Bimetallism is a monetary system where the value of the currency is based on two metals, typically gold and silver, which are used as legal tender at a fixed ratio. This system aims to stabilize the economy by providing a dual standard that can help regulate inflation and maintain currency value. Discover how bimetallism has influenced economic policies and your financial decisions throughout history in the rest of this article.

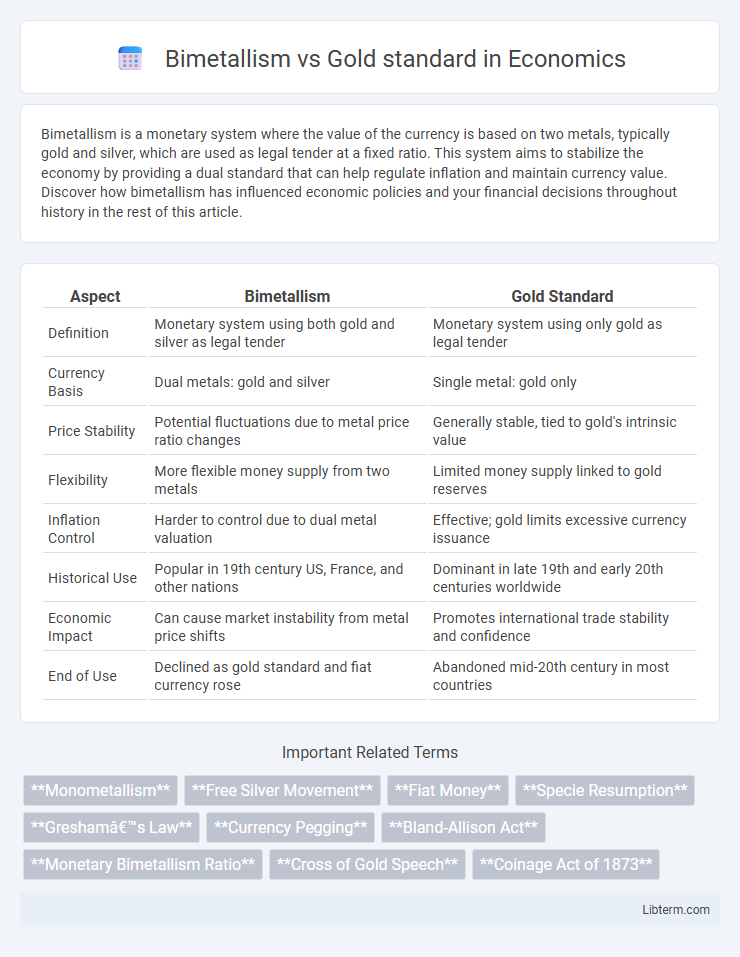

Table of Comparison

| Aspect | Bimetallism | Gold Standard |

|---|---|---|

| Definition | Monetary system using both gold and silver as legal tender | Monetary system using only gold as legal tender |

| Currency Basis | Dual metals: gold and silver | Single metal: gold only |

| Price Stability | Potential fluctuations due to metal price ratio changes | Generally stable, tied to gold's intrinsic value |

| Flexibility | More flexible money supply from two metals | Limited money supply linked to gold reserves |

| Inflation Control | Harder to control due to dual metal valuation | Effective; gold limits excessive currency issuance |

| Historical Use | Popular in 19th century US, France, and other nations | Dominant in late 19th and early 20th centuries worldwide |

| Economic Impact | Can cause market instability from metal price shifts | Promotes international trade stability and confidence |

| End of Use | Declined as gold standard and fiat currency rose | Abandoned mid-20th century in most countries |

Introduction to Monetary Systems

Bimetallism is a monetary system where the value of the monetary unit is defined as equivalent to certain amounts of two metals, typically gold and silver, allowing both to circulate as legal tender. The gold standard, by contrast, bases the monetary unit's value solely on a fixed quantity of gold, restricting currency issuance to gold reserves. These systems fundamentally influence inflation control, currency stability, and international trade balance in economic policies.

What is Bimetallism?

