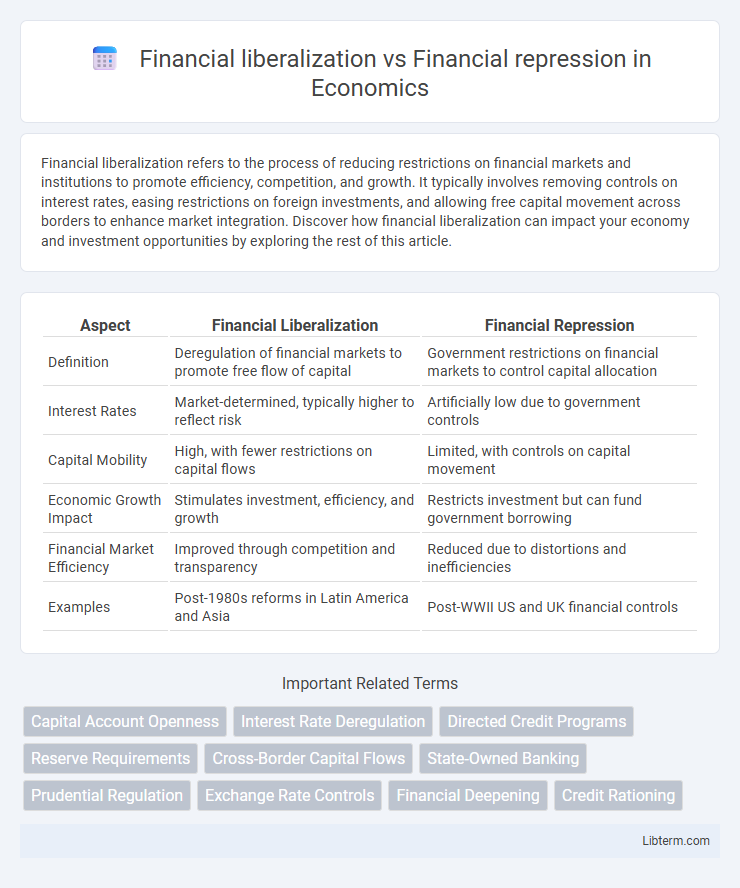

Table of Comparison

| Aspect | Financial Liberalization | Financial Repression |

|---|---|---|

| Definition | Deregulation of financial markets to promote free flow of capital | Government restrictions on financial markets to control capital allocation |

| Interest Rates | Market-determined, typically higher to reflect risk | Artificially low due to government controls |

| Capital Mobility | High, with fewer restrictions on capital flows | Limited, with controls on capital movement |

| Economic Growth Impact | Stimulates investment, efficiency, and growth | Restricts investment but can fund government borrowing |

| Financial Market Efficiency | Improved through competition and transparency | Reduced due to distortions and inefficiencies |

| Examples | Post-1980s reforms in Latin America and Asia | Post-WWII US and UK financial controls |

Introduction to Financial Liberalization and Repression

Financial liberalization refers to the removal of government restrictions on financial markets, aiming to enhance efficiency, increase competition, and attract investment by allowing market forces to determine interest rates, credit allocation, and capital flows. Financial repression involves government policies that channel funds to the public sector, often through regulated interest rates, credit controls, and capital restrictions, which can suppress economic growth by distorting market mechanisms. These contrasting approaches significantly impact financial sector development, influencing economic stability, investment patterns, and overall growth prospects.

Defining Financial Liberalization: Key Features

Financial liberalization refers to the process of reducing government restrictions and controls on the financial markets, allowing for increased market-driven interest rates, capital mobility, and fewer barriers to entry for financial institutions. Key features include deregulation of interest rates, elimination of credit controls, and opening up to foreign capital inflows, which collectively enhance efficiency and promote economic growth. This shift contrasts with financial repression, where policies like interest rate caps and directed credit allocation restrict market operations and limit financial sector development.

