The specific factors model explains how income distribution changes when an economy opens to trade, focusing on factors tied to particular industries like land or capital that cannot move freely between sectors. It highlights how owners of factors specific to export industries typically benefit, while those tied to import-competing industries may lose. Discover how this model sheds light on trade impacts and what it means for your economic decisions by reading the full article.

Table of Comparison

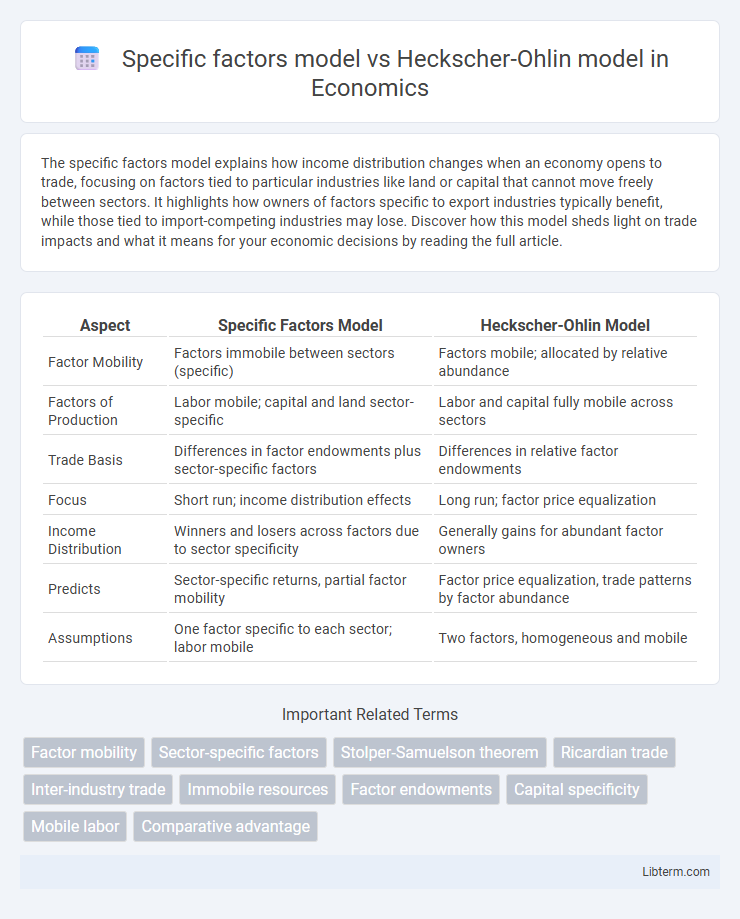

| Aspect | Specific Factors Model | Heckscher-Ohlin Model |

|---|---|---|

| Factor Mobility | Factors immobile between sectors (specific) | Factors mobile; allocated by relative abundance |

| Factors of Production | Labor mobile; capital and land sector-specific | Labor and capital fully mobile across sectors |

| Trade Basis | Differences in factor endowments plus sector-specific factors | Differences in relative factor endowments |

| Focus | Short run; income distribution effects | Long run; factor price equalization |

| Income Distribution | Winners and losers across factors due to sector specificity | Generally gains for abundant factor owners |

| Predicts | Sector-specific returns, partial factor mobility | Factor price equalization, trade patterns by factor abundance |

| Assumptions | One factor specific to each sector; labor mobile | Two factors, homogeneous and mobile |

Introduction to International Trade Theories

The Specific Factors Model emphasizes short-term mobility of labor while capital and land remain immobile, explaining trade by the sector-specificity of factors. The Heckscher-Ohlin Model centers on the relative abundance of capital and labor across countries, predicting trade patterns based on factor endowments and comparative advantage. Both models provide foundational insights into international trade theories by linking factor allocation to trade flows and production specialization.

Overview of the Specific Factors Model

The Specific Factors Model emphasizes that some production factors are immobile and tied to particular industries, affecting trade patterns and income distribution within countries. It contrasts with the Heckscher-Ohlin model by assuming short-run factor immobility, which leads to sector-specific impacts from trade rather than uniform resource reallocation. This model highlights the role of capital, labor, and land as sector-specific inputs, explaining variations in wages and returns due to international trade.