Bimetallism is a monetary system in which the value of the national currency is defined by fixed quantities of two metals, typically gold and silver, allowing both to serve as legal tender. This system aims to stabilize the economy by leveraging the combined metal reserves, providing flexibility against market fluctuations in either metal. Unlike the gold standard, which bases currency strictly on gold, bimetallism attempts to balance the currency's value between gold and silver to prevent deflation and promote economic growth.

Understanding the Gold Standard

The gold standard is a monetary system where a country's currency value is directly linked to a specific amount of gold, ensuring stability and limiting inflation by restricting money supply to gold reserves. Unlike bimetallism, which relies on both gold and silver as monetary metals, the gold standard eliminates the complexities of dual valuation and potential market imbalances between metals. Maintaining the gold standard supports fixed exchange rates and fosters international economic confidence but can constrain monetary policy flexibility during economic fluctuations.

Historical Context of Bimetallism

Bimetallism, a monetary system using both gold and silver as legal tender, gained prominence during the 19th century amid fluctuating silver prices and economic expansion. Its historical context is marked by debates over currency stability and inflation control, particularly during the late 1800s when countries like the United States and France faced pressure to either maintain bimetallism or adopt the gold standard. The system's decline began as many nations standardized on gold, seeking uniformity in international trade and reducing the complexities caused by dual-metal valuation.

The Rise of the Gold Standard

The rise of the gold standard in the late 19th century marked a shift from bimetallism, where both gold and silver were used as monetary standards, to a system relying solely on gold for currency valuation and international trade stability. Countries adopting the gold standard, including the United Kingdom and the United States, aimed to ensure fixed exchange rates and reduce inflation by backing their currency with a definite quantity of gold, creating a more predictable global economic environment. This transition diminished the use of silver as legal tender and influenced global finance by promoting gold reserves as the primary measure of monetary credibility and economic power.

Key Differences: Bimetallism vs Gold Standard

Bimetallism involves using both gold and silver as a basis for currency valuation, allowing governments to issue money backed by either metal, while the gold standard restricts currency backing exclusively to gold. Under bimetallism, fixed exchange rates between gold and silver are established by law, often leading to complications like Gresham's Law, where the overvalued metal drives out the undervalued one from circulation. The gold standard provides greater monetary stability and international confidence by limiting money supply to gold reserves but can cause deflationary pressures during gold shortages.

Economic Impacts of Bimetallism

Bimetallism influenced economic stability by enabling currency flexibility through the use of both gold and silver, which helped moderate inflation and deflation cycles. The system supported broader money supply growth, benefiting farmers and debtors by increasing liquidity and easing credit access. However, fluctuating relative values of metals sometimes caused market uncertainty and challenges in maintaining fixed exchange rates.

Effects of the Gold Standard on Global Trade

The gold standard stabilized global trade by providing a common monetary framework, reducing exchange rate volatility and fostering international investment. Countries on the gold standard experienced increased confidence in currency value, facilitating smoother transactions and lowering transaction costs. However, its rigidity limited monetary policy flexibility during economic crises, sometimes exacerbating recessions and trade imbalances.

Arguments For and Against Each System

Bimetallism promotes monetary stability by allowing currency to be backed by both gold and silver, increasing money supply and preventing deflation, but faces challenges such as price fluctuations between metals and potential government manipulation. The gold standard ensures long-term price stability and international trust through a fixed currency value linked solely to gold, yet it can cause economic rigidity, restrict monetary policy flexibility, and exacerbate deflation during financial crises. Economic historians debate bimetallism's ability to stimulate growth versus the gold standard's advantage in maintaining stable, predictable currency values.

Legacy and Modern Relevance

Bimetallism, which relied on fixed ratios between gold and silver, shaped 19th-century economies by promoting currency stability and facilitating trade but eventually gave way to the gold standard due to its complexity and potential for market distortions. The gold standard established a single-metal monetary system that anchored currency values to gold reserves, providing long-term price stability and international confidence, influencing global finance well into the 20th century. Today, the legacy of these systems persists in modern monetary policy debates, highlighting ongoing tensions between fixed and flexible currency valuations in managing inflation and economic growth.

Bimetallism Infographic

libterm.com

libterm.com