Understanding Financial Repression: Core Characteristics

Financial repression involves government policies that limit the freedom of financial markets, often through interest rate caps, high reserve requirements, and directed credit to favored sectors. These measures lead to suppressed interest rates, reduced capital mobility, and distorted credit allocation, hindering efficient capital distribution and economic growth. Understanding financial repression reveals its impact on savings behavior, investment incentives, and the overall financial system's development constraints.

Historical Context and Evolution

Financial liberalization began in the late 20th century, marked by deregulation of interest rates, removal of credit controls, and opening capital accounts to foreign investment. This shift contrasted sharply with the financial repression era from the post-World War II period to the 1970s, when governments imposed measures like high reserve requirements and interest rate ceilings to direct credit and control inflation. The global transition toward liberalized financial markets was driven by the need to stimulate economic growth, increase efficiency, and integrate with the expanding global economy.

Objectives and Motivations Behind Each Approach

Financial liberalization aims to enhance economic efficiency by removing restrictions on capital flows, interest rates, and credit allocation, fostering increased investment and economic growth. Its objective is to create a competitive financial market that allocates resources more effectively and attracts foreign investment. Conversely, financial repression seeks to maintain economic stability and control inflation through regulated interest rates, capital controls, and directed credit, often prioritizing government financing needs and protecting domestic industries.

Impacts on Economic Growth and Development

Financial liberalization, characterized by reduced government control over interest rates, capital accounts, and credit allocation, generally promotes economic growth by enhancing efficiency, encouraging investment, and improving capital allocation. In contrast, financial repression, involving policies like interest rate caps and capital controls, can stifle growth by restricting credit availability, discouraging savings, and leading to capital misallocation. Empirical studies show countries with liberalized financial systems experience higher rates of GDP growth and development due to improved financial intermediation and market-driven resource distribution.

Policy Tools: Liberalization vs. Repression Mechanisms

Financial liberalization utilizes policy tools such as deregulation, interest rate liberalization, and the removal of credit controls to encourage market efficiency and competition. In contrast, financial repression employs mechanisms like directed credit, interest rate caps, high reserve requirements, and capital controls to channel resources to the government and favored sectors. These contrasting policy tools significantly impact capital allocation, economic growth, and financial market development.

Case Studies: Successes and Failures

Financial liberalization, characterized by the reduction of government controls over interest rates, capital flows, and financial institutions, often leads to increased investment and economic growth, as demonstrated by Chile's reforms in the 1980s, which spurred substantial GDP growth and financial sector development. However, mismanaged liberalization efforts can result in financial crises, evidenced by the Asian Financial Crisis of 1997, where sudden capital outflows and inadequate regulatory frameworks caused severe economic downturns in countries like Thailand and Indonesia. Conversely, financial repression, involving government-imposed restrictions and fixed interest rates, as seen in post-war Japan, can sustain long-term industrial policy objectives and debt management, but often at the cost of reduced financial efficiency and slower innovation.

Risks and Challenges of Financial Liberalization

Financial liberalization involves removing restrictions on financial markets, which can increase access to capital but also heighten risks such as market volatility, financial crises, and asset bubbles. Challenges include inadequate regulatory frameworks, which may lead to poor risk management and increased vulnerability to external shocks. Furthermore, liberalization can exacerbate income inequality and financial instability if not accompanied by strong institutional oversight.

Future Outlook: Balancing Liberalization and Repression

Future economic stability relies on finding an optimal balance between financial liberalization and financial repression, where liberalization encourages investment and growth while measured repression safeguards against volatility and systemic risks. Emerging markets may adopt adaptive regulatory frameworks that promote transparent capital flows and resilient banking systems, optimizing access to credit without compromising financial stability. Advances in digital finance and regulatory technology will play critical roles in tailoring policies that dynamically respond to evolving global economic conditions and market sentiments.

Financial liberalization Infographic

libterm.com

libterm.com