The term "final incidence" refers to the total number of new cases of a disease or condition that develop in a specific population during a defined period. Understanding final incidence helps public health officials and researchers evaluate the effectiveness of interventions and allocate resources efficiently. Explore the full article to learn how tracking your community's final incidence can improve health outcomes.

Table of Comparison

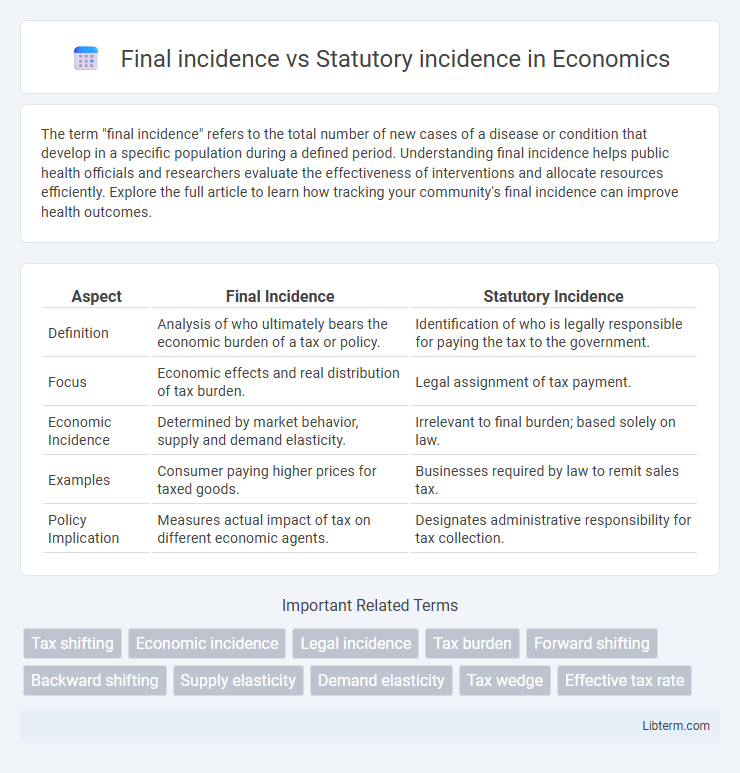

| Aspect | Final Incidence | Statutory Incidence |

|---|---|---|

| Definition | Analysis of who ultimately bears the economic burden of a tax or policy. | Identification of who is legally responsible for paying the tax to the government. |

| Focus | Economic effects and real distribution of tax burden. | Legal assignment of tax payment. |

| Economic Incidence | Determined by market behavior, supply and demand elasticity. | Irrelevant to final burden; based solely on law. |

| Examples | Consumer paying higher prices for taxed goods. | Businesses required by law to remit sales tax. |

| Policy Implication | Measures actual impact of tax on different economic agents. | Designates administrative responsibility for tax collection. |

Understanding Final Incidence and Statutory Incidence

Final incidence refers to the true economic burden of a tax, indicating who ultimately bears the cost after market adjustments. Statutory incidence identifies the legal responsibility for paying the tax, often assigned to producers or consumers by law. Understanding the distinction clarifies how taxes influence market behavior, resource allocation, and economic welfare.

Key Definitions: Final Incidence vs Statutory Incidence

Final incidence refers to the actual economic burden of a tax, indicating who ultimately bears the cost after market adjustments. Statutory incidence denotes the legal obligation to pay the tax, identifying the entity required by law to remit the tax to the government. Understanding the distinction between final incidence and statutory incidence is crucial for analyzing tax policy impacts on consumers, producers, and overall market efficiency.

The Legal Assignment of Tax: Statutory Incidence

The statutory incidence of a tax refers to the entity legally responsible for paying the tax to the government, as defined by law, often differing from the final incidence which represents who actually bears the economic burden of the tax. Legal assignment of tax liability determines statutory incidence, typically involving sellers or producers, but market adjustments can shift the economic impact to consumers or other parties. Understanding statutory incidence is crucial for tax policy analysis, as it establishes formal tax obligations without guaranteeing who ultimately absorbs the cost.

Economic Burden of Tax: Final Incidence Explained

Final incidence refers to the ultimate economic burden of a tax borne by consumers or producers after market adjustments, contrasting with statutory incidence, which denotes the entity legally responsible for paying the tax to the government. Economic burden analysis highlights how taxes shift prices, output, and resource allocation, revealing that the statutory payer may pass on costs through higher prices or reduced wages, affecting final incidence. Understanding final incidence is crucial for policymakers to assess the true impact of taxation on economic behavior and equity.

Comparing Final Incidence and Statutory Incidence

Final incidence refers to the actual economic burden of a tax, indicating who ultimately bears the cost after market adjustments, while statutory incidence denotes the legal responsibility to pay the tax as defined by law. Comparing final incidence and statutory incidence reveals discrepancies when market dynamics shift tax burdens from the party legally obligated to pay to another, often consumers or producers. Understanding this distinction is crucial for tax policy analysis, as it impacts economic behavior and equity considerations.

Determinants of Tax Incidence: Who Really Pays?

Final incidence refers to the actual economic burden of a tax, showing who ultimately bears the cost after market adjustments, while statutory incidence identifies the party legally responsible for paying the tax to the government. Key determinants of tax incidence include price elasticity of demand and supply, which influence how tax burdens shift between consumers and producers. For example, when demand is inelastic relative to supply, consumers bear a larger share of the tax incidence because they are less responsive to price changes.

Real-World Examples: Statutory vs Final Incidence

Statutory incidence refers to the legal assignment of a tax, such as a sales tax imposed on sellers, while final incidence identifies who ultimately bears the economic burden, often shifted to consumers through higher prices. For example, a cigarette tax legally collected from manufacturers (statutory incidence) often results in increased retail prices, causing smokers to bear the final incidence. In the labor market, payroll taxes legally paid by employers may lead to lower wages, revealing that employees bear the final incidence despite the statutory burden resting on firms.

Policy Implications of Tax Incidence Distinctions

Final incidence refers to who ultimately bears the economic burden of a tax after market adjustments, while statutory incidence denotes the entity legally responsible for remitting the tax. Understanding this distinction is crucial for policymakers to design effective tax policies, as shifting the statutory incidence may not alter the final economic burden due to market responses. Recognizing the divergence between statutory and final incidence informs more accurate predictions of tax impacts on consumer behavior, income distribution, and economic efficiency.

Measuring and Analyzing Tax Incidence

Measuring tax incidence differentiates between statutory incidence, which identifies the legal burden of a tax on a particular entity, and final incidence, which reveals who ultimately bears the economic cost after market adjustments. Analyzing tax incidence requires assessing how taxes affect prices, wages, and resource allocation, highlighting redistribution effects beyond the legal tax assignment. Understanding the divergence between statutory and final incidence enables policymakers to evaluate the true economic impact and efficiency of tax policies.

Final Thoughts: Importance of Recognizing Tax Incidence Differences

Understanding the final incidence of a tax reveals who ultimately bears the economic burden, which often differs from the statutory incidence defined by law. Recognizing these differences is crucial for policymakers to assess the true impact of taxation on consumers, producers, and overall market behavior. Accurate analysis of tax incidence guides the design of equitable and efficient tax systems that minimize unintended economic distortions.

Final incidence Infographic

libterm.com

libterm.com