Core Assumptions of the Specific Factors Model

The Specific Factors Model assumes that labor is mobile across sectors while capital and land are immobile, specific to particular industries. It posits that each industry uses a distinct factor of production, with wages equalizing across sectors but returns to specific factors differing. This model contrasts with Heckscher-Ohlin by emphasizing short-run factor immobility rather than varying factor endowments across countries.

Heckscher-Ohlin Model: Key Principles

The Heckscher-Ohlin Model emphasizes comparative advantage driven by differences in factor endowments, asserting countries export goods that intensively use their abundant resources. It relies on two key factors--capital and labor--to explain patterns of trade, predicting that resource-rich nations export products requiring their plentiful inputs. This model contrasts with the Specific Factors Model by assuming factor mobility between industries, focusing on broad factor proportions rather than industry-specific assets.

Factor Mobility in Both Models

The Specific Factors Model assumes limited factor mobility in the short run, as certain factors like capital and land are sector-specific and cannot easily move between industries, leading to sector-dependent income effects. In contrast, the Heckscher-Ohlin Model posits full factor mobility across sectors within a country in the long run, allowing labor and capital to reallocate until factor prices equalize, driving comparative advantage based on factor endowments. This fundamental difference in factor mobility assumptions results in distinct predictions on income distribution and trade patterns between the two models.

Comparative Advantage: Specific Factors vs. Heckscher-Ohlin

The Specific Factors model attributes comparative advantage to the immobility of factors such as labor, capital, and land that are tied to specific industries, leading to output differences based on sector-specific endowments. In contrast, the Heckscher-Ohlin model explains comparative advantage through relative factor endowments across countries, where nations export goods that intensively use their abundant and cheaper factors of production. Empirical evidence often supports the Heckscher-Ohlin theory when examining trade patterns driven by broad factor proportions, while the Specific Factors model better captures short-run trade dynamics influenced by sector-specific inputs.

Income Distribution Effects

The Specific Factors model emphasizes that income distribution effects arise because mobile labor and immobile specific factors, such as capital or land tied to particular industries, experience different impacts from trade, typically benefiting owners of factors specific to export industries while harming those tied to import-competing sectors. In contrast, the Heckscher-Ohlin model predicts income distribution changes based on factor abundance, where trade benefits owners of abundant factors and harms owners of scarce factors, attributing gains or losses to changes in factor returns across the entire economy. This distinction highlights the Specific Factors model's focus on sector-specific impacts and the Heckscher-Ohlin model's focus on factor endowment differences driving income inequality post-trade.

Real-World Applications and Empirical Evidence

The Specific Factors model highlights labor and capital immobility across sectors, explaining short-term trade effects observed in industries like manufacturing versus agriculture, while the Heckscher-Ohlin model emphasizes factor endowments such as land, labor, and capital to predict long-term trade patterns driven by resource abundance, as evidenced by U.S. exports of capital-intensive goods and developing countries exporting labor-intensive products. Empirical studies demonstrate the Specific Factors model's relevance in analyzing sector-specific income distribution and labor market adjustments during trade shocks, whereas the Heckscher-Ohlin framework aligns with broad trade flows and factor price equalization across countries with differing resource endowments. Real-world applications include policy formulation on trade protection and labor mobility, where the Specific Factors model informs transitional assistance, and the Heckscher-Ohlin model guides comparative advantage and resource allocation strategies.

Strengths and Limitations of Each Model

The Specific Factors model excels in analyzing short-run trade effects by considering sector-specific resources, offering detailed insight into income distribution among factors tied to particular industries but falls short in long-term predictions due to fixed factor immobility. The Heckscher-Ohlin model strengths lie in its ability to explain trade patterns based on countries' relative factor endowments, providing robust long-term analysis of comparative advantage, yet it assumes perfect factor mobility and identical technologies, which limits its real-world applicability. Both models complement each other by addressing different time horizons and factor mobility assumptions but face limitations in capturing dynamic adjustments and technological differences in international trade.

Conclusion: Choosing Between the Models

Choosing between the Specific Factors model and the Heckscher-Ohlin model depends on the economy's factor mobility and the factors' specificity. The Specific Factors model is more appropriate when factors are immobile and sector-specific, highlighting short-term income distribution effects. The Heckscher-Ohlin model better explains long-term trade patterns driven by differences in factor endowments and assumes factor mobility across sectors.

Specific factors model Infographic

libterm.com

libterm.com